Glassnode: Uncertainty in the crypto market will continue

- May 24, 2022

- 0

Weak on-chain metrics and the prevalence of fears in the derivatives market are hampering bitcoin’s recovery after a wave of price declines since late March. These are the

Weak on-chain metrics and the prevalence of fears in the derivatives market are hampering bitcoin’s recovery after a wave of price declines since late March. These are the

Weak on-chain metrics and the prevalence of fears in the derivatives market are hampering bitcoin’s recovery after a wave of price declines since late March. These are the conclusions made by Glassnode analysts.

The severity of the bear market hurt the market’s macro price performance metrics. #Bitcoin and #Ethereum

This week, we analyze the declining returns profile of both. $BTC + $ETHand what market structure and on-chain usage informs us about the road ahead.https://t.co/5KK6xBLVUg

– glass knot (@glassnode) 23 May 2022

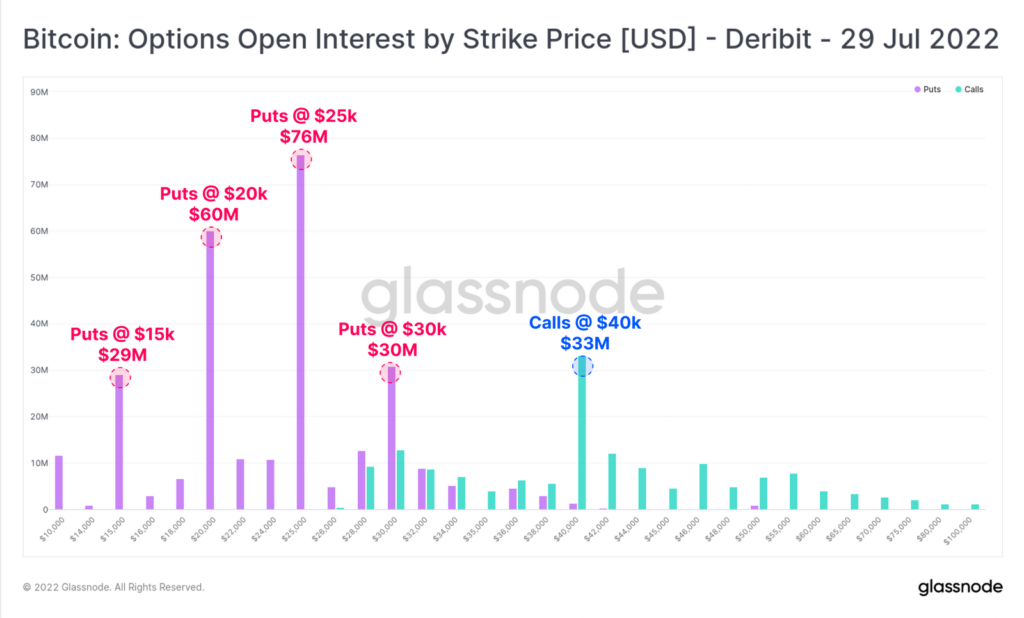

The collapse of LUNA and the general weakening of the market affected the expectations of participants in the crypto derivatives market. In Bitcoin, the open sell and call rate has increased from 50% to 70%, indicating an increased desire by investors to secure positions from the ongoing negative dynamics.

In the calls that will expire at the end of July this year, the largest open interest (OI) is concentrated around $40,000.

Participants mostly prefer sells that will yield profits if the price drops to $25,000, $20,000, and $15,000. That is, by mid-year, the market is geared towards hedging and/or speculation of further price cuts. .

At a longer distance, optimists prevail. Year-end contracts have the most open interest in the $70,000 to $100,000 range, with the largest OR concentrated between $25,000 and $30,000, which is close to current levels.

On-chain indicators for Bitcoin and Ethereum indicate that demand for space on the block has dropped to lows in a few years.

In the first cryptocurrency network, total daily transaction fees have returned to the minimum range of 10-12 BTC observed since July 2021.

The median gas price on Ethereum dropped to 26.2 Gwei after short-term gains from the Otherside metaverse NFT’s dispersal and Terra’s collapse. These levels were last observed in May-July 2021 and after March 2020.

ETH burning rate through EIP-1559 has dropped to a record low. Last week, 2370 ETH was withdrawn from circulation, which is 50% less than at the beginning of May. The share of these untreated coins reached a record high of 81.6%, which put pressure on the price.

Analysts pointed to a reduction in the number of active addresses and the amount of value transferred when interacting with popular DeFi protocols such as Aave, Compound and Uniswap.

Recall that Goldman Sachs pointed to the risks arising from the growing interconnectedness of projects in the decentralized financial sector.

Source: Fork Log

I’m Sandra Torres, a passionate journalist and content creator. My specialty lies in covering the latest gadgets, trends and tech news for Div Bracket. With over 5 years of experience as a professional writer, I have built up an impressive portfolio of published works that showcase my expertise in this field.