Changpeng Zhao questions the viability of Terra hard fork

- May 15, 2022

- 0

With the network return to the time before the collapse of LUNA and UST, a hard fork of the Terra blockchain will not work, because the new chain

With the network return to the time before the collapse of LUNA and UST, a hard fork of the Terra blockchain will not work, because the new chain

With the network return to the time before the collapse of LUNA and UST, a hard fork of the Terra blockchain will not work, because the new chain will have no value. This was stated by Changpeng Zhao, head of Binance cryptocurrency exchange.

personal opinion. NFA.

This won’t work.

– forking does not assign any value to the new fork. This is a wish.

— not all transactions can be invalidated after a legacy snapshot, both on-chain and off-chain (changes).Where is all the BTC that needs to be used as a reserve? https://t.co/9pvLOTlCYf

— CZ 🔶 Binance (@cz_binance) 14 May 2022

After the collapse of the Terra ecosystem, the project community proposed a hard fork and issued a new token. The distribution of the latter can be carried out according to the network snapshot made before the market crash.

The initiative also provides for the creation of a new mechanism for organizing the blockchain and a pool for redemption of the UST algorithmic hard coin.

“The fork will not add any value to the new chain. This is a wish. After the old snapshot, it is impossible to cancel all transactions both on the blockchain and outside the block (exchange), Zhao wrote.

The head of Binance wondered about the use of the Luna Foundation Guard (LFG) bitcoin reserve. In his view, assets should have been used to use UST, but they didn’t.

According to analytics firm Elliptic, LFG had around $3.5 billion in BTC. When the algorithmic stablecoin lost its pegged value against the US dollar, these funds were transferred to the Binance and Gemini platforms, making transactions more difficult to track.

After the collapse of Terra’s UST stablecoin, we are tracking down $3.5 billion of bitcoin held in reserve to help prevent precisely such an outcomehttps://t.co/rTvpB7PLQn

— elliptical (@elliptic) May 13, 2022

“Bitcoin reserves quickly moved to the two cryptocurrency exchanges, but it is unclear whether they were sold, moved to other wallets, or remained on the platforms,” the experts wrote.

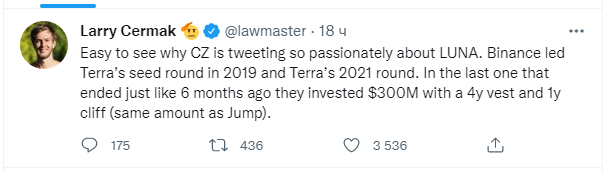

Block analyst Larry Cermak tweeted that Zhao is paying close attention to LUNA, as Binance led the Terraform Labs seed round in 2019 and invested $300 million in the company in 2021.

The head of Binance denied this information, after which Cermak deleted the tweet.

According to Zhao, Binance did not participate in Terraform Labs’ second funding round. The company’s president explained that he simply “pointed out potential issues” for the ecosystem.

3/ Binance did not participate in the 2nd round of Luna’s fundraising and we did not purchase any UST.

Binance Labs invested $3 million in Terra (layer 0 blockchain) in 2018. UST came long after our initial investment.

— CZ 🔶 Binance (@cz_binance) May 15, 2022

“Coin issuance and forks do not create value. Buyback and incineration does that, but it requires financing. Funding that the project team may not have. […] I’m not always right, but my view is that there are failures. But when that happens, transparency, prompt communication with the community, and accountability to it are extremely important,” he wrote.

Remember, Zhao said he was “disappointed” by the Terra ecosystem team’s actions. According to him, the developers endangered investors, but did not take responsibility.

Source: Fork Log

I’m Sandra Torres, a passionate journalist and content creator. My specialty lies in covering the latest gadgets, trends and tech news for Div Bracket. With over 5 years of experience as a professional writer, I have built up an impressive portfolio of published works that showcase my expertise in this field.