Uniswap has traded over $1 trillion since the launch of the DEX

- May 25, 2022

- 0

Uniswap has traded the equivalent of over $1 trillion since the launch of the DEX in 2018. 1/ It’s been a great trip 🚀 As of today, the

Uniswap has traded the equivalent of over $1 trillion since the launch of the DEX in 2018. 1/ It’s been a great trip 🚀 As of today, the

Uniswap has traded the equivalent of over $1 trillion since the launch of the DEX in 2018.

1/ It’s been a great trip 🚀

As of today, the Uniswap Protocol has surpassed the $1 Trillion cumulative lifetime transaction volume. pic.twitter.com/stFdMDgJPZ

— Uniswap Labs 🦄 (@Uniswap) 24 May 2022

According to Uniswap Labs, behind the project, the number of users of the protocol has approached 3.9 million – more than 80% of all participants in the DeFi space.

2/ Protocol in the last three years,

🛹 Involved millions of users into the world of DeFi

💸 Fair and unauthorized trade introduced

🚰 The barrier to liquidity provision has been reduced pic.twitter.com/mT2ZzjMTav— Uniswap Labs 🦄 (@Uniswap) 24 May 2022

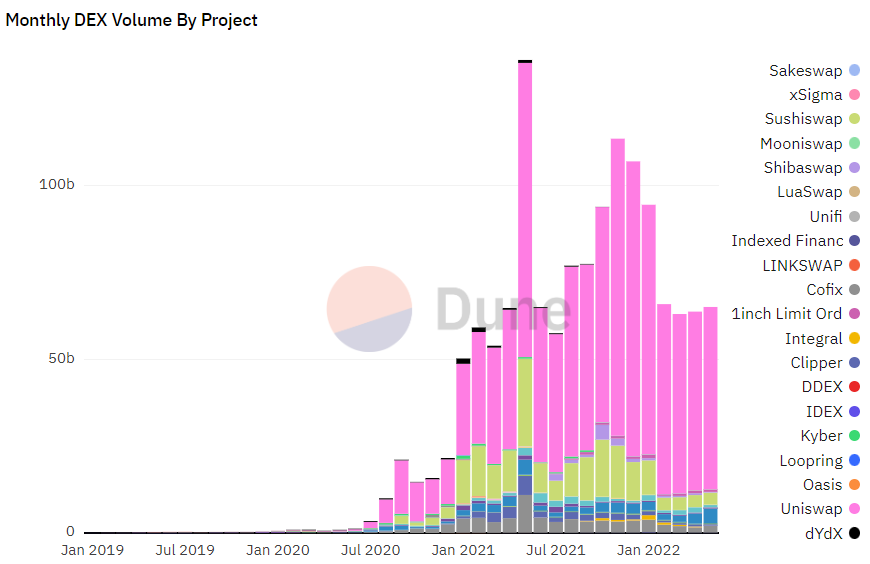

According to Dune Analytics metrics, the project remains the dominant player in terms of trading volume among DEXs on Ethereum. Over the past seven days, its stake was 84% ($9.09 billion) in April, or 76.2% ($51.4 billion).

According to CoinGecko, Uniswap’s share (including all versions) is 41.3% when considering DEX trading volume across all networks. On the BNB Chain, its closest competitor, PancakeSwap, has 15.4%.

Compared to centralized platforms, Uniswap will rank seventh after Binance, FTX, Coinbase, KuCoin, Huobi Global and OKX with a daily trading volume of $1.05 billion. DEX scores were higher than Kraken, Crypto.com, Bitfinex and others.

According to DeFi Llama, TVL project $5.9 billion. According to this indicator, Uniswap ranks fifth among all protocols and second among DEXs.

The decentralized exchange supports Ethereum, Polygon, Optimism and Arbitrum.

Recall that in April Uniswap launched the Swap Widget service that allows developers to integrate project functions with third parties. dapps.

Earlier in the US, the company was accused of violating securities laws.

President in August 2021 SEC Gary Gensler warned of increased DeFi regulations and stressed that the decentralized nature of projects does not make them immune from corporate oversight.

He described users of DeFi platforms as “vulnerable” in September. Gensler noted that the segment was “full of scams, fraud, and abuse.”

Later, information surfaced in the media about the SEC investigation against a number of companies in the segment, including Uniswap Labs.

In January 2022, Gensler announced creating a regulatory framework for cryptocurrency exchanges as a priority for this year.

Source: Fork Log

I’m Sandra Torres, a passionate journalist and content creator. My specialty lies in covering the latest gadgets, trends and tech news for Div Bracket. With over 5 years of experience as a professional writer, I have built up an impressive portfolio of published works that showcase my expertise in this field.