Fund volume in the DeFi ecosystem drops to $70 billion

- June 18, 2022

- 0

Against the background of the market crash, the general TVL The percentage of the DeFi ecosystem has dropped to $70.72 billion, which is comparable to March 2021 values.

Against the background of the market crash, the general TVL The percentage of the DeFi ecosystem has dropped to $70.72 billion, which is comparable to March 2021 values.

Against the background of the market crash, the general TVL The percentage of the DeFi ecosystem has dropped to $70.72 billion, which is comparable to March 2021 values.

Compared to its peak in early December 2021 (~$250 billion), the indicator has dropped 71%.

The first place in the DeFi Llama rating is occupied by a veteran of the segment, the MakerDAO descent service with which the decentralized stablecoin DAI is associated.

Among the top 5 services, Aave, Curve and Lido have the biggest drops in TVL. Celsius and Three Arrows Capital actively interacted with the first two platforms that had a liquidity crisis and negatively impacted the entire market.

The sharp drop in Lido is largely due to Terra’s collapse, as the service provided the opportunity for LUNA’s liquid staking as well as issues with stETH.

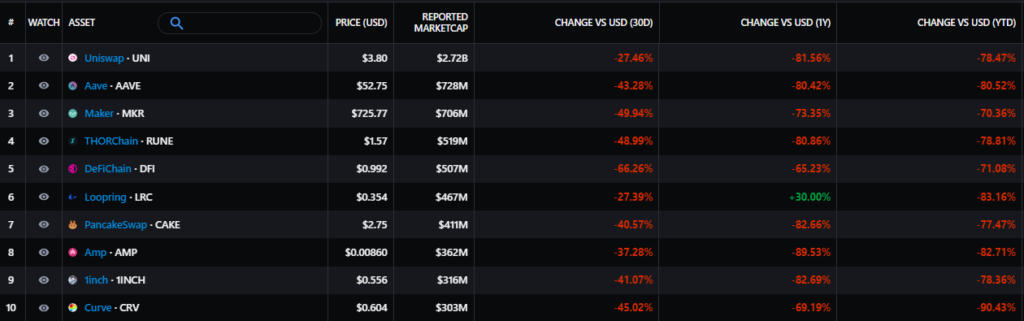

Since the beginning of the year, top DeFi tokens have dropped by 70-90%.

Despite the Ethereum price falling, the low gas price also bears witness to the low activity in the segment.

Recall that in May the volume of venture capital financing of the DeFi sector fell to $ 176.3 million, the lowest figure since September 2021.

According to Chainalysis, 97% of cryptocurrencies stolen in 2022 came from DeFi protocols.

Read ForkLog bitcoin news in our Telegram – cryptocurrency news, courses and analysis.

Source: Fork Log

I’m Sandra Torres, a passionate journalist and content creator. My specialty lies in covering the latest gadgets, trends and tech news for Div Bracket. With over 5 years of experience as a professional writer, I have built up an impressive portfolio of published works that showcase my expertise in this field.