In the context of declining activity in the Bitcoin derivatives market, medium and long-term constructive trends are emerging. These are the conclusions made by Glassnode analysts.

Trading volumes, implied volatility and spreads to the spot market have dropped to all-time lows over the past 12 months. This has been facilitated by price consolidation since mid-January.

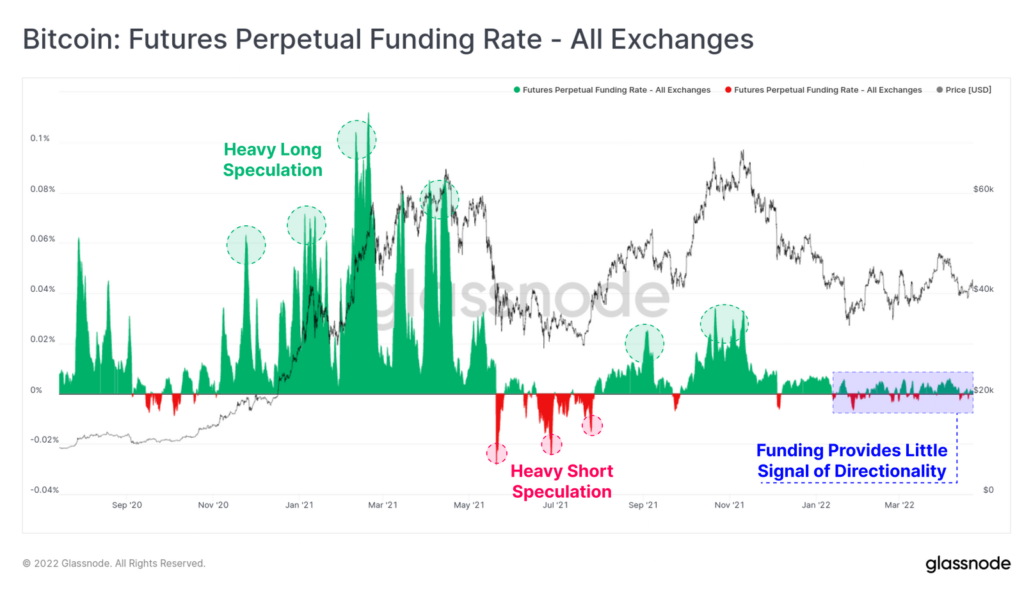

The funding rate for perpetual contracts began to contrast sharply with previous months, which were characterized by long and short periods of asset accumulation.

Annual rates in terms of funding rate and cost rolling Futures for the next three months are starting to look unattractive to market makers. Experts believe that such market conditions create preconditions for the flow of capital to segments with different risk and return profiles, especially given the annual inflation jumping to 8.5% in the US.

There is also a decrease in network activity. The daily transferred on-chain value fluctuates in the $5.5 billion-$7 billion range, which is 40% lower than the peak during the bull market, although higher than the values observed in 2019-2020.

Experts emphasized that since October 2020, the share of transactions with the equivalent of $ 10 million or more has increased from 10% to 40%. Experts explained this with the growing influence of business decisions from corporate and wealthy individuals.

Another positive factor in terms of medium-term prospects is the cyclical discrepancy between the entry/exit volume associated with cryptocurrency exchanges and the total trading volume. Currently, the figure has dropped to 32%.

For analysts, this is evidence of the shift from speculation to basic demand-driven actions such as over-the-counter transactions, coin hodlers and custody operations.

Recall that on April 25, initial cryptocurrency prices updated the local minimum below $38,500.

BitMEX co-founder Arthur Hayes said digital gold could drop to $30,000 by the end of the second quarter of 2022 due to the drop in the Nasdaq index.

Glassnode analysts previously announced that the process of redistributing coins from speculative investors to hodlers is complete, allowing bitcoin to bottom out.