WSJ: Tether “technically bankrupt” if assets drop 0.3%

- August 29, 2022

- 0

A 0.3% drop in the value of reserve assets could send the stablecoin Tether (USDT) issuer into “technical bankruptcy.” These results were obtained in The Wall Street Journal.

A 0.3% drop in the value of reserve assets could send the stablecoin Tether (USDT) issuer into “technical bankruptcy.” These results were obtained in The Wall Street Journal.

A 0.3% drop in the value of reserve assets could send the stablecoin Tether (USDT) issuer into “technical bankruptcy.” These results were obtained in The Wall Street Journal.

The publication acknowledged that such a “thin cushion of equity” threatens market chaos if Tether’s liabilities exceed its assets. Journalists warned that under these circumstances, trust could erode, leading to a wave of people looking to convert stablecoins into fiat.

According to the Tether Limited website, the organization’s capital stock is estimated at $190.9 million, with assets of $67.74 billion.

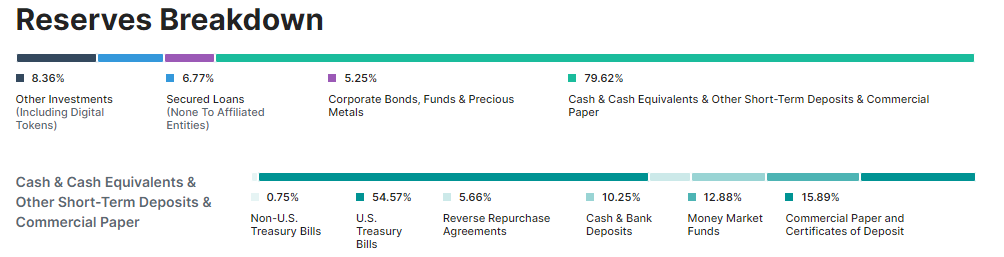

79.62% of USDT reserves are backed by cash, cash equivalents, other short-term deposits and commercial papers.

The remainder consists of other investments with a stake of 8.36%, including unspecified digital tokens, 6.77% in secured loans to non-affiliates and 5.25% in corporate bonds, funds and precious metals.

In an interview with CTO Tether Limited, Paolo Ardoino predicted a “significant increase”. [капитала] as a percentage of investment” in the next few months. He recalled that at the time of Terra’s collapse, the company processed the conversion of 7 billion tokens into fiat (~10% of total assets) within 48 hours.

“I don’t think we pose a systemic risk. [крипто]system”said.

The top manager confirmed his intention to increase the frequency of publication of audit reports – now they will be published monthly, not quarterly.

Recall that on August 19, BDO Italia, the world’s fifth largest inspector, approved the supply of Tether.

The USDT issuer has approved plans to reduce its commercial paper stock to $200 million by the end of August, with these assets being completely divested before the end of the year. For the second quarter, the position was down 58% to $8.5 billion.

Earlier, Tether called the idea of shorting USDT by hedge funds “categorically incorrect”.

Prior to that, in mid-May, the stablecoin tested the $0.94 level, diverging from its stable price to the US dollar. Later, the rate returned to par.

Read ForkLog bitcoin news in our Telegram – cryptocurrency news, courses and analysis.

Source: Fork Log

I’m Sandra Torres, a passionate journalist and content creator. My specialty lies in covering the latest gadgets, trends and tech news for Div Bracket. With over 5 years of experience as a professional writer, I have built up an impressive portfolio of published works that showcase my expertise in this field.