AASI On-Chain Indicator Points to Possible Bitcoin Recovery

- August 23, 2022

- 0

Bitcoin is exiting the short-term oversold zone. This means that the price of the cryptocurrency is likely to increase in the coming days or weeks, according to the

Bitcoin is exiting the short-term oversold zone. This means that the price of the cryptocurrency is likely to increase in the coming days or weeks, according to the

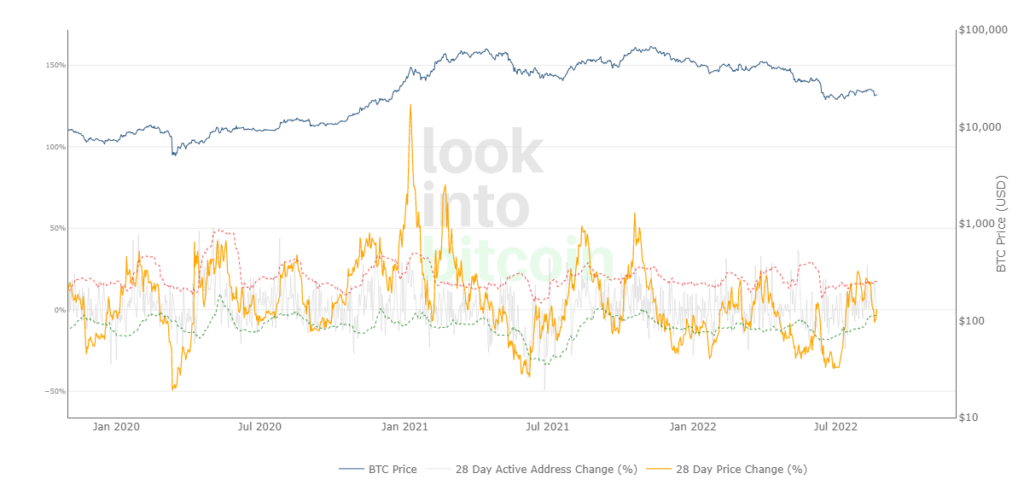

Bitcoin is exiting the short-term oversold zone. This means that the price of the cryptocurrency is likely to increase in the coming days or weeks, according to the Active Address Sensitivity Indicator (AASI) on-chain metric.

The graph below shows the yellow line crossing the lower limit of the range of changes in the number of active addresses.

This is a sign of market sentiment and the potential growth of the cryptocurrency in the short term, according to the indicator’s description.

Oversold bitcoin, Net Unrealized Profit/Loss indicator (NUPL) – the line again enters the “surrender” zone.

A similar signal is indicated by a longer-term indicator – RHODL Ratio.

“The RHODL Ratio is useful for predicting bitcoin price in extreme market conditions. It can predict the period in which the price of the cryptocurrency may pull back. In this case, the metric line is included in the upper range highlighted in red. In addition, after the indicator values remain in the green range for a while, the price may start to rise.

According to CoinGecko, the first cryptocurrency is trading in the region of $21,400. In the past seven days, the price of digital gold has decreased by 11.4%.

Earlier, Charles Edwards, founder of Capriole Investments, concluded that the period of capitulation of bitcoin miners has passed. He says it’s a “great buy signal.”

Read ForkLog bitcoin news in our Telegram – cryptocurrency news, courses and analysis.

Source: Fork Log

I’m Sandra Torres, a passionate journalist and content creator. My specialty lies in covering the latest gadgets, trends and tech news for Div Bracket. With over 5 years of experience as a professional writer, I have built up an impressive portfolio of published works that showcase my expertise in this field.