Fantom Network Token Up 40% Amid Rumors Of Andre Cronje’s Return

- May 23, 2022

- 0

On May 20, Andre Cronje proposed changing the sFTM and fUSD liquidation model, as well as imposing a limit on the issuance of assets in the Fantom network.

On May 20, Andre Cronje proposed changing the sFTM and fUSD liquidation model, as well as imposing a limit on the issuance of assets in the Fantom network.

On May 20, Andre Cronje proposed changing the sFTM and fUSD liquidation model, as well as imposing a limit on the issuance of assets in the Fantom network. Amid rumors of the prominent DeFi developer’s return, the price of the native FTM token jumped almost 40%.

New FIP out!

Read on to learn about the recommended changes for sFTM and fUSD.

addressing:

– liquidations

– how to pay outstanding debt

— LTVs and mintage limitsEveryone is welcome to leave comments on Github.

🧵https://t.co/3wV6Q7jJFg

— The Phantom Foundation (@FantomFDN) 20 May 2022

The changes proposed by Cronje relate to the FMint platform, which allows the issuance of synthetic assets and the fUSD stablecoin on the Fantom network. Second, against the backdrop of the collapse of the Terra ecosystem and the collapse of the crypto market in May, the pair lost against the US dollar.

After the incident, the Phantom Foundation, a nonprofit organization, said fUSD uses a different stabilizer model compared to Terra’s UST.

2nd/

• If the value of the FTM falls below the minimum margin rate, the FTM is progressively auctioned to users who bid using fUSD (to keep it stable). UST had no auction process.A detailed blog post detailing how fUSD functions will be released in the coming weeks

— The Phantom Foundation (@FantomFDN) 18 May 2022

“fUSD is an over-collateralized stablecoin (like DAI) backed by FTM tokens in staking. UST was not supported by anything. Users create fUSD by borrowing FTM secured assets in staking. If the FTM value falls below the minimum collateral rate, the assets are gradually auctioned to users for fUSD. This process is not used in UST,” the developers wrote.

According to CoinGecko, despite having a similar model to DAI, fUSD has yet to return to par with the US dollar, with an asset price of $0.69 at the time of writing.

Cronje proposed a series of measures aimed at stabilizing the situation and increasing the sustainability of the Phantom ecosystem as a whole. In particular, they involve the liquidation of positions that do not have a margin surplus of 300%.

“Users have time before activating this module to pay off their debts. Given fUSD’s current low liquidity, [Fantom Foundation] The offer will create a pool of fUSD/USDC so users can buy fUSD and use positions to avoid liquidation.

According to the document, when it comes to sFTM loans, the user risks losing rewards and entitlement. Validators, in turn, can leave the network. Paying off fUSD debt will allow them to avoid it.

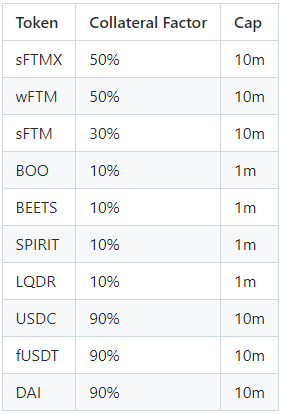

Cronje also proposed setting emission limits at 150 million sFTM and 50 million fUSD. At the same time, validators will be denied the opportunity to issue sFTMs. The initiative assumes a dynamic interest rate that depends on the ratio of loan positions to the total asset supply in phantom markets.

The developer noted the need to revise the provisioning model. He proposed introducing coefficients for different assets affecting the maximum loan amount and setting limits on the total amount of borrowing.

“Example: Assuming the margin rate for FTM is 50% and the FTM price is $1,000, the maximum amount you can issue in fUSD is $500,” the author said.

FTM offers responded positively to Cronje’s potential return. At the time of writing, FTM is trading around $0.49.

Recall that Anton Nell and Andre Cronje, senior solutions architect of the Phantom Foundation, decided to leave the cryptocurrency industry in March 2022.

Source: Fork Log

I’m Sandra Torres, a passionate journalist and content creator. My specialty lies in covering the latest gadgets, trends and tech news for Div Bracket. With over 5 years of experience as a professional writer, I have built up an impressive portfolio of published works that showcase my expertise in this field.