Data company Alteryx is being acquired by private equity firms Clearlake Capital Group and Insight Partners in a $4.4 billion deal.

Software company Alteryx has announced that it will be acquired by private equity firms Clearlake and Insight. A few months ago, the company was already considering a takeover, but no proposal could meet its requirements, and now it is opting for a deal worth $4.4 billion. With this amount, Clearlake and Insight beat another private equity firm, Symphony Technology Group. The impact on Alteryx’s approximately 2,900 employees is not yet clear.

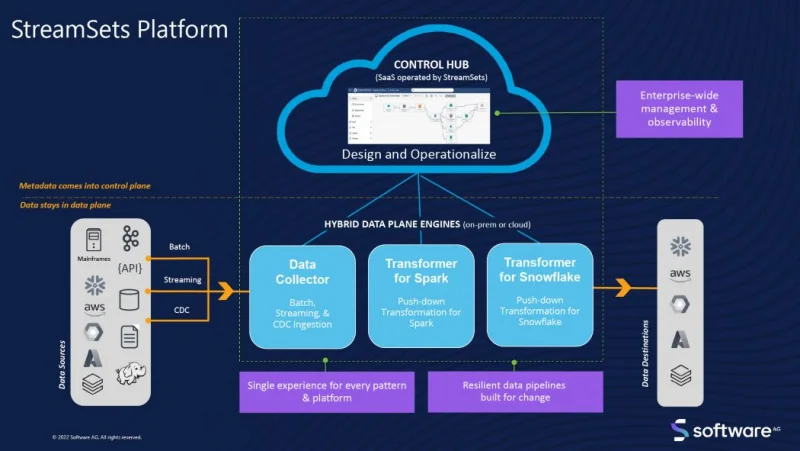

Alteryx is known for its ETL (Extract, Transform, and Load) tools. With these tools, companies can prepare huge amounts of data for analysis. Alteryx’s Analytics Cloud platform includes a wide range of business tools and features. Additionally, the company has already innovated with generative AI to strengthen its data platform.

With this deal, Alteryx has found new investors to realize further developments. The Clearlake Insight deal, which includes debt, puts Alteryx’s assets at about $3.46 billion. Although the company has experienced slow growth in recent quarters, this acquisition could be a positive turnaround.

The acquisition would not only advance Alteryx, but also benefit its customers (more than 8,300) and suppliers. Provided Clearlake and Insight keep their promise.

New collaboration

This deal would provide some cash value to Alteryx shareholders. Additionally, this transaction would also provide additional working capital and industry expertise, said Alteryx CEO Mark Anderson.

Over the past few years, Alteryx has implemented a comprehensive transformation strategy and built a strong roadmap for cloud and AI innovation.