Glassnode: Market has not made a solid bottom yet

- July 12, 2022

- 0

The Bitcoin bear market has reached its final stage with signs of deep capitulation, but no bottom signals have formed yet. This is the conclusion Glassnode analysts have

The Bitcoin bear market has reached its final stage with signs of deep capitulation, but no bottom signals have formed yet. This is the conclusion Glassnode analysts have

The Bitcoin bear market has reached its final stage with signs of deep capitulation, but no bottom signals have formed yet. This is the conclusion Glassnode analysts have come to.

this #Bitcoin The market has many hallmarks of a deep capitulation and a late-stage bear market in the game.

Both Long Term Owners and Miners are currently under extreme financial stress

But is it enough to build a resilient base?

Read more at The Week Onchainhttps://t.co/9DUtlKahxG

– glass knot (@glassnode) 11 July 2022

The current situation has a lot in common with the decline in quotes in 2018-2019. Then the trend continued for 15 months, down about 85%. Before the eventual capitulation, the market tried to hold the support at $6,000 for a long time. Lost 50% of the cost after one failure within a month.

In 2022, that attraction level was $30,000. After its spill, losses reached 40% two weeks later. undo ATH It was 72.3%.

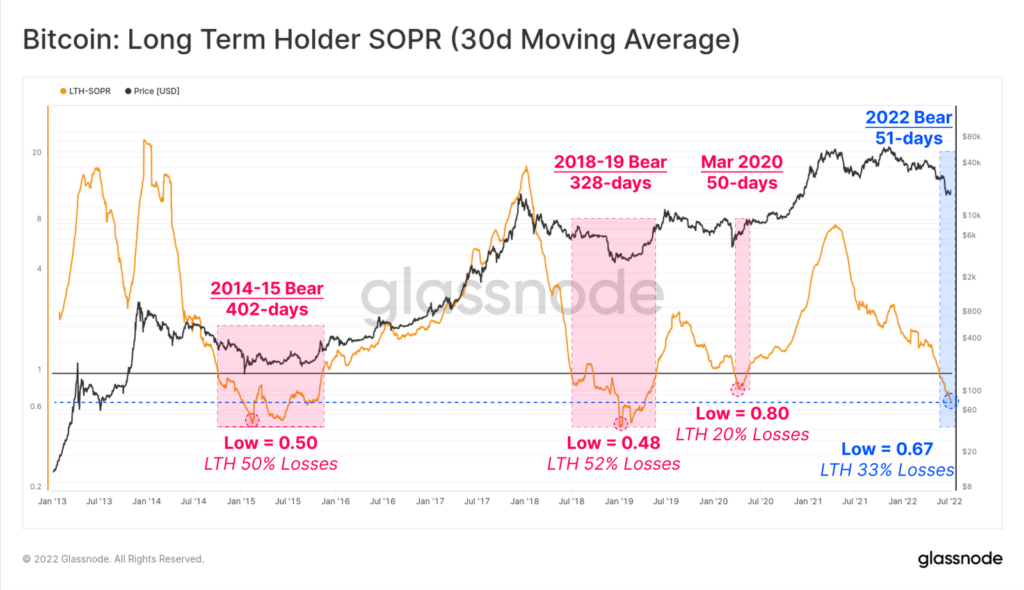

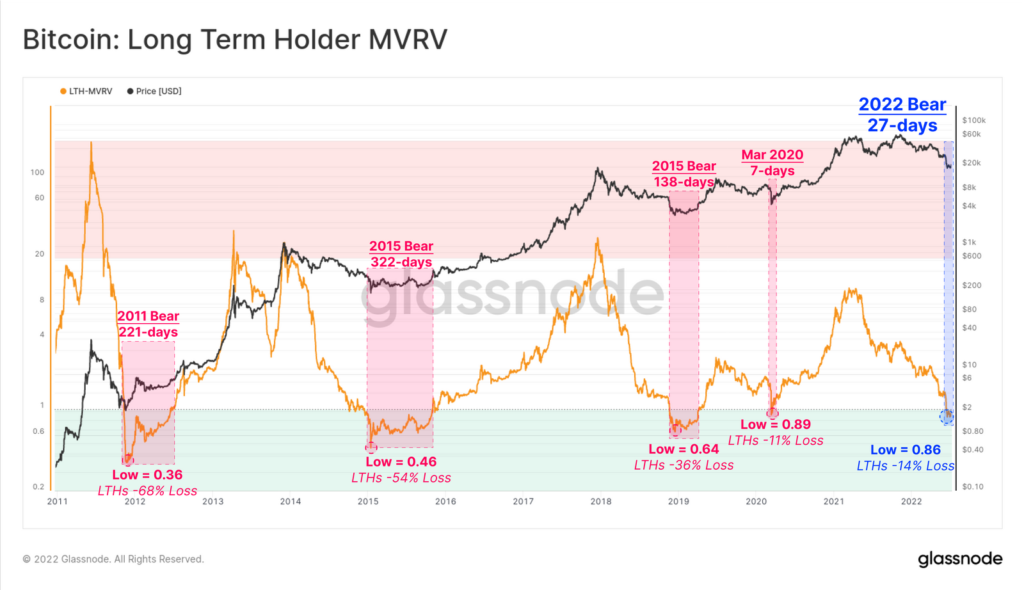

The current decline is driven by sales, including by long-term investors. The LTH-SOPR indicator dropped to 0.67 (average loss reached 33%).

Analysts compared the above data with a base coin acquisition cost of $22,300 and an unrealized 14% loss for this category of market participants. Experts concluded that the main expenditure was made by those who bought bitcoin at a much higher price, and hodlers from 2017-2020 played a minimal role in this.

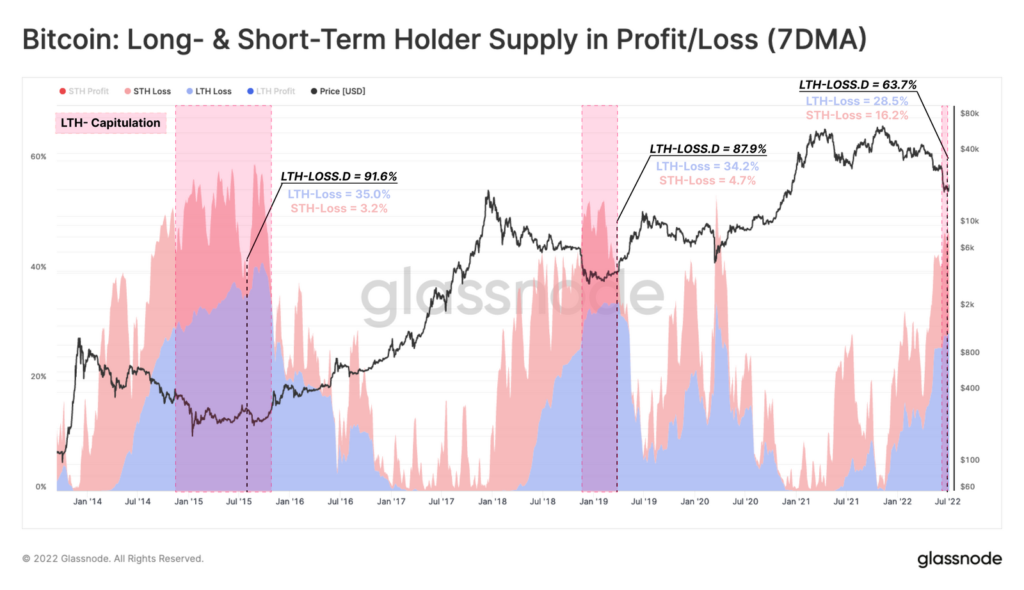

Experts note that, as a rule, the formation of the sole is preceded by the fulfillment of two conditions:

In the past, the share of “unprofitable” coins among long-term investors reached 34-35%, while short-term – 3-5%. Currently these parameters are 28.5% and 16.2% respectively.

s“Recently redistributed coins must now go through a ‘maturation’ period in the hands of higher-level convinced holders. Despite the presence of many signals of bottom formation, the market still needs time to move on to a sustainable growth path.experts stressed.

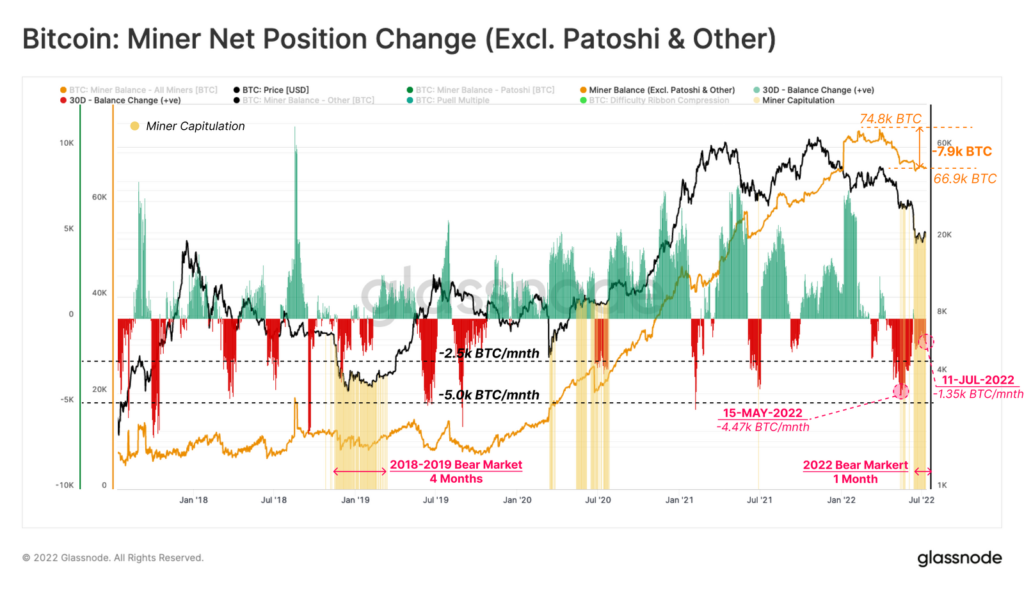

The surrender continues among the miners. The monthly balance decline rate has slowed to 1350 BTC from 4470 BTC in mid-May. They have 66,900 BTC left at their address. In the last two months, the spend has reached 7900 BTC. During the 2018-2019 bear market, the trend continued for four months.

“In the next quarter, if coin prices do not recover meaningfully, further distribution risk will remain”experts concluded.

Recall that mining establishments stopped their operations in Texas due to peak electricity demand caused by a strong heat wave.

In June, the total revenue of the first cryptocurrency miners decreased by 26% to $668 million. The indicator has been falling rapidly since March.

Read ForkLog bitcoin news in our Telegram – cryptocurrency news, courses and analysis.

Source: Fork Log

I’m Sandra Torres, a passionate journalist and content creator. My specialty lies in covering the latest gadgets, trends and tech news for Div Bracket. With over 5 years of experience as a professional writer, I have built up an impressive portfolio of published works that showcase my expertise in this field.