Justin Sun on Tron’s USDD Sustainability Model

- June 2, 2022

- 0

The Tron team has learned from the collapse of the Terra ecosystem, so the USDD algorithmic stablecoin will not repeat the fate of its predecessor. This was stated

The Tron team has learned from the collapse of the Terra ecosystem, so the USDD algorithmic stablecoin will not repeat the fate of its predecessor. This was stated

The Tron team has learned from the collapse of the Terra ecosystem, so the USDD algorithmic stablecoin will not repeat the fate of its predecessor. This was stated by the founder of the Justin Sun project.

According to Sun, “Terra’s rapid rise” encouraged the team to release USDD. However, he stressed that even after the creation of the Luna Foundation Guard (LFG) reserve fund, the security of TerraUSD (UST) is always under threat.

“Despite LFG’s best efforts, most of UST’s collateral consisted of LUNA, a highly volatile asset, with less than 15% of stablecoins backed by bitcoin. We have witnessed the consequences of this mistake for the last two weeks,” he wrote.

Sun emphasized that USDD will be fully supported by a combination of stable and volatile assets. Initially, the Tron DAO Reserve (TDR) fund included stablecoins such as USDT and USDC alongside Bitcoin and TRX.

“Currently, the security level is in the 180-200% range. By gradually increasing the USDD supply, we will pay attention to product expansion,” added the Tron founder.

USDD was launched in early May 2022. A stablecoin is issued according to a similar pattern to the UST – you need to burn the corresponding number of TRX to issue it. The refund takes place in the same way.

At the same time, unlike Terra, at the initial stage only authorized TDR participants whose addresses are on the “white lists” can issue IHR. This restriction will be removed in the future.

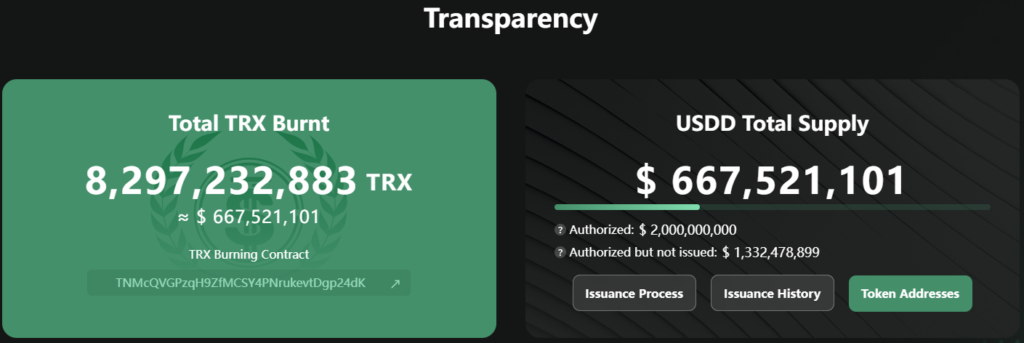

According to TDR, at the time of writing, the asset’s bid exceeds 667.52 million USDD. For the issuance of stablecoins, the participants of the organization have withdrawn more than 8.29 billion TRX from circulation.

Sun noted that the supply of USDD was limited to 2 billion coins in the first phase. During this time, the ecosystem offers up to 30% annual income from deposits to attract new users.

In the second phase of project development, the USDD limit will be removed, but the deposit interest calculation model will also change. Participants who agree to block liquidity for a year or more will continue to earn high returns. Short-term investors will have to operate at a lower rate.

“Liquidity is crucial, so we want to reward early adopters with adequate returns on the funds they raise. As a result, the USDD supply limit will be determined by the total trading volume of the asset,” Sun explained.

According to the founder of Tron, TRD “plans to ensure” that USDD is always supported by a basket of liquid assets. He noted that more than $550 million has already been diverted to the reserve – this amount will increase as the stablecoin supply increases. At the end of the first phase, the fund volume will reach $2 billion and in the long run, $10 billion will be allocated for these purposes.

Sun previously stated that despite the collapse of UST and LUNA, the Tron ecosystem will not give up on USDD.

Recall that in May, the volume of funds blocked in Tron-based decentralized applications increased by 48%.

Source: Fork Log

I’m Sandra Torres, a passionate journalist and content creator. My specialty lies in covering the latest gadgets, trends and tech news for Div Bracket. With over 5 years of experience as a professional writer, I have built up an impressive portfolio of published works that showcase my expertise in this field.