Cryptocurrency markets, which have been on everyone’s lips lately, huge profits and huge losses a medium. Those who invest based on rumors or have enough of them without knowledge Individuals who start trading unfortunately end up losing huge amounts of money.

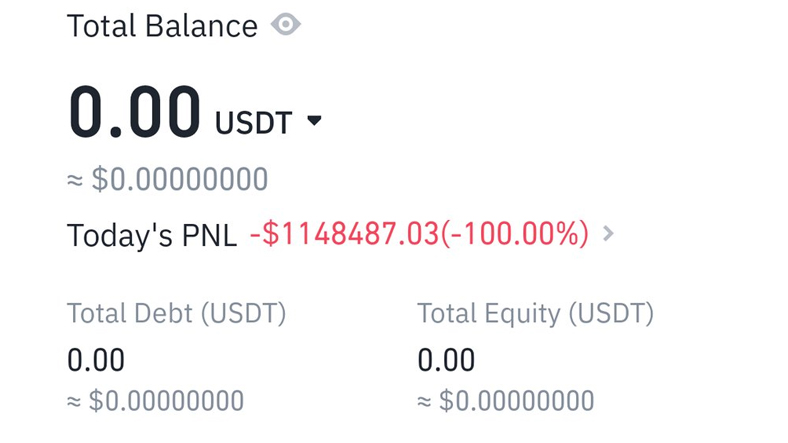

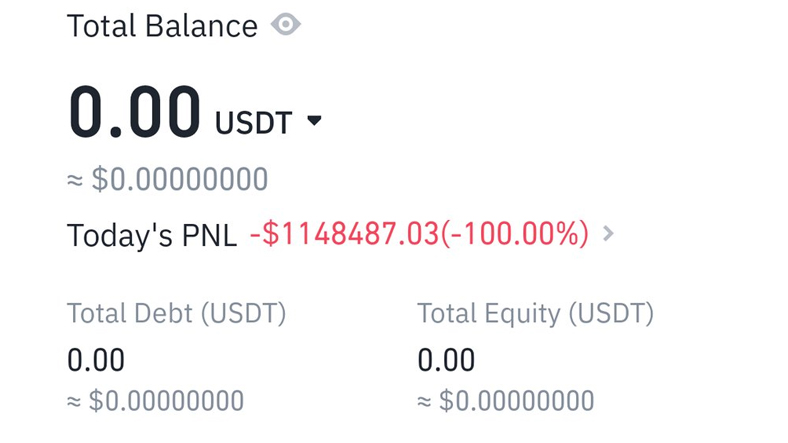

This situation has been quite intense in recent days. the disturbing news made sure it was served. One of them, “CryptoNerdA user named depressed It was shared that a Turkish doctor committed suicide.

Stay away from leveraged trades!

The main reason why people make a lot of money in the cryptocurrency markets and lose the same amount is: leveraged transactions. Let’s simply explain what this is. This transaction type, which is available in virtually every cryptocurrency exchange, With more money than you have It gives you the opportunity to take a stand. So you’re actually trading with money you don’t have. Profit and loss on leveraged trades compared to cash trades It’s quite risky.

Opening trades for very high amounts in a leveraged trade it becomes possible. We can talk about such an account. Let’s say you have $100. If you set 10x leverage $1,000 You can open a trade. However, there is a point here. In a leveraged trade, your chance of profit or loss increases depending on the amount of leverage you open. So opening a 10x trade becomes much riskier than opening a 2x trade.

Let’s see what Crypto Nerd went through after losing about $1 million recently. This friend PEPE He opened a 3x leveraged trade in the said cryptocurrency and lost all his money. The reason why such an event happened is because Crypto Nerd That was because he didn’t have enough collateral.. If Crypto Nerd had made a correct calculation, made the trade slightly smaller and placed collateral equal to the amount he opened the trade with, something like this wouldn’t have happened.

There are a few important points that come into play here. One of them, liquidation level. The exchanges’ algorithms determine a liquidity level based on the amount in the wallet and the transaction opened. This level indicates when the transaction will be liquidated. Here, the correct calculation can even ensure that the liquidation level drops to 0. But whoever does not do this random usersUnfortunately, they suffer great losses.

Let’s give an example of leveraged trades:

Let’s say you have $100 in your futures wallet. “Webtekno coinLet’s imagine that we will open a trade with 10x leverage on an imaginary crypto asset called “. Let’s say the price of Webtekno Coin is 1,000 dollars. Normally we can trade 0.1 Webtekno Coin. 10x leverage Our money will be $1,000. In other words, we are making a transaction for 1 Webtekno Coin. Let’s assume that the trade we will execute is bullish.

After opening the transaction the most important thing is; our profit and loss ratio, based on total transaction size calculated. Let’s say Webtekno Coin lost 10 percent of its value from $1,000 and dropped to $900. Our $100 principal then drops to zero and 100 percent damage he would have written. This is exactly why people lose so much money in the cryptocurrency markets.

There is no such risk with spot transactions!

If you invest your money in cash trades instead of wasting it on leveraged trades You are protected against such risks. If you buy Webtekno Coin for $100, a 10 percent loss in value will cause you to lose at this rate. Because you don’t have such a situation as borrowing from the market. On cryptocurrency exchanges spot transactionsYou can compare it to buying dollars or euros with TL.

It’s about what you do and don’t do. yours your decision. However, if you want advice from us, you should definitely avoid leveraged transactions without fully understanding the system. Stay out. Yes, you can make quick profits with leveraged trades. However, keep in mind that you may experience the opposite situation. All your money, at the slightest fluctuation steam it could be.

Follow Webtekno on Threads and don’t miss the news