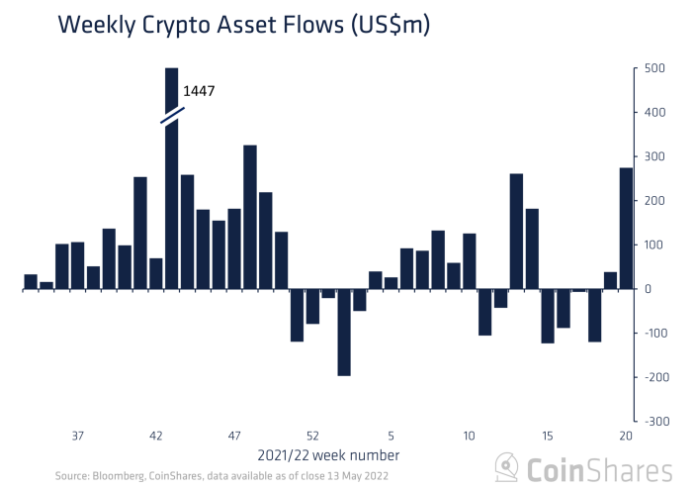

The volume of funds in crypto investment products increased by $274 million during the week. CoinShares analysts explained the influx of investors from Terra as a desire to capitalize on the price drops associated with the collapse of the UST stablecoin.

Such high income rates in crypto funds were last observed at the end of March.

The positive dynamics were driven by the $284.8 million inflow of funds from Canadian Purpose Investments to the Purpose Bitcoin ETF. Investors focused on the first cryptocurrency – investments in products based on it attracted a total of $298.6 million during the week.

Fund outflow from Ethereum funds continued. In seven days, it was $26.7 million and $236 million since the beginning of the year.

Mixed dynamics were observed for products based on other altcoins. AUM only LUNA related instruments fell 99%.

Separately, analysts talked about the third largest ever fund withdrawal from shares of blockchain companies ($51 million).

Recall that Coinbase securities have dropped 81.8% since the IPO in anticipation of the release of financial statements for the first quarter. The net loss of the bitcoin exchange for this period amounted to $1.98 per share, nearly double what analysts had expected.

Shares of other blockchain companies also outperformed the market as Bitcoin dropped to $30,000.

Source: Fork Log

I’m Sandra Torres, a passionate journalist and content creator. My specialty lies in covering the latest gadgets, trends and tech news for Div Bracket. With over 5 years of experience as a professional writer, I have built up an impressive portfolio of published works that showcase my expertise in this field.