BIS announces central banks’ high interest on CBDC

- May 6, 2022

- 0

Nine out of ten central banks worldwide conduct research CBDCMost regulators prefer projects that focus on retail use cases. This is stated in a study by the Bank

Nine out of ten central banks worldwide conduct research CBDCMost regulators prefer projects that focus on retail use cases. This is stated in a study by the Bank

Nine out of ten central banks worldwide conduct research CBDCMost regulators prefer projects that focus on retail use cases. This is stated in a study by the Bank for International Settlements (BIS).

Work on retail #CBDC mainly focuses on improving the efficiency, security and financial stability of domestic payments in developed economies; emerging markets and emerging economies also highlight increasing financial inclusion https://t.co/aQhcWCT5g0 pic.twitter.com/GKz9pbNA8Q

— Bank for International Settlements (@BIS_org) May 6, 2022

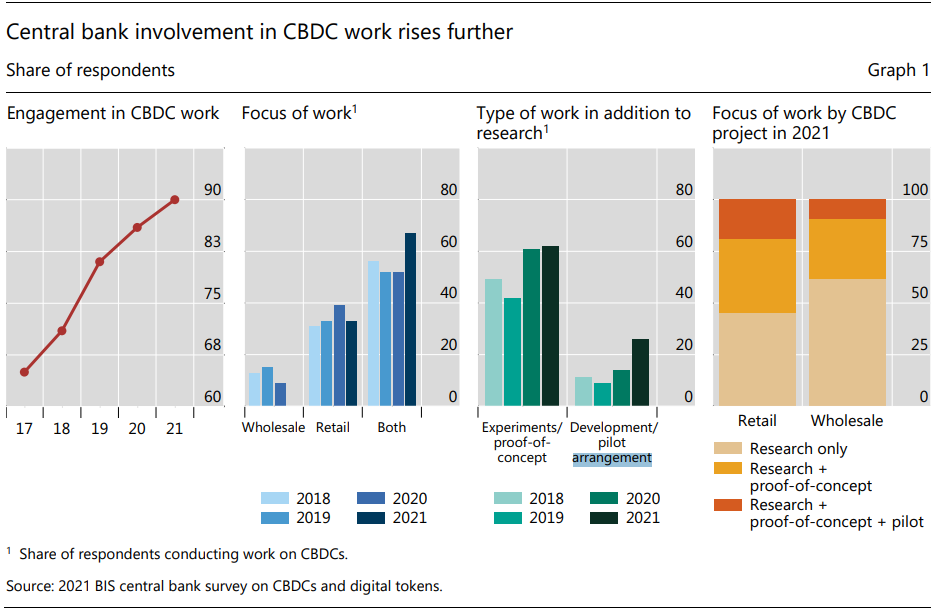

As part of the work in the fall of 2021, the BIS met with representatives of 81 central banks. The aim of the study was to examine the progress of monetary regulators in the CBDC study and their motives and plans for the introduction of these instruments.

According to the results, more than half of the Central Banks surveyed are developing their own digital currencies or “running certain experiments”. About 20% of respondents said they have created or tested a retail CBDC – half as many organizations are working on a wholesale version of the tool.

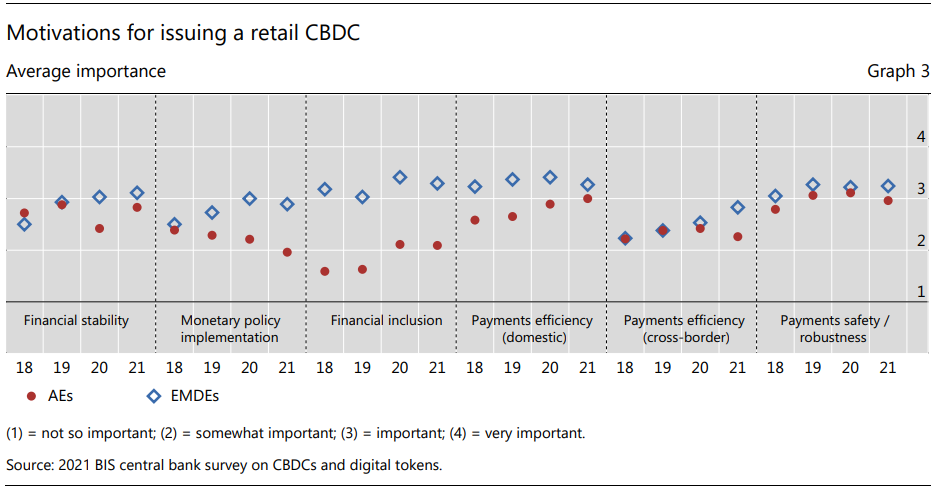

The BIS noted that regulators in developed (AEs) and emerging (EMDEs) economies have different motivations for developing retail CBDCs. The former is more concerned with improving financial stability as well as the efficiency and security of domestic payments.

For the latter, these factors also play a serious role, but in their case it is more important to improve the availability of financial services and the efficiency of cross-border payments.

The report’s authors also noted that 70% of central banks are investigating the potential impact of stablecoins on monetary and financial stability, with nearly a quarter of respondents considering using cryptocurrencies.

Recall that in April the BIS called the increase in the efficiency of payment systems the main motivation of central banks in developing countries studying CBDC.

Source: Fork Log

I’m Sandra Torres, a passionate journalist and content creator. My specialty lies in covering the latest gadgets, trends and tech news for Div Bracket. With over 5 years of experience as a professional writer, I have built up an impressive portfolio of published works that showcase my expertise in this field.