3AC’s debt amount is $3.5 billion

- July 19, 2022

- 0

Bankrupt hedge fund Three Arrows Capital (3AC) owes $3.5 million to dozens of investors, according to a court filing. creditor claims pic.twitter.com/toacH54XM1 – db (@tier10k) 18 July 2022

Bankrupt hedge fund Three Arrows Capital (3AC) owes $3.5 million to dozens of investors, according to a court filing. creditor claims pic.twitter.com/toacH54XM1 – db (@tier10k) 18 July 2022

Bankrupt hedge fund Three Arrows Capital (3AC) owes $3.5 million to dozens of investors, according to a court filing.

creditor claims pic.twitter.com/toacH54XM1

– db (@tier10k) 18 July 2022

It turns out that 3AC’s largest creditor is a cryptocurrency OTC– 17,443,644 shares of a subsidiary of the $2.36 billion Genesis platform Digital Currency Group provide debt GBTC; 446,928 shares GET, 2,739,043 AVAX coins and 13,583,265 NEAR. The amount of assets does not include liabilities.

Voyager Digital provided an unsecured loan of 350 million USDC and 15,250 BTC to the fund in March. The debt is estimated at $685 million.

Other major lenders to 3AC include:

The $65.7 million claims against 3AC were brought forward by the wife of co-founder Kyle Davis. Another co-founder of the fund, Su Zhu, lent the company $5 million.

The 3/3AC founders used their spouses as creditors.

According to the paperwork, he owes ~$66 million to Kyle Davies’ wife.

You cannot make up for it. pic.twitter.com/u2tnQT8rwg

— Milk Road (@MilkRoadDaily) 18 July 2022

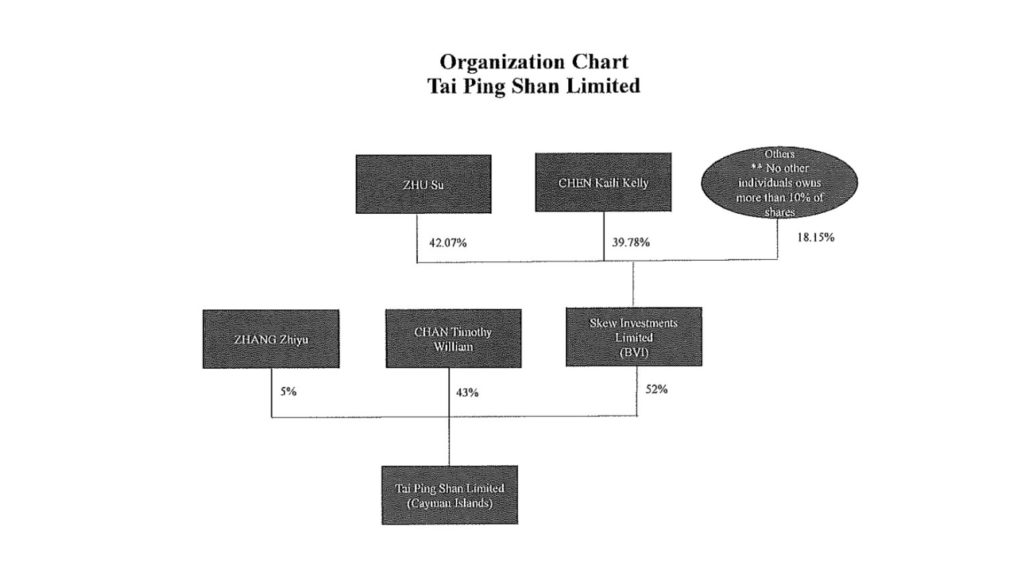

Deribit also claims that $31.6 million of stablecoins were transferred by 3AC to the wallets of the Tai Ping Shan Limited trading platform. Previously, the service refused to connect with the fund. However, according to the document, Davis’ wife and Su Zhu own a 52% stake through a joint firm.

3AC co-founders bought a $50 million yacht to impress investors. Zhu has owned two expensive bungalows in Singapore in recent months.

4/ The cherry on top?

3AC founders bought a $50 million yacht using borrowed funds.

They wanted it to be the largest yacht owned by Singaporean billionaires. pic.twitter.com/24LwS63tq7

— Milk Road (@MilkRoadDaily) 18 July 2022

According to journalist Colin Wu, 3AC’s unmet liabilities range from $1 billion to $1.5 billion.

Recall that the liquidators of the hedge fund tried to investigate and save Singaporean assets.

Read ForkLog bitcoin news in our Telegram – cryptocurrency news, courses and analysis.

Source: Fork Log

I’m Sandra Torres, a passionate journalist and content creator. My specialty lies in covering the latest gadgets, trends and tech news for Div Bracket. With over 5 years of experience as a professional writer, I have built up an impressive portfolio of published works that showcase my expertise in this field.