What happened in the mobile game and application industry in the first half of 2022? In response to this SocialPeta“H1 2022 Mobile Game and App Marketing Reviewhas published its content and will help people working in the mobile game and app industry in the globalization of their products. important information as long as.

This white paper integrates industry insights from dozens of companies, including Snapchat, Chartboost, Liftoff, Vungle, Udonis, Mobidictum, Game Factory, and more. This one in the first half of the year An accurate analysis of mobile game and application industry data and predictions of future trends, global mobile marketing data, observation of popular regions, accurate channel ads, advertising budget costs and based on popular mobile game and app analytics.

Overview of global advertising market data

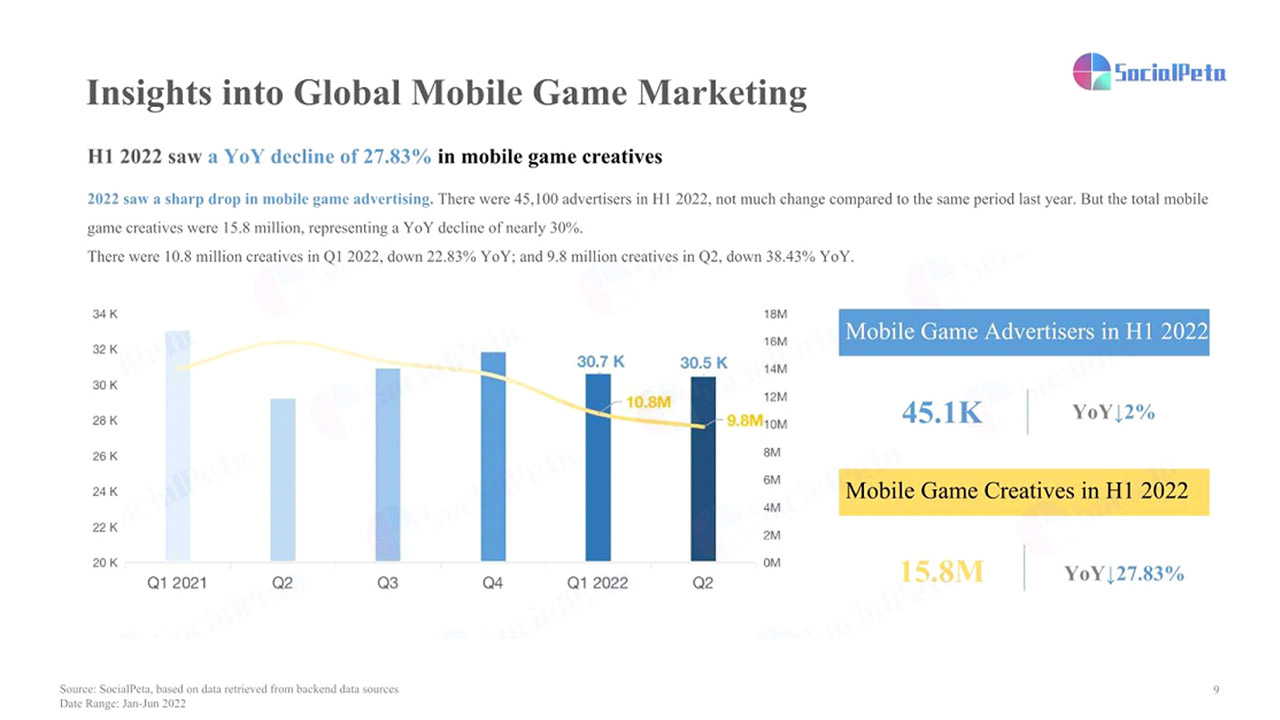

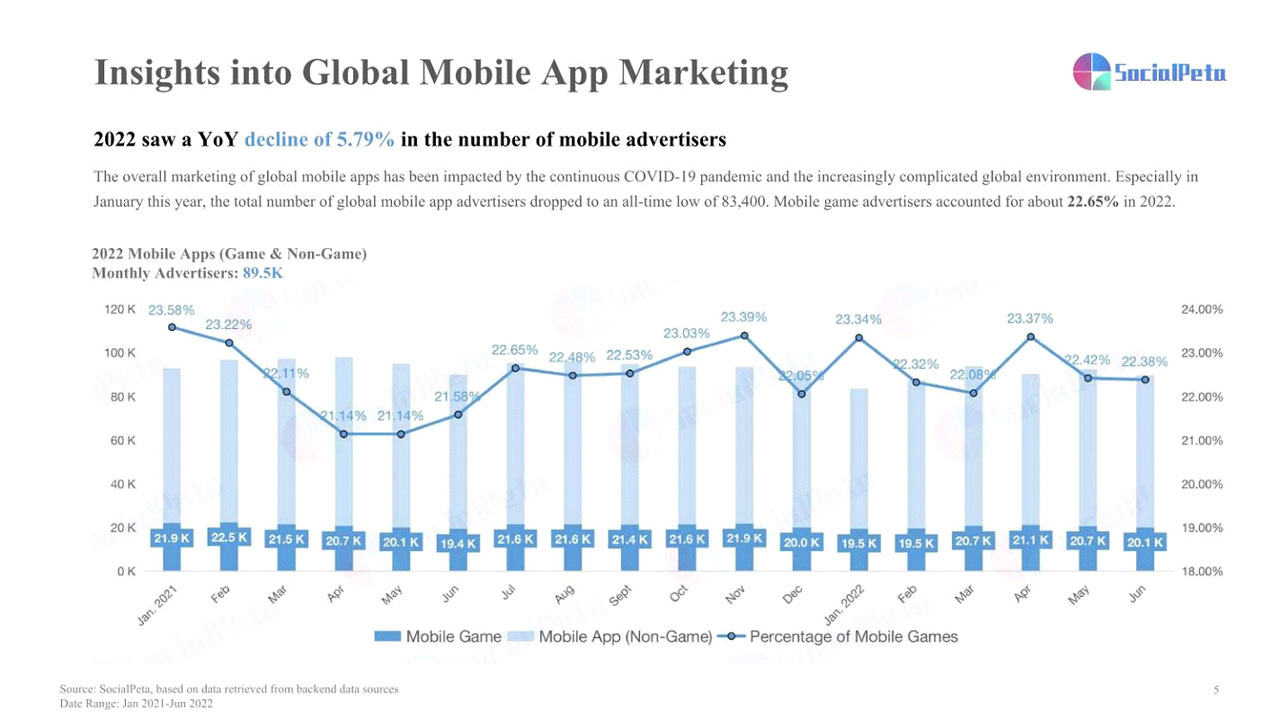

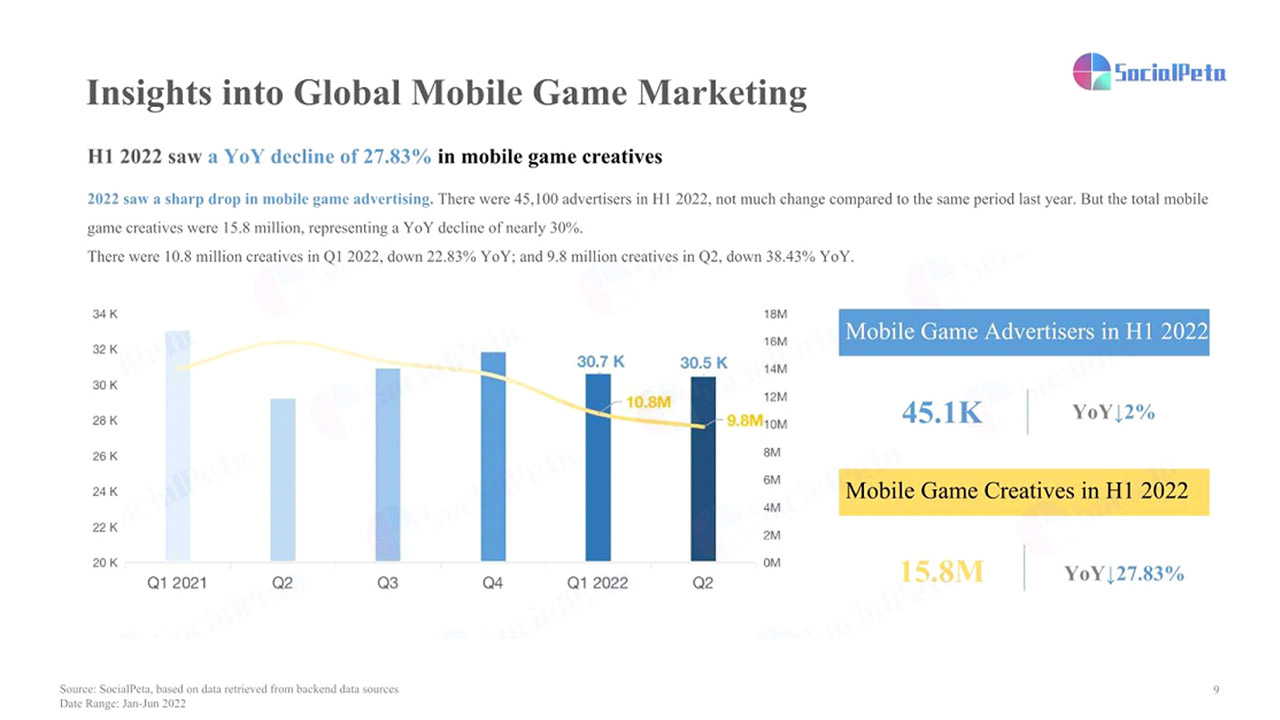

- The total number of ads for mobile games has decreased by about 30%. in light mobile games reported an annual increase.

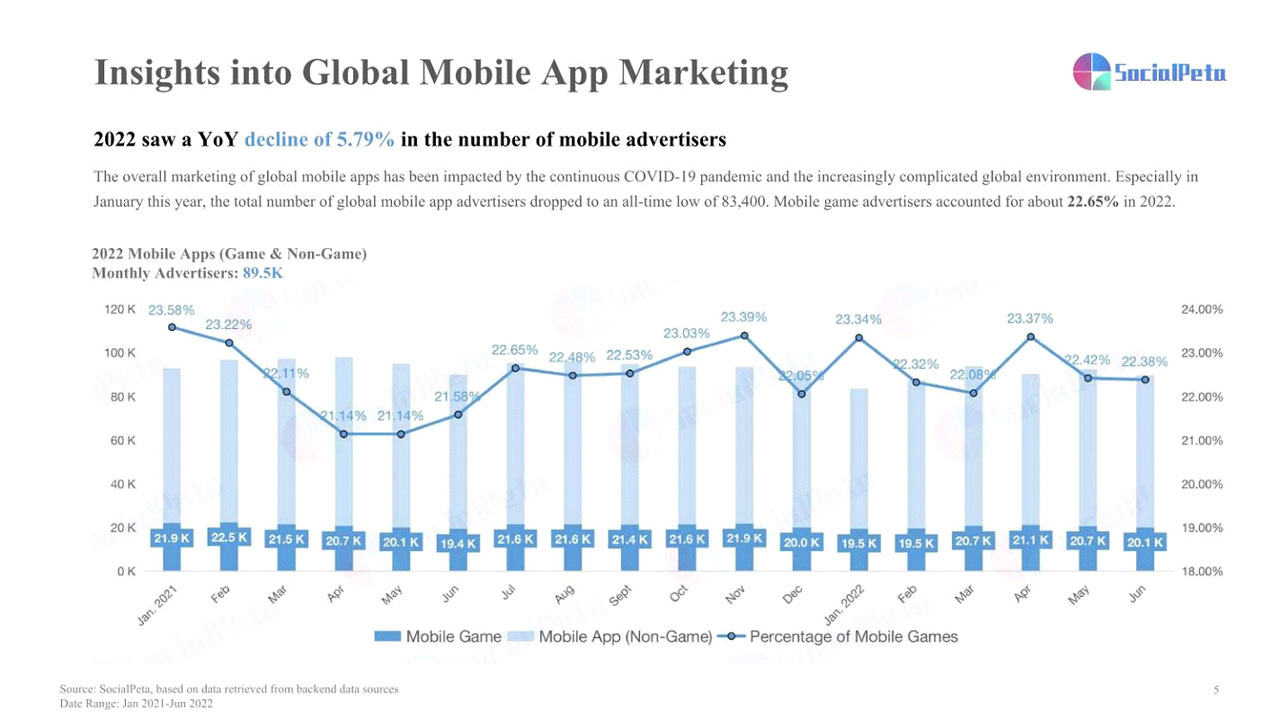

- Total number of global advertisers for mobile apps in January this year as 83,400 slumped to an all-time low, with mobile game advertisers remaining around 22.65%.

- Ad market data: Although the total number of ads decreased by about 30%, in T2 and T3 markets The number of advertisers has risen sharply.

- H1 2022, with a decline of about 30% year-over-year 15.8 million mobile game creative. By region, Oceania and Europe reported downward trends in the number of advertisers, and in all other regions, the number of advertisers in the T2 and T3 markets increased significantly.

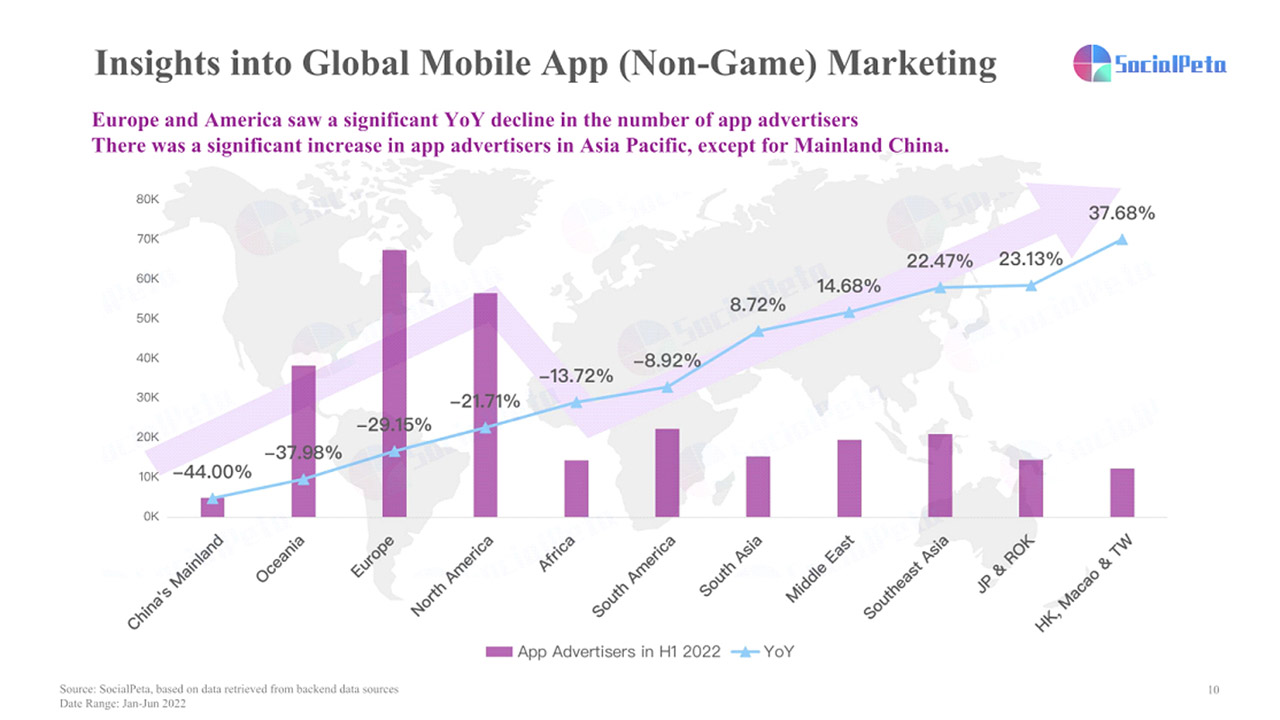

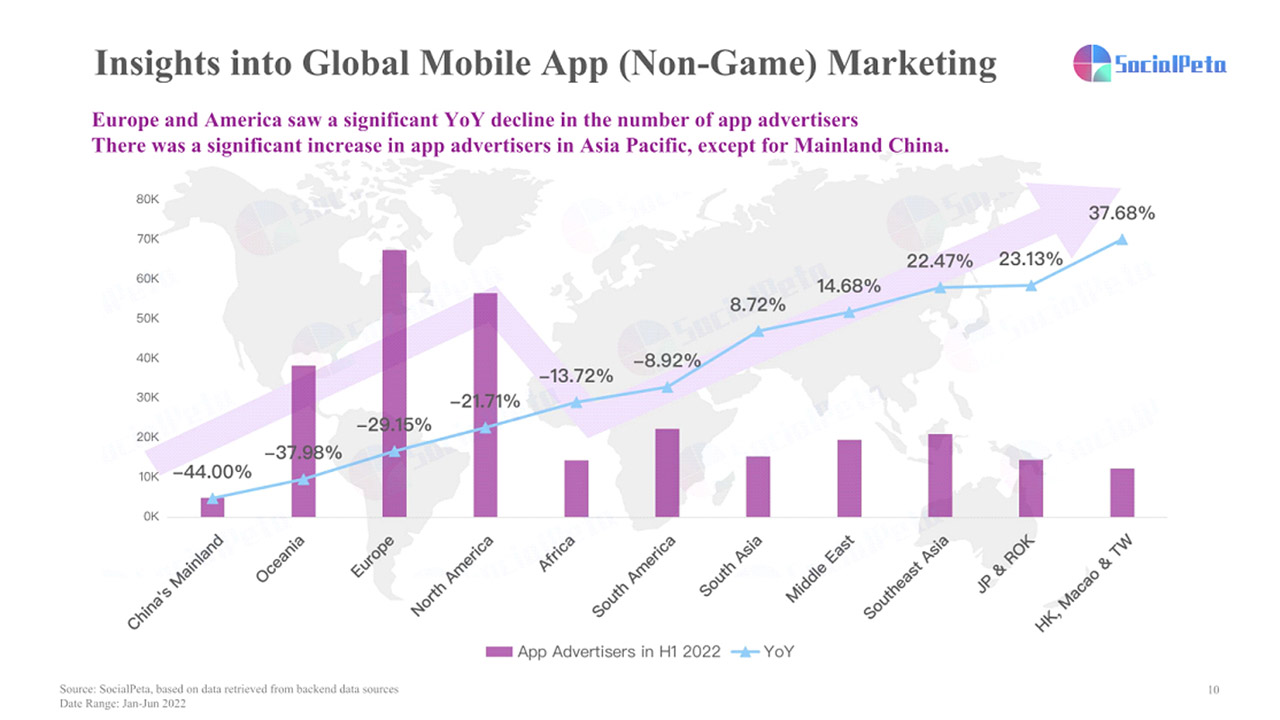

- Decrease in Europe and America and increase in the Asia-Pacific region: Approx. a 30% drop consists.

- H1 2022, over 4 million creatives, a 27% year-over-year decline for mobile apps (non-game) and a 6.24% year-over-year increase more than 130,000 advertiser has seen.

- Europe, Americas and China (Mainland) in app advertisers, 44% yoy in China (Mainland), 15% per year in Europe and North America reported a significant annual decline of 22%. Other regions in Asia-Pacific (excluding mainland China) saw significant increases in the number of app advertisers. Of these, the Chinese regions of Hong Kong, Macau, and Taiwan also have an estimated annual number of advertisers. 40% increase has shown.

App Store downloads, revenue and ad charts

Best practices were mostly gadgets, shopping, and social apps.

Global marketing overview for mobile apps in different countries/regions

The second part of the report focuses on an overview of mobile game and app marketing in popular countries/regions around the world.

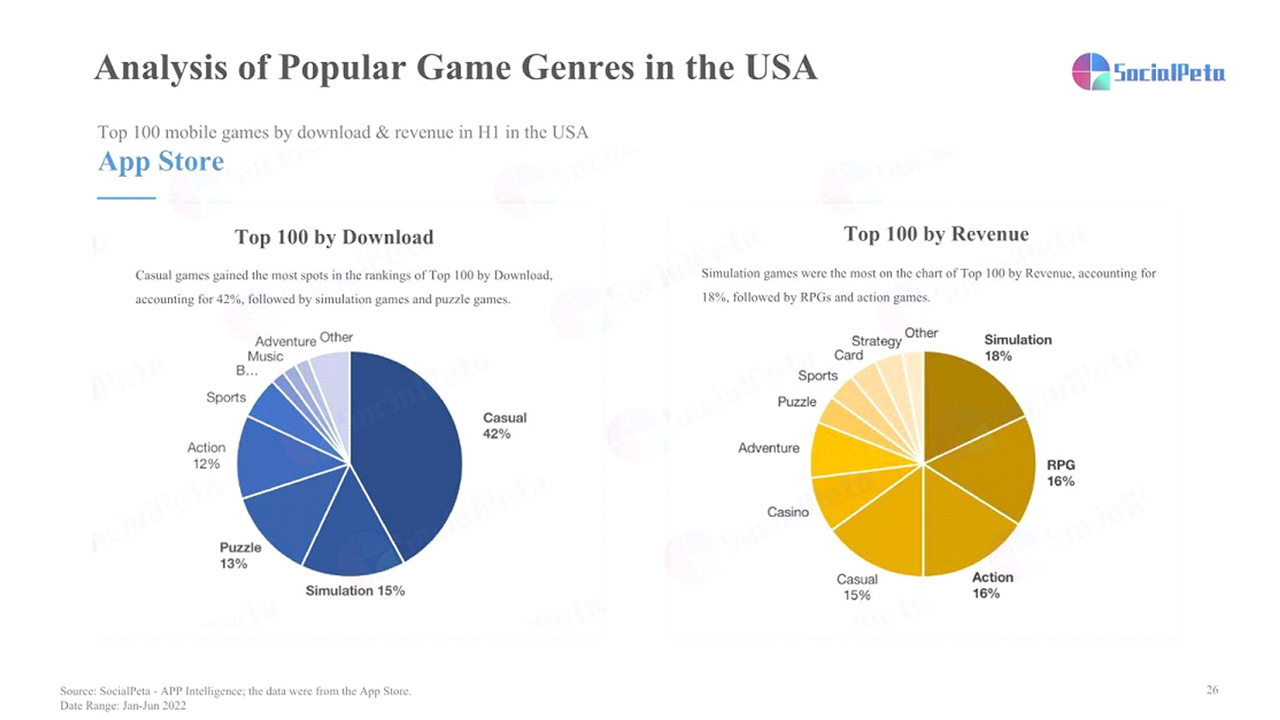

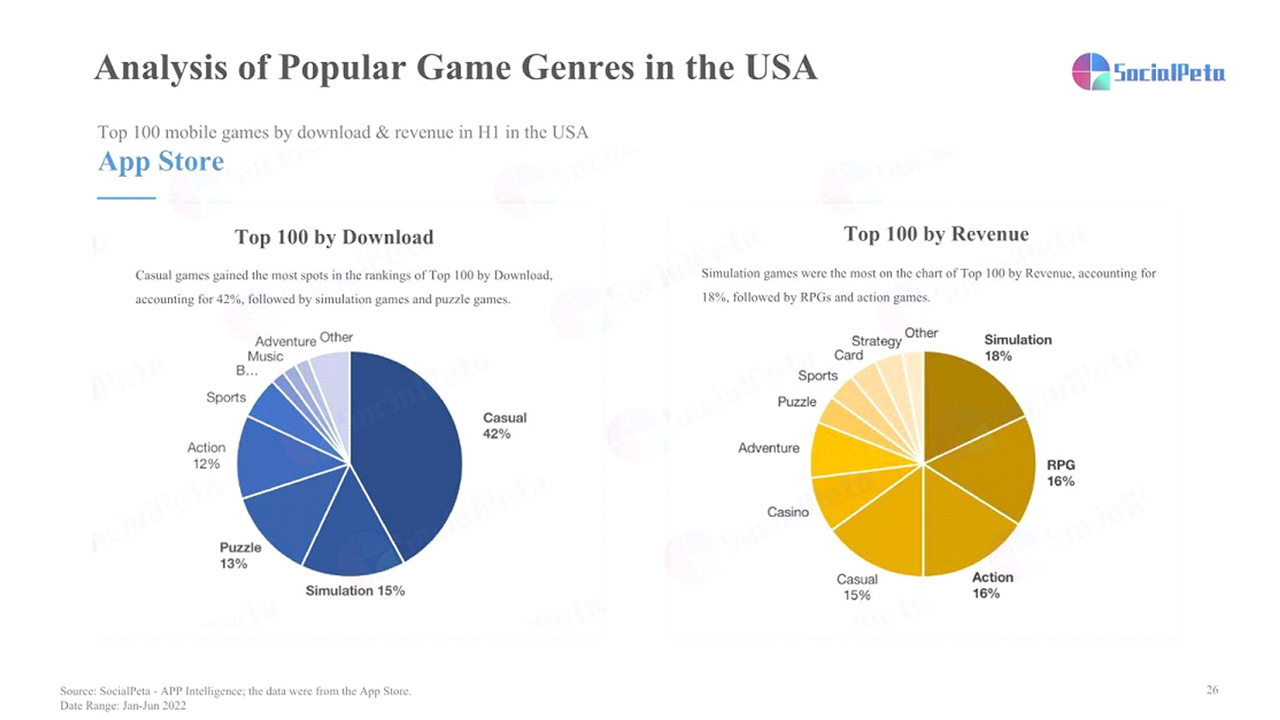

- Regional Market Analysis: Advertisers for hyper-casual and puzzle mobile games make up over 40% of the US. in America hyper casual and puzzle game advertisers together make up the highest percentage of over 40%. As for the total number of ads by game type, it has the most content including hardcore games, SLGs and match-3 games.

- As for download, hyperlink based on PC gaming IPs casual games and mobile games, especially [Diablo Immortal] and [Apex Legends Mobile] was relatively superior. In terms of revenue, match-3 games and SLGs are stronger.

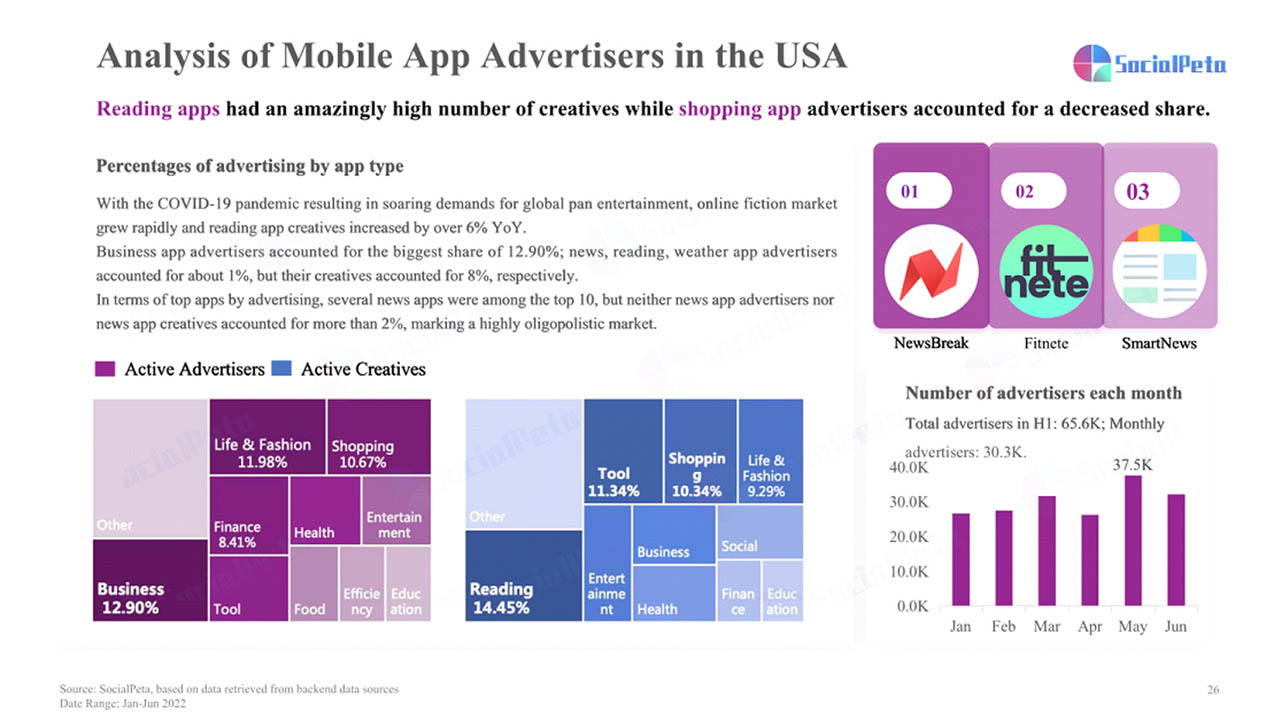

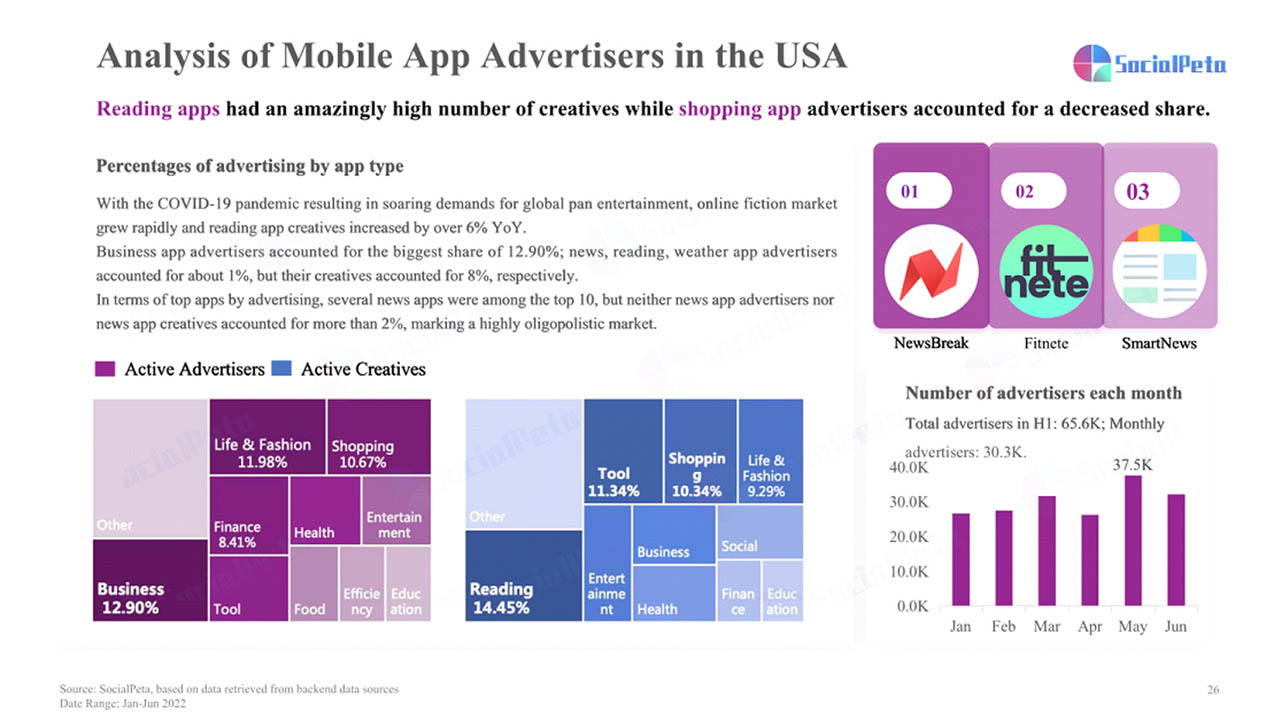

- Reading apps had an extraordinary number of creatives, and TikTok It dominated the US market.

- The increasing demand for global pan entertainment has led to the rapid growth of the online fiction market. In the US, creatives for reading apps grew more than 6% year-over-year, while advertisers for business apps in the office grew 12.90%. highest percentage has made. Advertisers for news, reading and weather apps all accounted for about 1%, while ads all accounted for about 8%.

Download the full whitepaper to learn more about different countries/regions.

Cost:

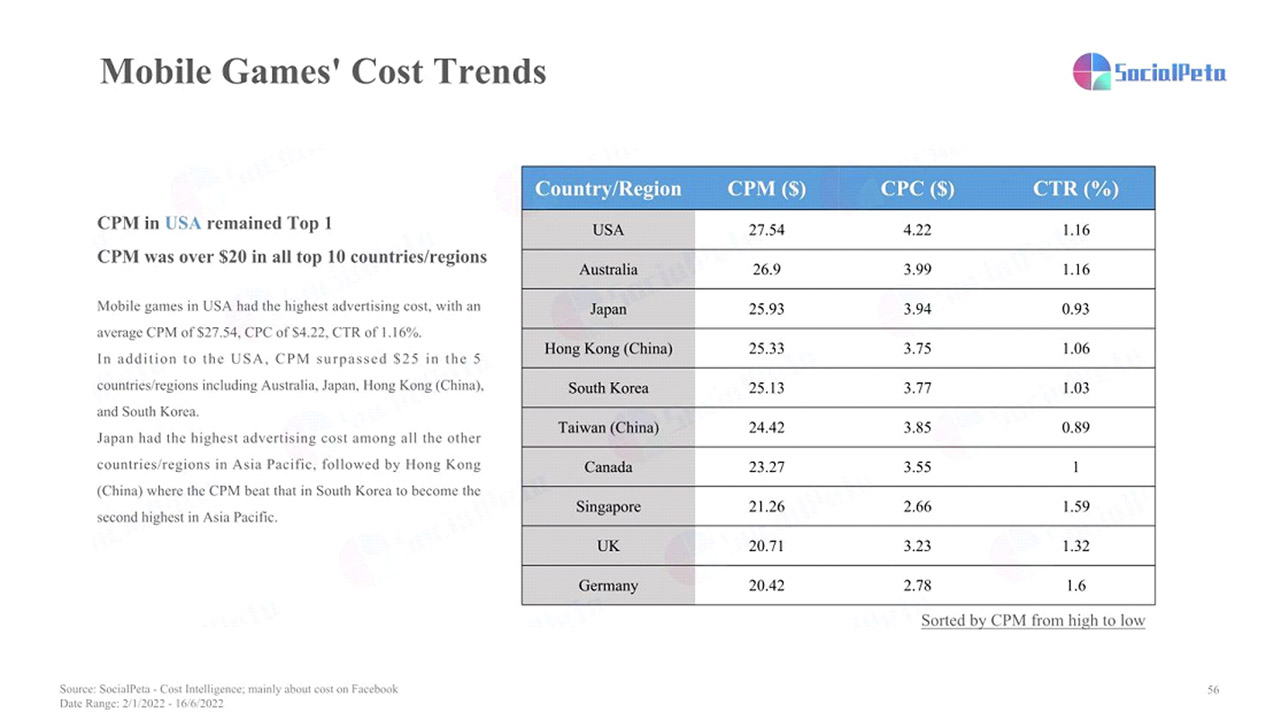

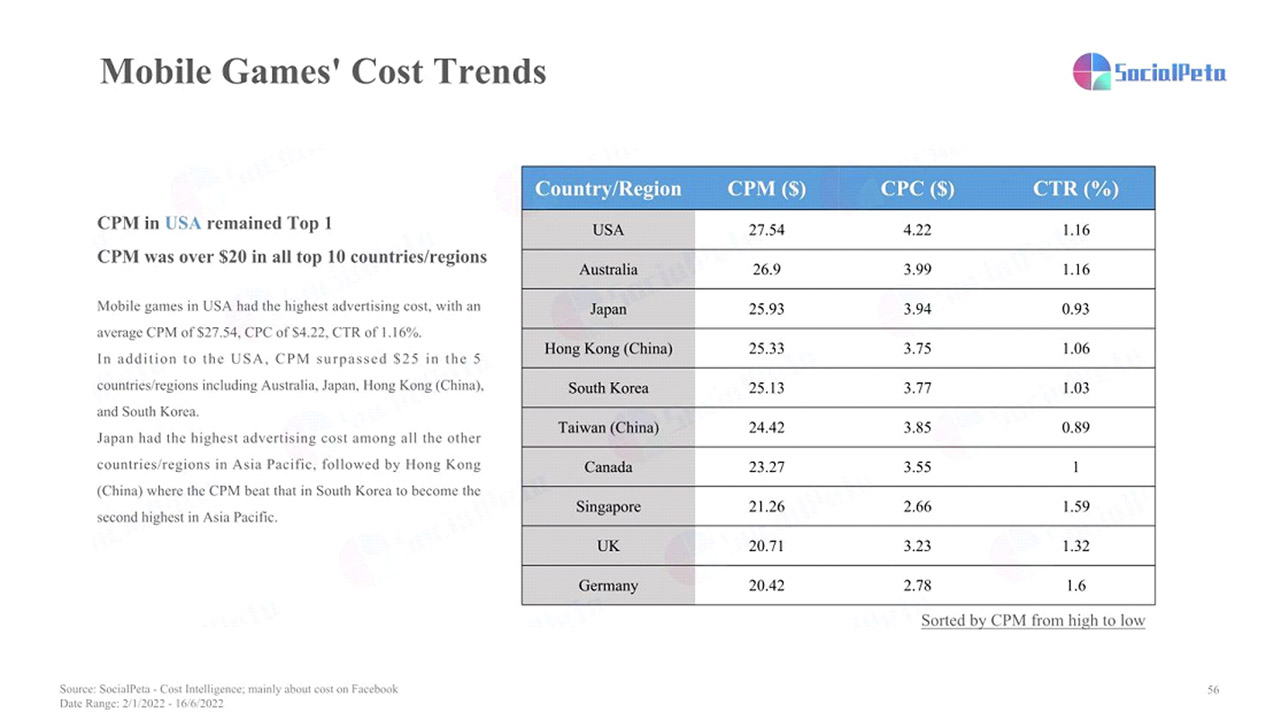

- There was fierce competition in global advertising and United States had the highest advertising costs. Of all countries/regions, the United States has the highest ad costs for mobile games, with an average CPM of $27.54, CPC of $4.22 and a CTR of 1.16%. In addition to the US, the CPM is $25 in 5 countries/regions, including Australia, Japan, Hong Kong (China) and South Korea. has exceeded.

- your mobile games advertisement cost Increased. CPM averaged $19.31, an increase of 18% compared to last month, CPC was $2.57, a decrease of 3% compared to last month, and CTR averaged 1.48%, an increase of 7% compared to last month.

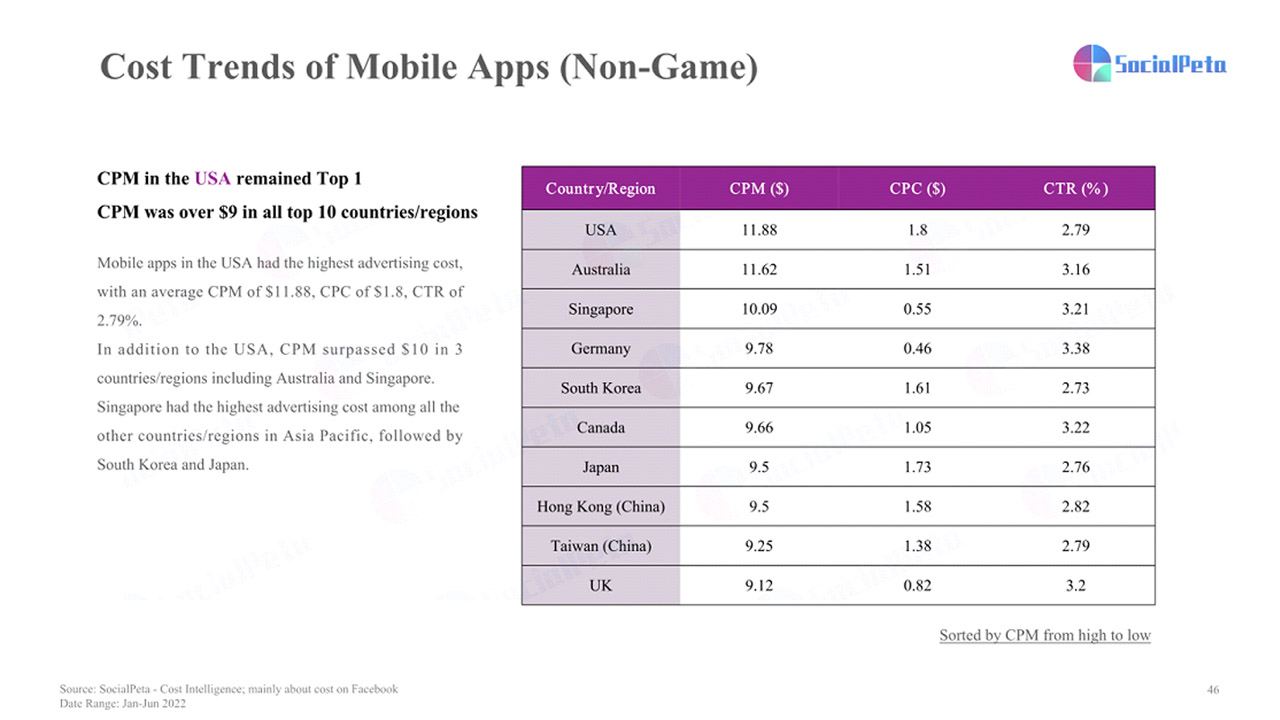

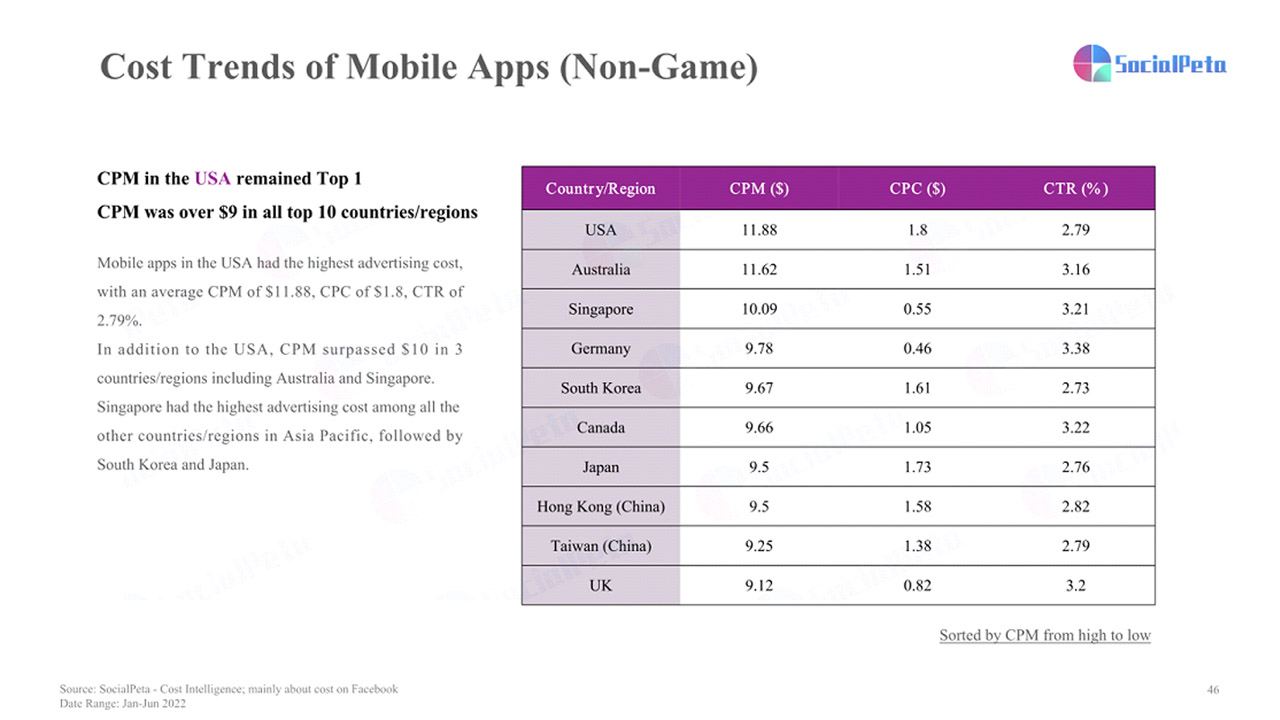

- The CPM for mobile applications increased by 64% compared to the previous month and the CPM of 3 countries exceeded 10 dollars. Overall, mobile app advertising costs continued to rise in H1 2022, with an average CPM of 64% higher than last month. $9.16 The average CPC was $0.93, up 181% from the previous month, and the average CTR% increased 22% from the previous month to 2.74%. The US has the highest ad cost for mobile apps, with an average CPM of $11.88, CPC of $1.8 and CTR of 2.79%. Three countries/regions, including Australia and Singapore, have CPMs above $10. Singapore is the country with the highest advertising costs in the Asia-Pacific region. South Korea and Japan followed.

Advertising Trends

- casual gameswas the key to creatives.

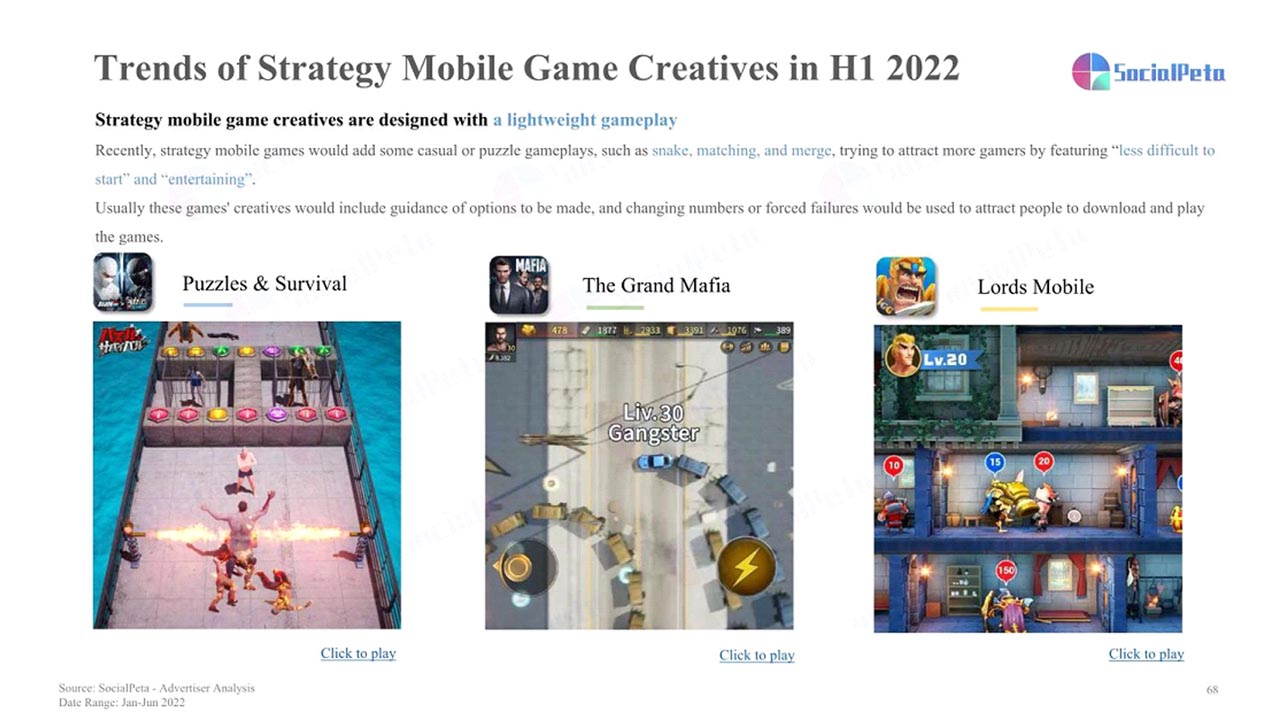

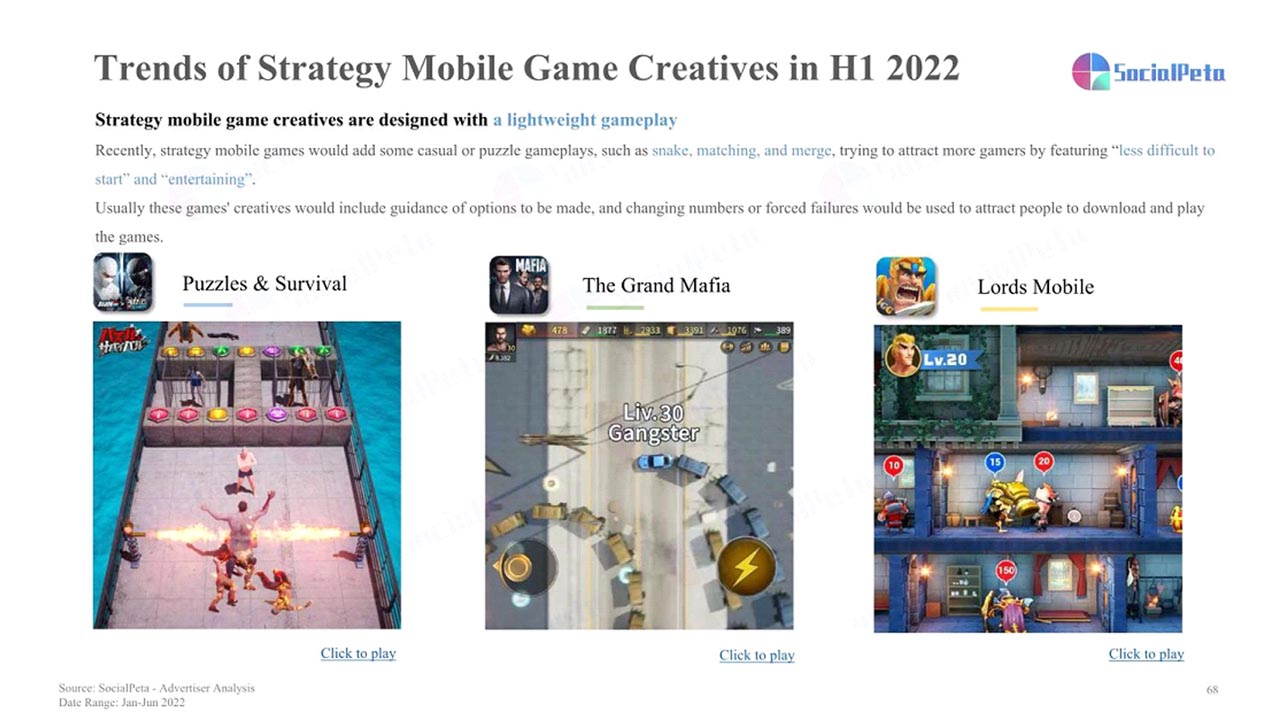

- Strategy mobile games: Ads are designed to make games easier to play to attract more viewers as they download.

- Creatives released in the first half of 2022 are often designed with light gameplay and are “less difficult to get started” and “enjoyable” tried to attract more players with its features.

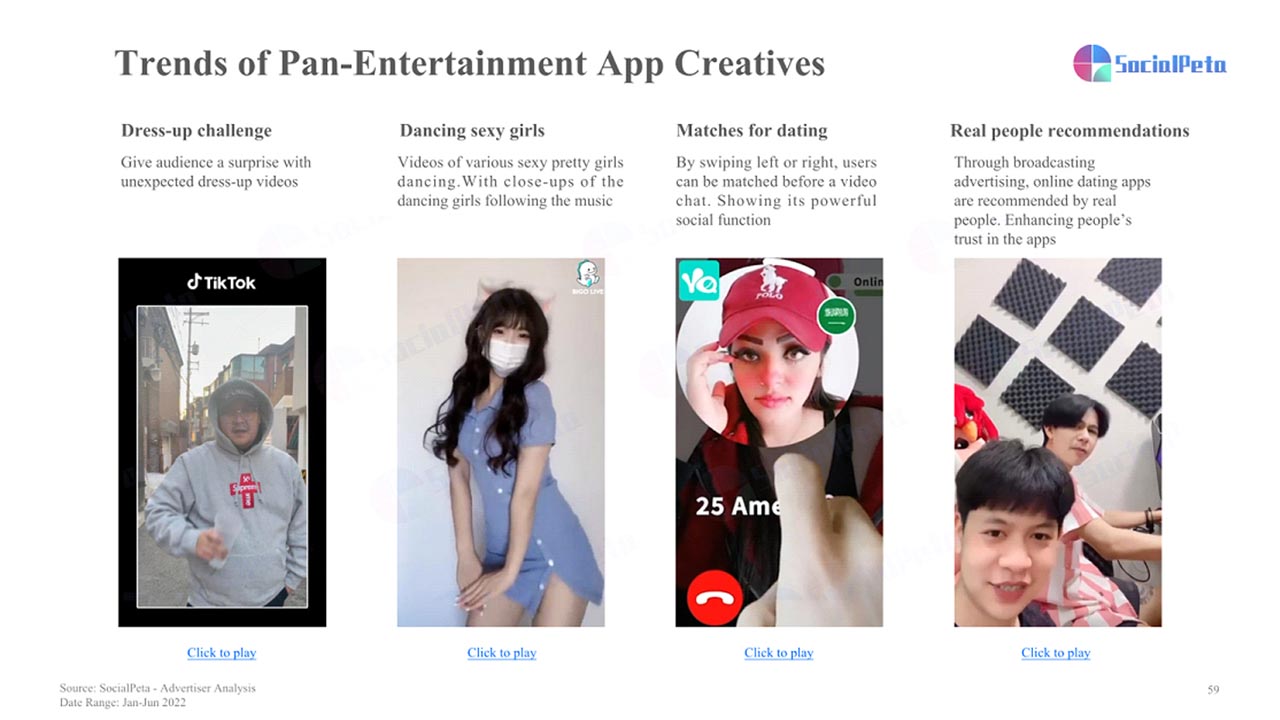

- As global demand for pan entertainment grows, short video live streamEntertainment platforms have undergone a serious revolution TikTok, Bigo Live and other short video applications and live streaming platforms have changed the dominant position of meta platforms, creating a fierce conflict between thousands of live streaming platforms. to competition has caused.

Trends in the mobile game and app industry

- High budget and quality mobile games are growing and the beginning of a new era of mobile games Activision announced that in the first half of 2022, “Call of Duty: Warzone” will be developed into a brand new mobile AAA version. Apple selected the “Genshin Impact” mobile game to showcase product performance at its new product launch event this spring, and the game will be labeled “AAA Game” on slides. Going forward, AAA will be producing mobile games and announcing its plans to bring the PC gaming experience to mobile. Lake The gaming business is expected to emerge.

- ACGN mobile games have evolved even more and have become a worldwide sensation. “Genshin impactremained at the top of the list of all global mobile games. On the first day after its release, the Japanese version of “Arknights” topped the App Store’s free game charts and its in-game events were highly rated. version of Taptap, “ACGN tagged as” items and scheduled for release more than 145 game exists.

- To avoid fierce competition, application globalization must seek new opportunities in the T3 market. The T3 market has accelerated digital infrastructure construction after COVID-19. Many financial technologies in the T3 market, e-commercesocial interaction and entertainment, gaming and similar industries began to attract attention. For example, Mexico’s fintech business has grown rapidly to become one of the largest fintech systems in Latin America, thanks to huge demand and strong government support for fintech services.

- Since the concept of Metaverse became a sensation, every day a new “metaverseapp was published. From November 2021 to January 2022, there were 552 apps labeled “metaverse”. However, these apps were rough and fast, and there was no official definition of metaverse apps. Therefore, metaverse social apps are still at a very early stage is located. However, there is a huge gap that needs to be filled before it can have huge earning potential or become popular.

The data for this report is based on more than 90 mobile marketing platforms worldwide and in total more than 1.2 billion Covers 72 countries/regions worldwide with mobile marketing ads. For more information on industry data and growth opportunities for mobile gaming and apps the whole report you can download.