The concept that we call an economic bubble is basically a rapid increase in the price of an asset and all that Situations that result in a rapid rise followed by a rapid fall resources. Looking at today’s examples, interest rates rise with great interest and then fall sharply. NFT market We can say that it is also called a balloon.

Economic bubbles, of which there are many examples from the past to the present, first and most interesting One is “Tulip Mania”. Before we get into the details of this economic bubble called Tulip Mania, we should consider how this phenomenon compares to current examples such as cryptocurrency and NFT markets. In some respects We can also say that they are similar.

Tulip mania This economic bubble, which occurred in the Netherlands in the mid-seventeenth century, has a place in history as an interesting example of how people’s emotional impulses and financial goals are intertwined.

The story begins with tulips traveling from the Ottoman Empire to the Netherlands.

Dutch ambassador During the reign of Suleiman the Magnificent The Netherlands was introduced to tulips when he brought tulip bulbs with him when he returned after his visit to the Ottoman Empire.

Not long after the Dutch were introduced to tulips, tulips became popular among the public. very popular and it becomes a flower that attracts a lot of attention from the Dutch.

Tulips attract a lot of attention and become a symbol of status and luxury.

So much so that the rich people of the Netherlands love tulips because of their wealth and… an indication of their status They consider these tulips as their own and begin to display them in their homes.

With increasing demand, tulips are beginning to attract the attention of the middle class and are turning into an investment instrument.

With the ever-increasing demand, tulips are becoming a sector and markets are starting to form.

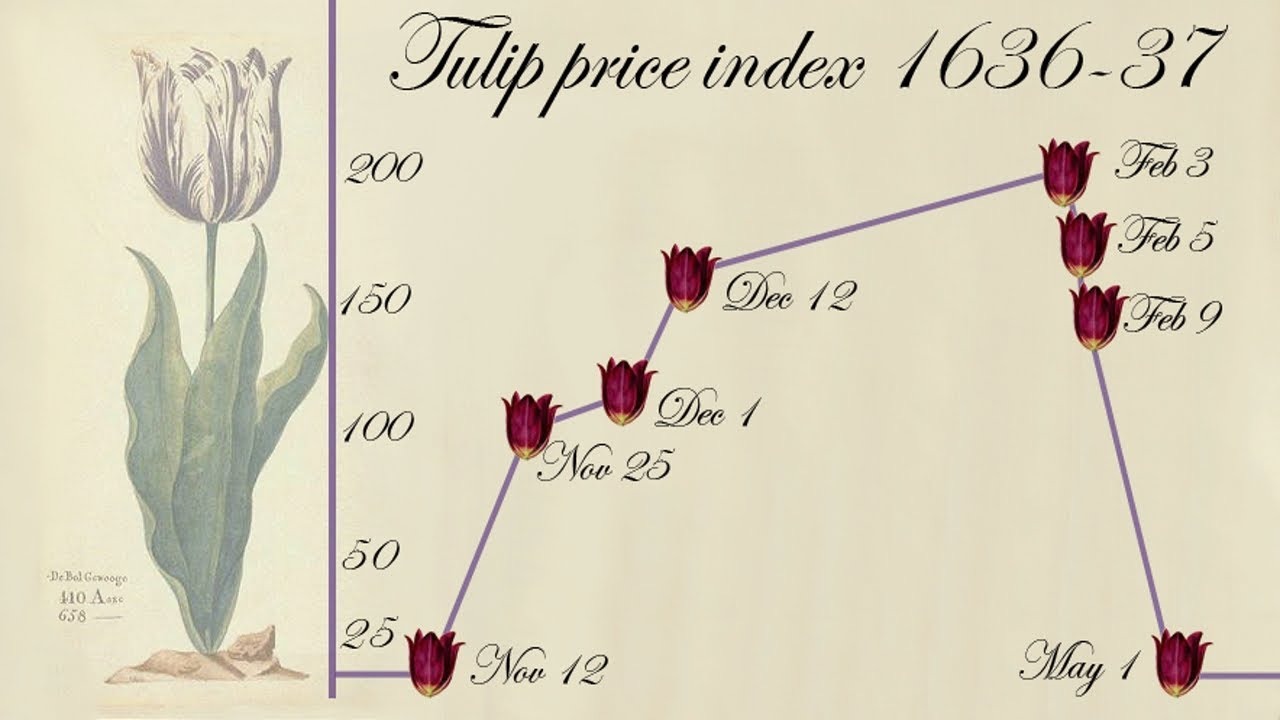

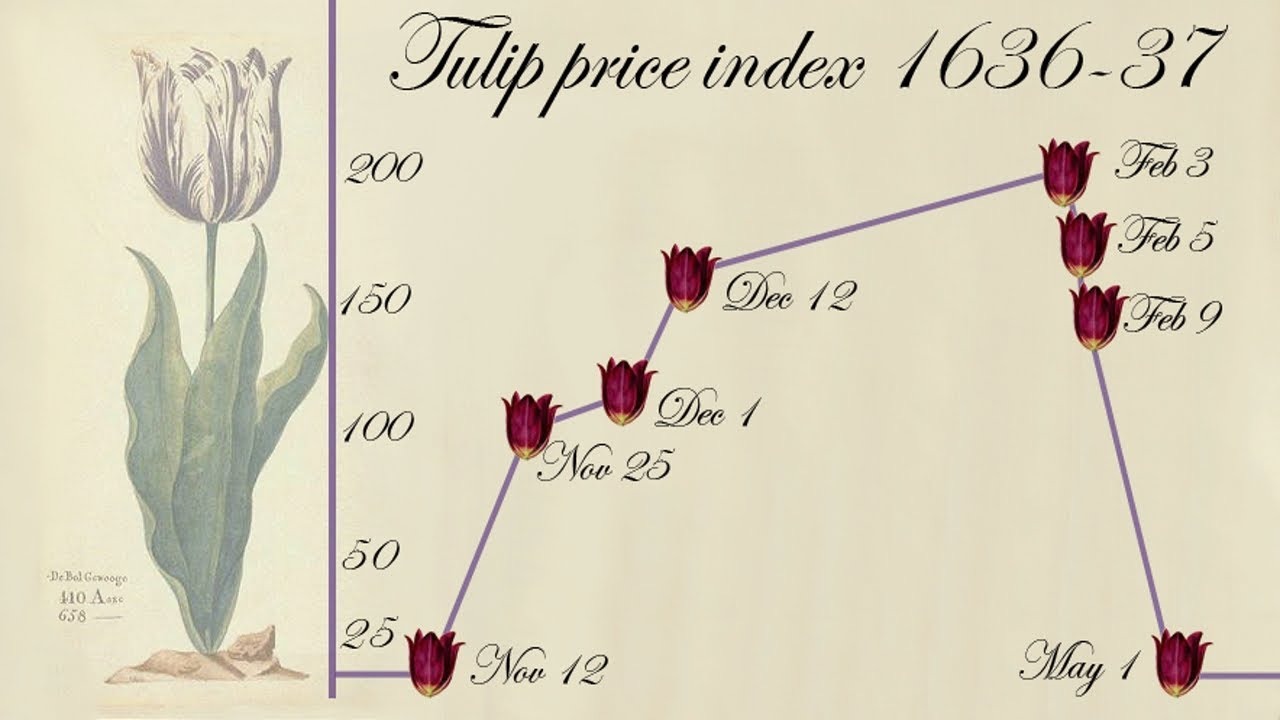

Tulips, which have become a kind of commodity, are traded on the stock exchanges and the interest they receive as an investment instrument is increasing so much that investors think the price of tulip bulbs will rise even further. long-term transactions He even does it.

Prices are rising so much that, now that the end of the tulip craze is approaching, the price of a tulip bulb is now an employee’s full annual salary reaches equivalent levels.

Of course, the tulip market also faces the tragic end that every economic bubble encounters, and the bubble bursts!

In other words: on the market recession prevails It’s starting to happen and those who have tulip bulbs are starting to no longer be able to find buyers.

Because everyone on the market wants to throw away tulip bulbs to avoid loss, the price drop dominates and those with tulip bulbs in their hand Investors face huge losses. So the tulip bubble bursts and the tulip market collapses…

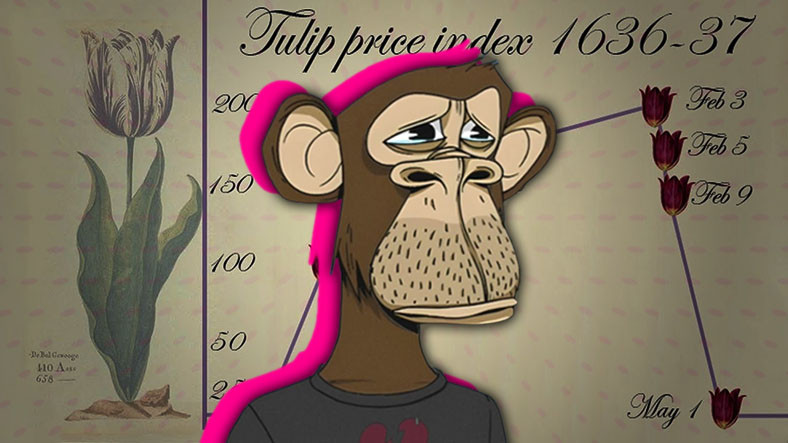

Does Tulip Mania remind you a bit of the cryptocurrency and NFT markets?

Especially in recent years NFT market You may recall that investors are very interested in markets related to virtual assets, especially virtual assets.

This situation had become such that many people had positive feelings about the rising prices and saw these markets as opportunities and hoped to get a piece of the pie; have invested in the virtual products in question, some have won, while many others have He had suffered great losses.

So much so that even virtual works of art, called NFTs, from virtual lots found buyers at very high prices. Currently the price of most of them well below expectations Remained…

So what does the research say?

Research has shown that although there are some similarities between Tulip Mania and Bitcoin, this is the case There is no relationship between the two markets and it was concluded that it was incorrect to identify the two markets in question.

Since the conditions of today and those of the 17th century are not the same, the markets in question according to the circumstances of the period According to researchers who argue that evaluation is needed, it would not be correct to say that these two markets are comparable in all respects.

If we look at the irrational behavior of investors, we can say that there are some similarities.

So the tulip bulb market and the crypto asset markets even if it is not qualitatively related There are some similarities in investor behavior.

For example, someone who buys tulip bulbs worth an employee’s annual salary to display in their home would buy a “Bored Ape” NFT for $1.3 million. Justin Bieber lost almost 90% of his investment It seems to exhibit somewhat similar behavior. What do you think?

Sources: Eonder International Academic Journal, Library of Congress

Follow Webtekno on Threads and don’t miss the news