Glassnode Analysts Let Bitcoin Drop

- April 20, 2022

- 0

Bitcoin has been unable to break out of the range formed since February, but the process of redistributing coins from speculative investors to hodlers is already complete. A

Bitcoin has been unable to break out of the range formed since February, but the process of redistributing coins from speculative investors to hodlers is already complete. A

Bitcoin has been unable to break out of the range formed since February, but the process of redistributing coins from speculative investors to hodlers is already complete. A similar scenario has not been ruled out in Glassnode.

This bear market has been restructured #Bitcoin ownership with $BTC Moving from Short Term speculative to Long Term investor hands.

Statistically, we apparently saw the greatest surrender in both cohorts.

Read our analysis👇https://t.co/jooUzNt5k8

– glass knot (@glassnode) 19 April 2022

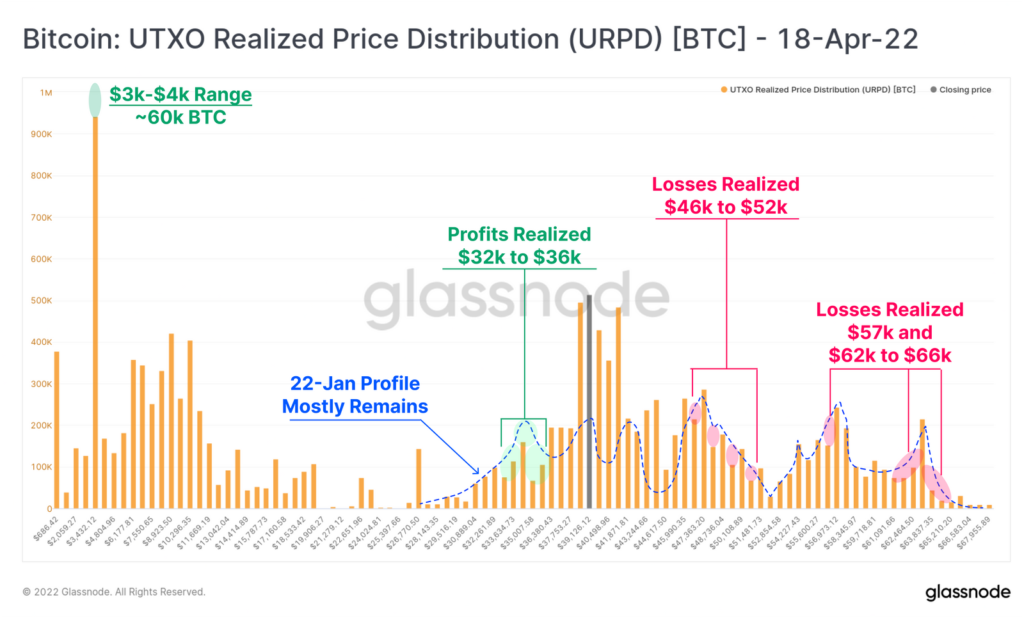

Experts again recalled the coin accumulation in the $35,000-42,000 corridor. Comparing UTXO at the time of writing and as of January 22 (marked with a blue dotted line), they came to the following conclusions:

According to the market profile chart, there are few participants among speculators who bought BTC in the $50,000-60,000 range. Mainly their purchases are concentrated in the $38,000-$50,000 corridor.

Hodlers is holding 15.2% of the total market supply at a loss, surviving the current 50% correction. According to analysts, this confirms that the probability of selling pressure in the future is low.

The speed with which coins turned into unrealized losses during the current correction turned out to be significant in retrospect.

Short-term investors’ net realized capitalization (three standard deviations) fell only twice as badly at the extremes of the 2018 bear market. Current dynamics exceeded the July 2021 correction.

A more dramatic drop (4.5 standard deviations) was noted by analysts in metrics for long-term investors. It turned out to be something unprecedented.

The most convincing explanation for the trend is what experts called hodlers capitulation, fearing the speed of the current correction. They cited the purchase at below-average costs and the transition of speculators to the category of long-term investors as less important factors.

Recall that the head of Nexo Antoni Trenchev predicted that Bitcoin will hit $100,000 within a year.

BitMEX co-founder Arthur Hayes said that bitcoin would drop to $30,000 at the end of the second quarter, possibly due to the drop in the Nasdaq index.

Previously, analysts at Arcane Research found that the correlation between Bitcoin and tech stocks has reached its highest level since July 2020.

Source: Fork Log

I’m Sandra Torres, a passionate journalist and content creator. My specialty lies in covering the latest gadgets, trends and tech news for Div Bracket. With over 5 years of experience as a professional writer, I have built up an impressive portfolio of published works that showcase my expertise in this field.