3AC Co-Founders Accuse Hedge Fund Crash of Overconfidence

- July 22, 2022

- 0

In an interview with Bloomberg, Three Arrows Capital founders Su Zhu and Kyle Davis cited overconfidence created by a multi-year bull market as the root cause of the

In an interview with Bloomberg, Three Arrows Capital founders Su Zhu and Kyle Davis cited overconfidence created by a multi-year bull market as the root cause of the

In an interview with Bloomberg, Three Arrows Capital founders Su Zhu and Kyle Davis cited overconfidence created by a multi-year bull market as the root cause of the liquidated hedge fund’s collapse.

To them, similar sensations were characteristic of the entire crypto lending industry.

For customers, such activities were positioned as “risky”. In May, they were aware of this against the backdrop of worsening market sentiment, when the company met its emerging margin requirements.

Su Zhu and Kyle Davis said that overconfidence creates “a systemic failure in risk management.”

They said it was a combination of interconnected unilateral interest rates and supportive borrowing agreements that exploded at the same time. This led not only to the collapse of their funds, but also problems for Celsius Network, Voyager Digital and BlockFi.

“We have the capital. […] We also accept deposits from lenders and earn returns from them. […] That means we have similar deals.” Su Zhu explained.

Senior executives admitted that they were taken aback by Terra’s rate of collapse. They admitted this was possible because he was “so close” to the project’s founder, Do Kwon.

“We didn’t realize that LUNA could drop to zero in a few days. This would result in a reduction in lending across the industry and put significant pressure on all of our illiquid positions. It was very similar for us. moment LTCM. Like others, we had different kinds of deals that we thought were “good”. Then they all got a very negative evaluation at the same time. […] It was like an “infection”, they announced.

According to the founders, the hedge fund was able to continue because everyone was “happy” with their financial situation and allowed them to trade “as if nothing had happened.”

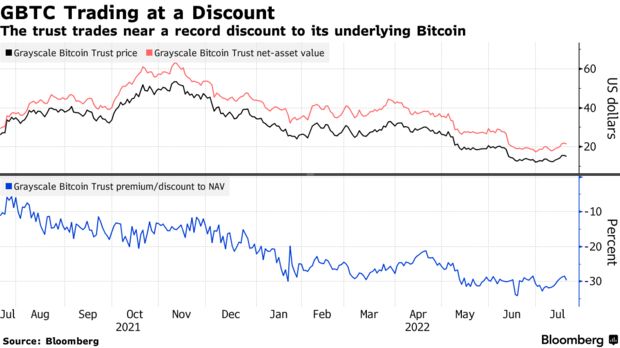

Another issue for 3AC was: GBTC From Grayscale Investments. The hedge fund put its position in the instrument at the equivalent of $1 billion. With the emergence of competing products, Bitcoin confidence spread. NAV expanded and lockDuring the period, the firm could not exit the agreement with leverage.

“We continued to do business as usual. But then when bitcoin dropped from $30,000 to $20,000, […] there was a kind of nail in the coffin, Su Zhu agreed.

The founders did not take into account that the credit market could be cyclical. A situation may arise when additional liquidity is needed and access to it is already lost. “When something is already wrapped on the fan,” they added.

The founders of 3AC dismissed the asset-robbing speculations shortly before the collapse of Three Arrows Capital, calling it part of a slander.

“We can be called stupid or crazy. […] When I get back more of my personal funds, they’ll say I ‘run away’ with the money.” said Su Zhu.

Regarding the yacht, one of the founders said that it was purchased more than a year ago and started operating in Europe. The transactions associated with it are public.

Su Zhu rejected the idea of the extravagant lifestyle inherent in it. According to him, he biked to work and the family has “only two houses in Singapore.”

“We’ve never been seen driving a Ferrari or Lamborghini. This doodle is from a classic game. […]. Funds are exploding […] and then there are the topics that people like to discuss, said Su Zhu.

The founding partners did not agree with the statement that they disappeared and did not maintain a dialogue with creditors. They described the concealment of their location as a threat of physical harm and said they had been in contact with their customers “from day one”.

Both are currently on their way to Dubai. They called their goal “the calm and orderly liquidation of the complex interweaving of their being.”

On July 22, it was learned that consulting firm Teneo, which attracted the attention of 3AC creditors, had seized control of the hedge fund’s assets with an estimated $40 million. Bloomberg.

Assets include cryptocurrencies, NFTs, shares in startups and bank accounts. This is just a small part of the $2.8 billion claimed by creditors.

The documents say 3AC’s founders still own or control “certain digital assets and bank accounts.”

As of July 1, liquidators sent information requests to about 30 banks and exchanges that may have worked with the hedge fund, in addition to about 40 individuals.

Recall, according to journalist Colin Wu, the amount of unpaid debts of 3AC is in the range of 1 billion – 1.5 billion dollars.

In early July, 3AC filed for bankruptcy in New York court.

Prior to that, the Virgin Islands court ordered the liquidation of Three Arrows Capital.

Read ForkLog bitcoin news in our Telegram – cryptocurrency news, courses and analysis.

Source: Fork Log

I’m Sandra Torres, a passionate journalist and content creator. My specialty lies in covering the latest gadgets, trends and tech news for Div Bracket. With over 5 years of experience as a professional writer, I have built up an impressive portfolio of published works that showcase my expertise in this field.