Waves Platform CEO and founder Alexander Ivanov accused Alameda Research of manipulating and organizing the price of WAVES. FUD– campaigns for panic selling of an asset. Sam Bankman-Fried, chairman of FTX and founder of Alameda Research, called such statements “poorly crafted conspiracy theories.”

In March, the native token surged 234.3%, raising its all-time high to $61.3. Ivanov attributed this to the opening of an office in the USA and the publication of a new roadmap, which led to increased demand for WAVES and increased demand TVL in the DeFi ecosystem.

In the third decade of March, Ivanov noted that the number of those who have doubts about the continuation of the rally in WAVES and are planning to open shorts has increased. The culmination was a post by a user under the pseudonym 0xHamz, whose subscribers have paid trolls.

“Anonymous vigilante” as Waves CEO says, declarationBorrowings in USDC/USDT are at 35% in Vires. Finance was used to stimulate the growth of WAVES. This is necessary to expand the issuance of the USDN stablecoin used as collateral in the protocol (which links Waves and USDN to UST and LUNA in the Terra project).

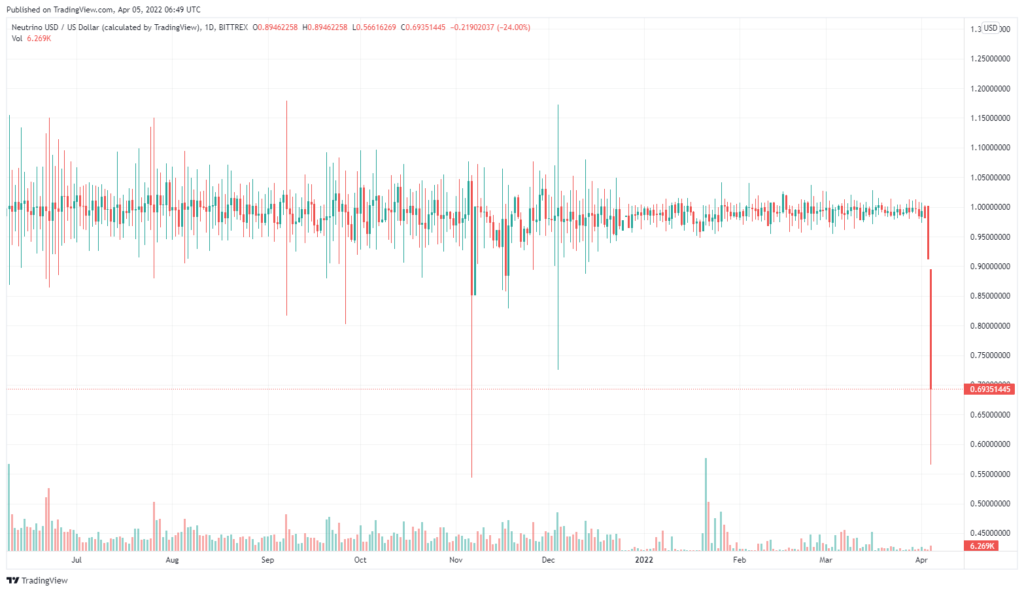

Repeated repetition of such actions, as the thruster claims, gave the mechanism the properties of Ponzi schemes. The algorithm has its limitations and vulnerabilities – when the price of WAVES drops, the USDN stablecoin loses its stable, and the ecosystem itself awaits “Armageddon,” 0xHamz pointed out.

Ivanov described the presented arguments as an attempt to “criminalize” borrowing. He was also skeptical that a few million dollars could affect the price of an asset with over $1 billion in trading volume, as his competitor might imply.

0xHamz disclosures led to liquidity withdrawals from Vires.Finance pools. Someone approached the team for a 1 million WAVES loan (possibly to open it short). The company refused for “ideological reasons”.

Ivanov later realized that an address associated with Alameda Research (3PHkZUJpS3AfmnXBNLCBmpqL25GJZb1hGiE) borrowed more than 631,478 WAVE (~$30.98 million) at 19.97% per annum through Vires.Finance.

As of March 20, the account redirected to Binance to sell the borrowed tokens and create a breakdown. Ivanov emphasized that the transactions coincided with the FUD regulated by 0xHamz.

According to the Waves CEO, the manipulators initially caused an increase in the price of WAVES. FTX. For Ivanov, this came as a surprise – he learned from Bloomberg that the exchange’s wallet has been significantly replenished with a “wrapped” version of the asset in Ethereum. At the same time, the project had not done business with FTX and had previously denied $1.5 million in integration fees.

According to Ivanov, subsequent “shorts” of Alameda Research were extremely unsuccessful due to the further growth of the asset. As a result, for the sake of getting out, he allegedly orchestrated the previously announced plan.

Recall that in December 2021, FTX published an article outlining its vision for fair regulation of the digital asset market.

On December 8, the US House of Representatives held a session on “Digital Assets and the Future of Finance: Understanding the Challenges and Benefits of Financial Innovation.” Among the participants was Bankman-Fried.