UST stablecoin briefly pegged to US dollar due to asset exit from Anchor

- May 8, 2022

- 0

Against the background of the decline in the rate of return on deposits, more than 2.2 billion USTs were withdrawn from the Anchor protocol in less than two

Against the background of the decline in the rate of return on deposits, more than 2.2 billion USTs were withdrawn from the Anchor protocol in less than two

Against the background of the decline in the rate of return on deposits, more than 2.2 billion USTs were withdrawn from the Anchor protocol in less than two days. Due to the incident, the Terra ecosystem’s algorithmic stablecoin briefly lost its peg to the US dollar.

According to CoinGecko, the asset was trading around $0.98 on May 8.

In March, the Anchor community voted in favor of a proposal that would change the deposit rate by up to 1.5%, depending on the size of the yield reserve.

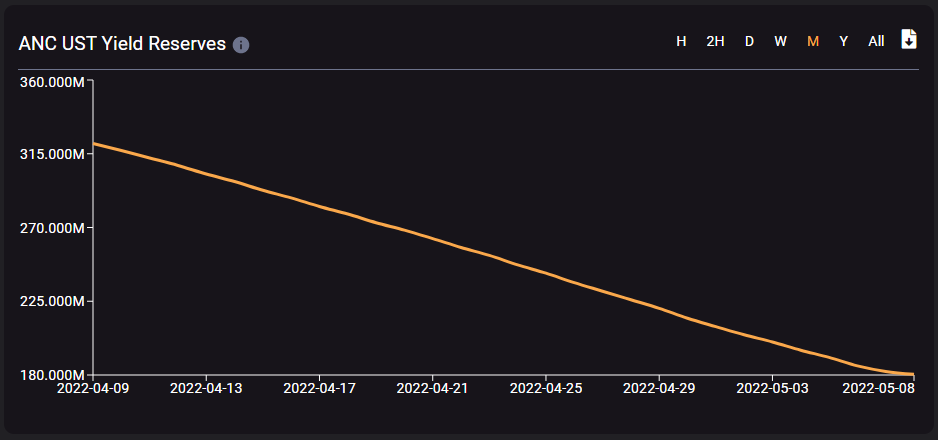

According to SmartStake, the volume of the project’s reserves has decreased by almost 44% over the past month to 180.45 UST.

There have been similar events to Anchor in the past – in February 2022 the protocol reserve was almost completely depleted. To prevent the collapse, the nonprofit Luna Foundation Guard (LFG) donated 450 million UST to the project.

However, this time there was no capital injection. In early May, the deposit interest rate at Anchor was reduced to 18% for the first time. Now its value is even lower – 17.87%.

Therefore, users began to withdraw assets from the protocol en masse. On May 7, Anchor’s deposits exceeded UST 14 billion, up from UST 11.77 billion (-16%) at the time of writing.

The decentralized exchange Curve Finance team also confirmed on May 7 that at the UST, “someone has started mass selling”, causing the stablecoin to lose its peg to the US dollar for a short period of time. The developers noted that these actions “faced a lot of resistance” in the form of ETH and stETH counter-sells.

Curve Wars News 🌈⚔️

Yesterday someone started selling UST in bulk, so depeg started. However, this was met with great resistance, so the nail was restored. Lots of ETH and stETH were also sold to get enough USD for it.

Post? High Curve throughput (>uni3) pic.twitter.com/ZChdZiVzcK

— Curve Finance (@CurveFinance) 8 May 2022

For example, the acquisition of UST was announced by Justin Sun, the founder of Tron, who described the move as his “secret plan.” According to Etherscan, it has purchased approximately 1 million UST using USD Coin (USDC) to purchase.

Previously, the USDD algorithmic stablecoin was launched on the Tron network, whose collateral model is similar to that used in the Terra ecosystem.

The mechanism for maintaining UST’s sustainability relies heavily on arbitrageurs, so the drop in Anchor’s yield has negatively impacted Anchor’s motivation to maintain parity of the stablecoin with the US dollar.

In March 2022, LFG established a bitcoin reserve fund, which should quickly provide the necessary BTC liquidity to maintain a stable UST price. In May, the volume of assets under management reached 80,394 BTC.

Some speculated that the loss of the UST pegged to the US dollar could lead to the liquidation of some of the fund’s assets. For example, this was announced by trading company Thanefield Capital under the pseudonym Resonance.

If Jump doesn’t defend this soon, there will be a $3.5 billion market sell-off for BTC.

FWIW I think this $3.5 billion buyout practice is weak – insider going ahead/public information etc.

Therefore, reverse flow can have a disproportionate effect.

— Resonance (@resonancethis) May 7, 2022

In the comments, users noted that the LFG fund does not automatically sell assets, so you should not expect an avalanche of Bitcoin market sales.

point is, there is no automatic “sell to market” trigger – UST needs to be sold to use BTC – then BTC is sold to buy UST to maintain stability, but it doesn’t happen out of the blue.

— | trainer | (@coachpoppavic) May 7, 2022

For more information on how Anchor’s problems can affect Terra’s economy, ForkLog recently wrote in a dedicated post:

Recall, Tether CTO Paolo Ardoino warned that algorithmic stablecoins with large caps are dangerous for the market.

Source: Fork Log

I’m Sandra Torres, a passionate journalist and content creator. My specialty lies in covering the latest gadgets, trends and tech news for Div Bracket. With over 5 years of experience as a professional writer, I have built up an impressive portfolio of published works that showcase my expertise in this field.