Billion-dollar satellites risk space insurance returns

- August 28, 2023

- 0

Viasat Inc. It has problems with orbiting satellites worth more than $1 billion, and space insurers operate with claims to disrupt the market. The Americas’ nearly $1 billion

Viasat Inc. It has problems with orbiting satellites worth more than $1 billion, and space insurers operate with claims to disrupt the market. The Americas’ nearly $1 billion

Viasat Inc. It has problems with orbiting satellites worth more than $1 billion, and space insurers operate with claims to disrupt the market. The Americas’ nearly $1 billion ViaSat-3 satellite, which has played a key role in expanding fixed broadband coverage and fending off rivals, including Elon Musk’s Starlink, ran into an unexpected problem in April when it placed its antenna into orbit. If Viasat were to declare full losses, industry executives predict the lawsuit would reach a record $420 million, making it harder and more expensive for other satellite operators to obtain insurance.

Due to the financial risk involved in insuring such an expensive satellite, ViaSat-3 is likely to be covered by multiple policies of different companies.

“No insurance company wants to take risks alone,” said Denis Bensoussan, who heads the satellite insurance business of Beazley Insurance, a syndicate of Lloyd’s of London, one of the ViaSat-3 insurer groups. No other major insurance company has been willing to publicly reveal its role as a satellite insurer.

Viasat reported that another spacecraft was damaged on 24 August, reporting power problems with the Inmarsat-6 F2 satellite launched in February. According to Space Intel Report, the failure could lead to the end of the ship’s life and $350 million in insurance claims. Viasat’s problems in orbit, American International Group Inc. It emerged a few years after leading insurance companies such as and Allianz SE closed their space portfolios. This left a smaller pool of providers to absorb the risks in the notoriously high $553 million market.

While large telecommunications firms with multi-million-dollar satellites still want coverage, Space Exploration Technologies Corp. Other space operators, such as the United States, have focused on launching large quantities of small satellites into low Earth orbit. Mask, don’t do the same. For them, the loss of a satellite is not a big deal.

Viasat executives said it was too early to say whether the company would file a lawsuit.

Viasat CEO Mark Dankberg told analysts on August 9 after the company announced quarterly results that exceeded expectations: “If we spend a few to three more months making quality measurements and then make those decisions, it will have no consequences for us.”

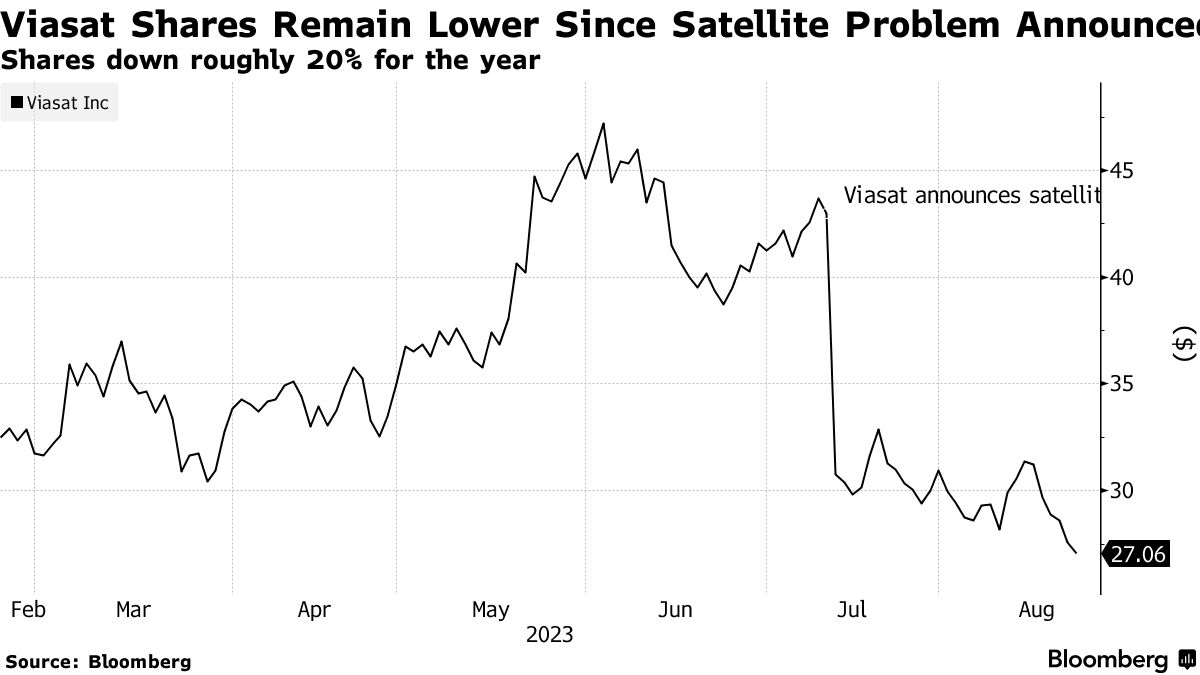

But investors are worried. Shares of Viasat fell 28% in July after the disclosure of the ViaSat-3 issue, with a record one-day drop. Management said the satellite issue will hinder growth in 2025, but its impact will be limited to fixed broadband services (only 13% of their business).

William Blair’s Louis DiPalma told customers last month that the company also experienced an antenna anomaly on the ViaSat-2 satellite launched in 2017, resulting in a $188 million claim.

“But the situation is much worse because the wait has been so long and Viasat is feeling the pressure from SpaceX,” DiPalma said. said.

Following the news of the Inmarsat-6 anomaly, Viasat and other industry players are likely to face significant difficulties in obtaining insurance for future satellite launches,” DiPalma said in its August 25 note.

The loss of US$420 million will surpass the FalconEye 1 satellite’s largest loss in 2019 of approximately €345 million (US$373 million). While large for the satellite insurance market, losses in other markets such as aviation can reach billions of dollars.

When mass satellite losses do occur, it is often accompanied by a small exodus of industry players. According to industry experts, premiums tend to increase as insurers leave.

According to launch and satellite database Seradata, satellite claims totaled $788 million in 2019, surpassing the year’s total premium of $500 million. In the years that followed, big names such as American International Group Inc., Swiss Re AG and Allianz SE closed the door to satellite insurance.

And if the pool of insurance companies shrinks, other insurers will act more confidently.

“People will be less interested in investing in things that are risky, like complex satellites or complex projects,” said Bensusan of Beasley. “They will either charge higher premiums for it or limit their insurance coverage.”

The basics of satellite insurance are more or less similar to property insurance. Satellite operators like Viasat usually pay a premium for the first year a vehicle stays in orbit, with the possibility of renewal and a serious launch pad failure.

“If the mission fails, they can be whole,” said Patton Kline, managing director of insurance brokerage Marsh. “They can go and buy a launch service, buy another satellite, and do the mission again.”

For smaller satellites, operators can potentially be covered by a single insurance company. But when satellites cost hundreds of millions of dollars, operators often have to apply to multiple insurance companies to get full coverage. Currently, there are around 20-30 players in the satellite insurance business.

“Some of the challenges we face are the low frequency of claims but high severity,” said Chris Kunstadter, head of global insurance at AXA SA. “So they don’t happen often, but when they do, they’re big.”

AXA declined to comment on whether they are covered by the ViaSat-3. Another insurance company, Marsh, said it was not interested in placing the satellite.

With so many insurers willing to take this big payout, insurers say satellite insurance premiums will rise in the coming months, increasing costs for satellite operators. This market turmoil is expected to subside over time, but it also comes at a time when insurers are exiting a market known for high volatility and high losses.

The number of active satellites in orbit has roughly quadrupled in recent years, thanks to the emergence of mega-constellations like SpaceX’s Starlink, which increases the potential for satellites to collide in space. Marsh Kline said that if this happens, the risks to the satellites in question may increase.

According to insurers, SpaceX does not insure its satellites. As more financial companies take the stage and launch smaller satellites into low Earth orbit, the desire to insure satellites is dwindling. While large batches of small and medium-sized satellites are being launched at the same time, the loss of one or more of these spacecraft is not significant, especially when compared to the loss of a single massive satellite such as the approximately 13,000-pound ViaSat-3. .

“Most of the premium is missing,” said Bensoussan. “This is probably one of the reasons why the space insurance market has not grown, even though the space industry is growing very, very dynamically and rapidly. It remains fairly stable.” Source

Source: Port Altele

As an experienced journalist and author, Mary has been reporting on the latest news and trends for over 5 years. With a passion for uncovering the stories behind the headlines, Mary has earned a reputation as a trusted voice in the world of journalism. Her writing style is insightful, engaging and thought-provoking, as she takes a deep dive into the most pressing issues of our time.