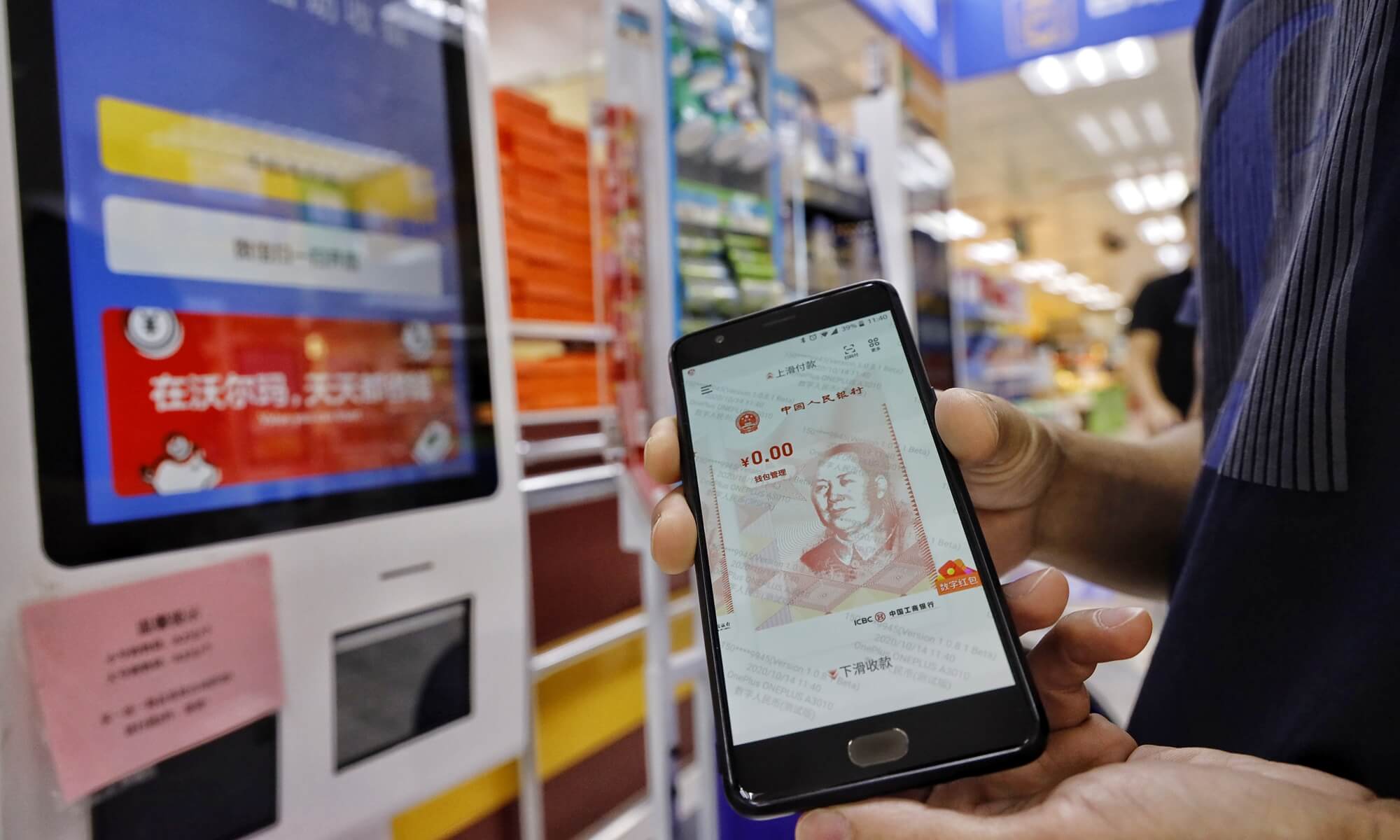

On April 14, the Cabinet of Ministers submitted a bill to the State Duma on taxes on transactions with digital assets.

The document explains the specifics of VAT, corporate tax on transactions related to the sale of digital assets, as well as taxpayers’ personal income tax on profits and income from the sale of digital assets.

According to the bill, VAT will be charged on the services of information systems operators where digital financial assets (DFA) are issued, and on services of digital financial asset exchange operators for the acceptance of digital rights.

The financial result of the transactions made with DFA is determined separately for each transaction and its total as of the income payment date.

For transactions with securities that are not traded in the organized securities market, the tax base may be reduced by the amount of loss in transactions with CFA.

In the exercise of digital rights that include securities and benefit tokens at the same time, the tax base is determined as the difference between the sales and acquisition price of the specified digital right, taking into account the tax amount.

The income tax of Russian organizations with digital rights will be 13% -15% for foreign companies.

Until February 1, 2023, the issuer of the CFA is obliged to submit the tax report to the transactions made with the CFA in 2022 and to the parties to the transaction.

Recall that the amendments to the Tax Code on the taxation of transactions with cryptoassets can be adopted in parallel with the draft law “On Digital Currency”, which provides for transactions with cryptocurrencies through Russian banks, identification of holders of crypto wallets and separation of investors. qualities.

Source: Fork Log

I’m Sandra Torres, a passionate journalist and content creator. My specialty lies in covering the latest gadgets, trends and tech news for Div Bracket. With over 5 years of experience as a professional writer, I have built up an impressive portfolio of published works that showcase my expertise in this field.