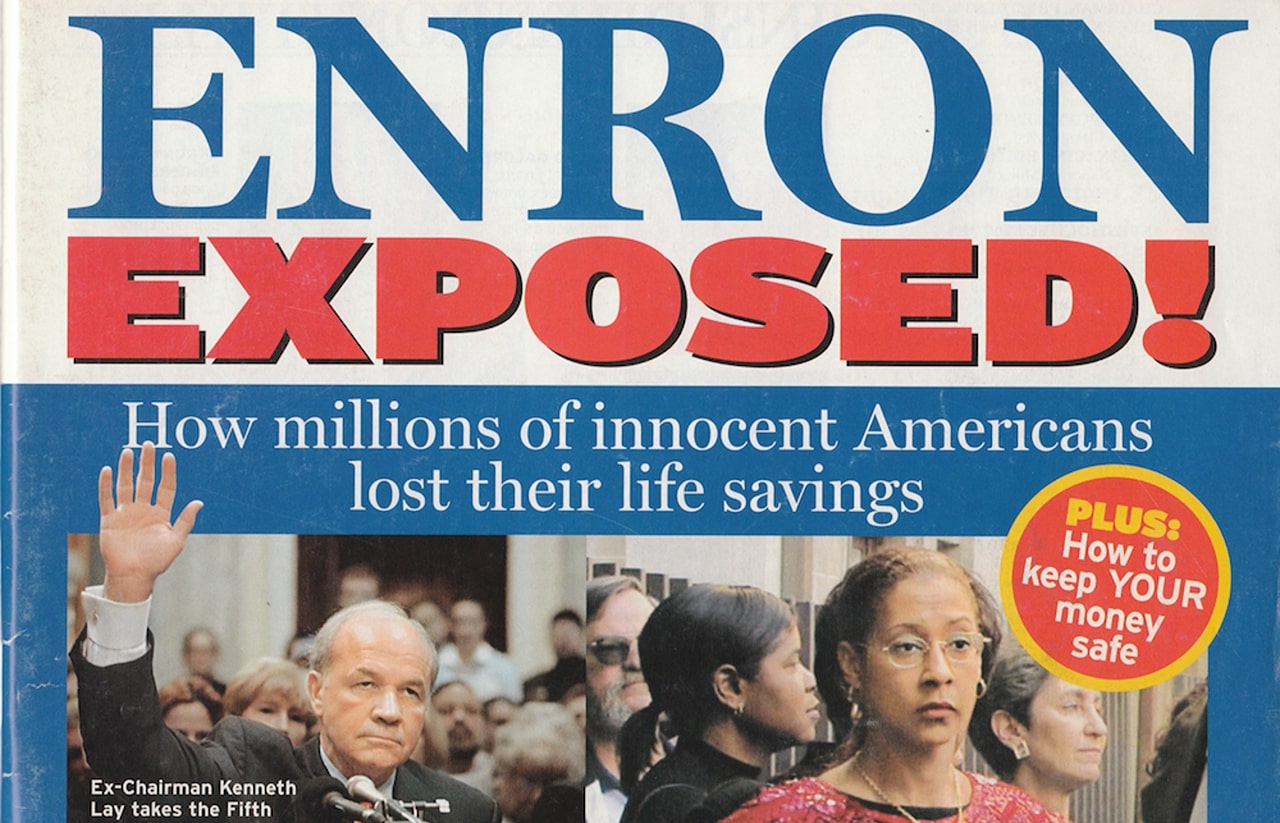

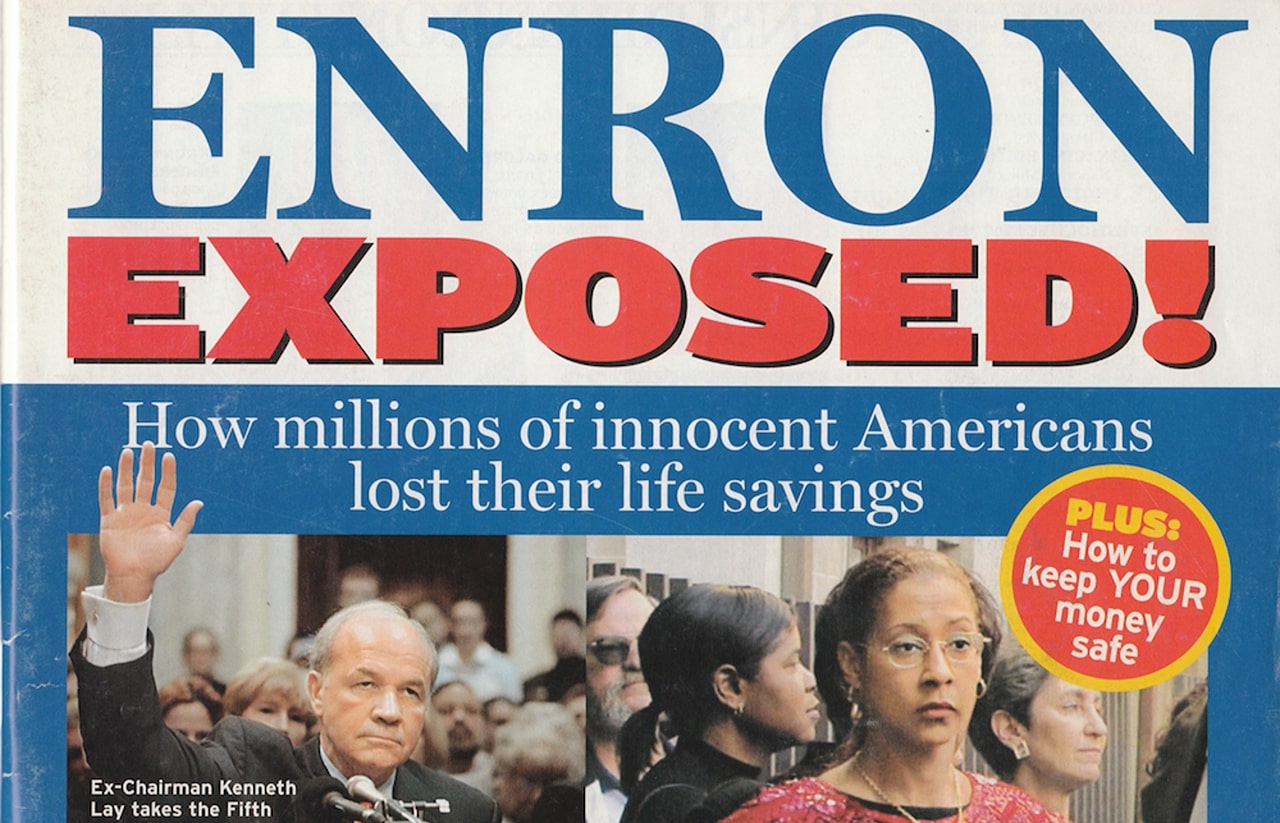

Enron scandal, It is known as the largest corporate fraud in history, even taught in universities today. This incident, which broke out in 2001, resulted in the bankruptcy of Enron, a famous energy company at the time, and obviously affected the lives of many investors and employees. It brought financial ruin.

Enron, a pioneer of its time and a shining star, was behind this bright appearance. manipulation and fraud he hid it.

The Enron scandal is one of the largest financial scandals in American history, resulting in the company’s bankruptcy.

in 1985 Enron, founded as an energy company in Houston has quickly become an impressive force in the US energy and services sector.

Natural gas It has achieved great success in its operations, communications and leadership in the paper industry. However, behind this good period, one of the biggest scandals in the company’s history developed. Enron’s collapse process, statutory accounting rules It started at the point of violation.

Company, was infamous for its off-balance sheet practice by hiding losses through other companies. These results, obtained through illegal accounting transactions, gave the company a misleadingly strong image and drove up stock prices.

In this case, one of the five largest accounting and accounting firms of that period Arthur Andersen is also mentioned.

Andersen, He audited Enron’s financial statements and promised to cover up Enron’s fraudulent accounting practices, collecting a total of $25 million for audit services and $27 million for consulting services in 2000. He received a salary of $52 million.

Although financial circles suspected that Arthur Andersen was causing complications in financial matters, the company’s solid reputation overshadowed these doubts.

Kenneth Lag

But on behalf of Andersen’s investors Failure to exercise effective control and because he failed to warn in time, he came under severe criticism when the scandal came to light.

Even when Enron’s dirty practices came to light By Arthur Andersen, It was revealed that the auditor in charge of Enron’s audit had put some of the important documents through a paper shredder, and the company received a tremendous public response.

in 1985 Kenneth Lag Founded by the merger of the Houston Natural Gas and InterNorth companies, Enron grew rapidly and by 1992 was the largest natural gas seller in North America.

The company gained successful momentum and made profits due to its high revenue streams and effective lobbying activities. increased its investments around the world.

This positive situation was also reflected in Enron’s stock prices.

until 1998 Shares rose slightly above the average growth rate of the S&P 500 index. It provided regular returns to its investors.

However, in 1999 the An extraordinary increase of 56%, was above the growth rate of the index. In 2000, the situation became even more difficult and Enron shares fell compared to the S&P 500 index. 87% emerged with an increase.

The data clearly showed that the company was growing incredibly quickly. Between 1996-2000 The company grew by more than 750%increased its revenue from $13.3 billion to $100.7 billion.

With sales of $138.7 billion in the first nine months of 2001, Enron was included in the Fortune Global 500 list. sixth He managed to get in from the ordinary.

This dramatic growth is usually due to annual growth, for example in the energy sector. Sectors with 2-3% growth In fact, it represented an extraordinary situation

This ‘remarkable success’ was actually the result of the accounting tricks employed.

This way, the company can benefit from the long-term agreements it concludes. Even in cases where the expected profit is not realized He recorded money he never received from these projects by providing misleading reports to investors.

Enron, To hide an unhealthy situation By trying to boost his income this way, he tried to close as many deals as possible, making it seem like he was making much more income than he actually was.

Not limited to this, in the brokerage and advisory services it offers, in lieu of the commission charged, total value of the mediated trade was recognized as income.

To hide debts, the costs of canceled projects are not recorded as losses. Shell companies are used and even credit transactions were recorded as turnover.

Enron accountant Arthur Andersenthe company was under great pressure to ignore this accounting fraud.

In particular, Enron’s management suggested that they would work with another accounting firm if Andersen did not take the required steps, and this led to protection of the accounting firm against accounting fraud. It made him reluctant.

On September 20, 2000, a Wall Street Journal reporter drew attention to this issue by writing a news story about how Enron had become widespread in the energy sector.

Then, “Is Enron Too Expensive?”, written in Fortune magazine on March 5, 2001. article, arguing that analysts and investors do not fully understand how the company makes money He questioned the reasons why Enron’s stock price was trading at 55 times its value. This is where the ropes started to break.

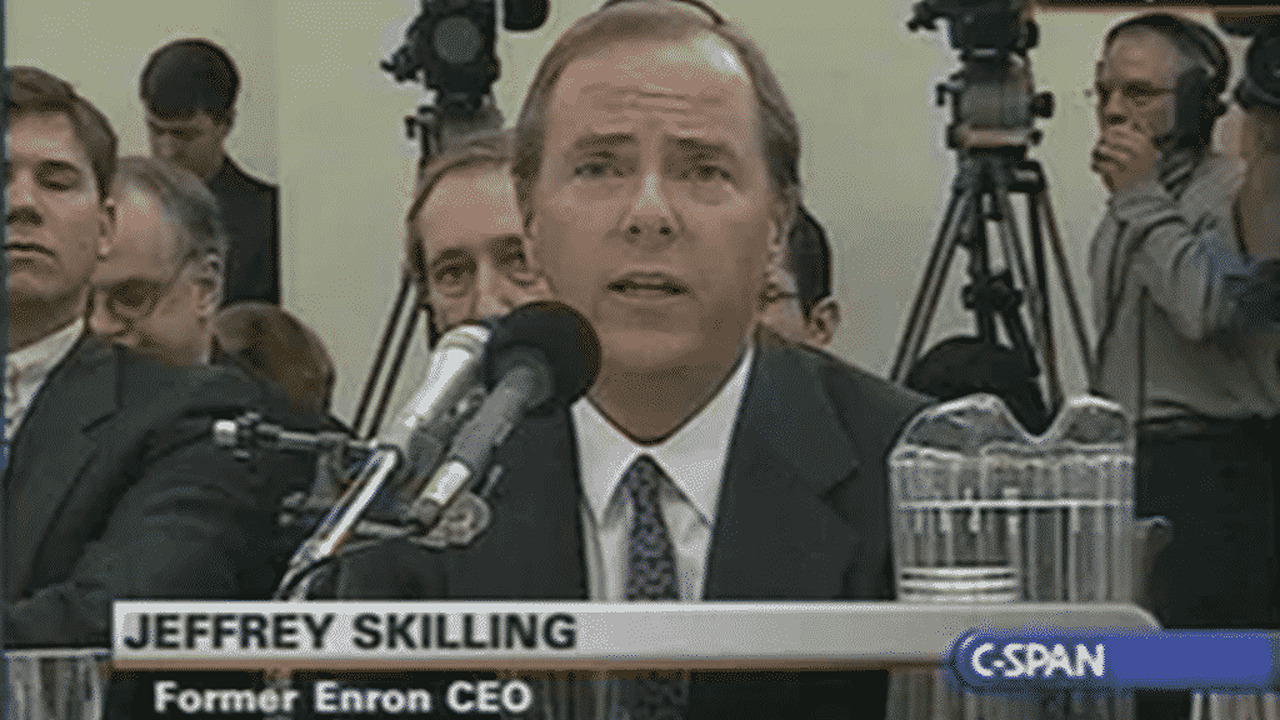

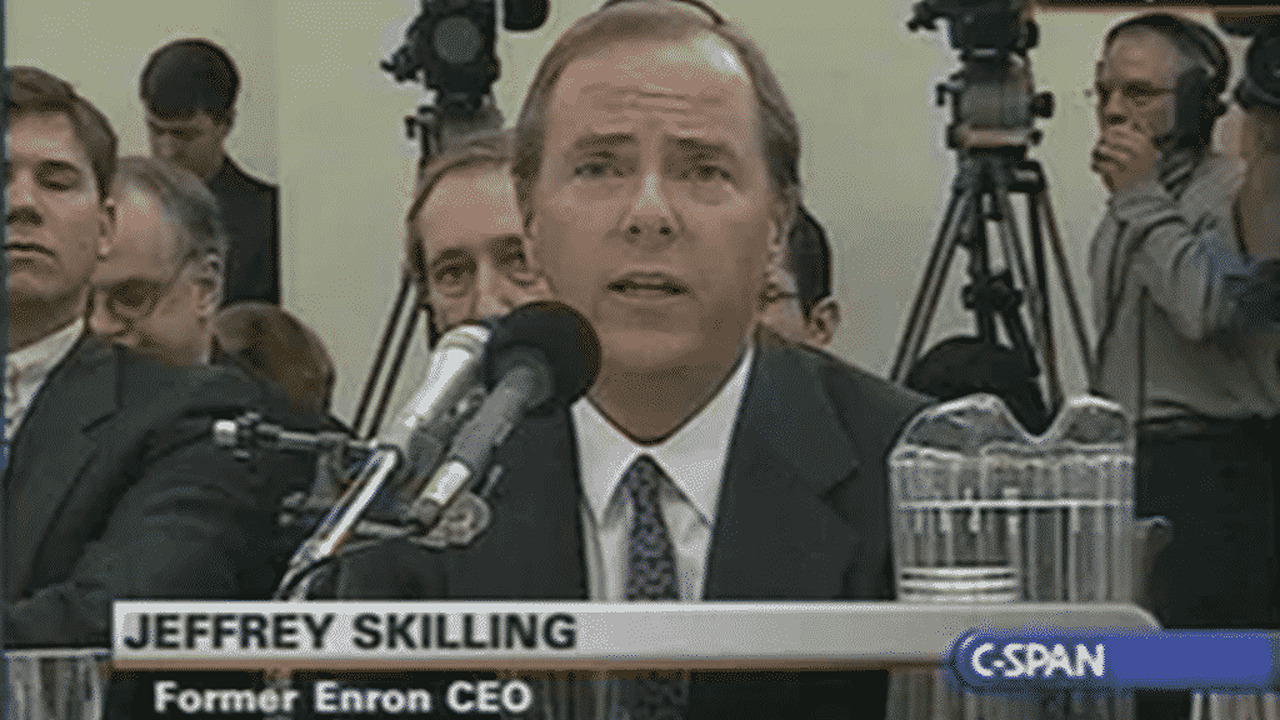

Enron CEO Jeff Skilling wrote the article “It is unethical because it was written without sufficient information” He criticized and insulted the reporter.

The escalating controversy caused Enron’s stock prices to plummet, causing panic in the markets.

On October 16, 2001 Enron’s announcement that it would restate its financial statements and the U.S. Securities and Exchange Commission’s decision to launch an investigation into the company’s activities pushed stock prices further down.

To remedy the situation, the company stock buyback programs tried to implement it, but ran into debt to finance these programs.

As a result, these programs consume company financial resources and are subject to international credit reporting agencies. from Fitch and Moody’s It led to Enron bonds being downgraded to non-investment grade.

After the debt option closed, Enron tried to escape through a merger with Dyenergy.

However, after long negotiations Dyenergygave up on the purchase of Enron, and this was the final blow for Enron.

Stock prices plummeted and Dyenergy suspended merger talks, paving the way for the company’s collapse. Bankruptcy, More than 4,000 employees lost their jobs and causes an estimated $74 billion in damage.

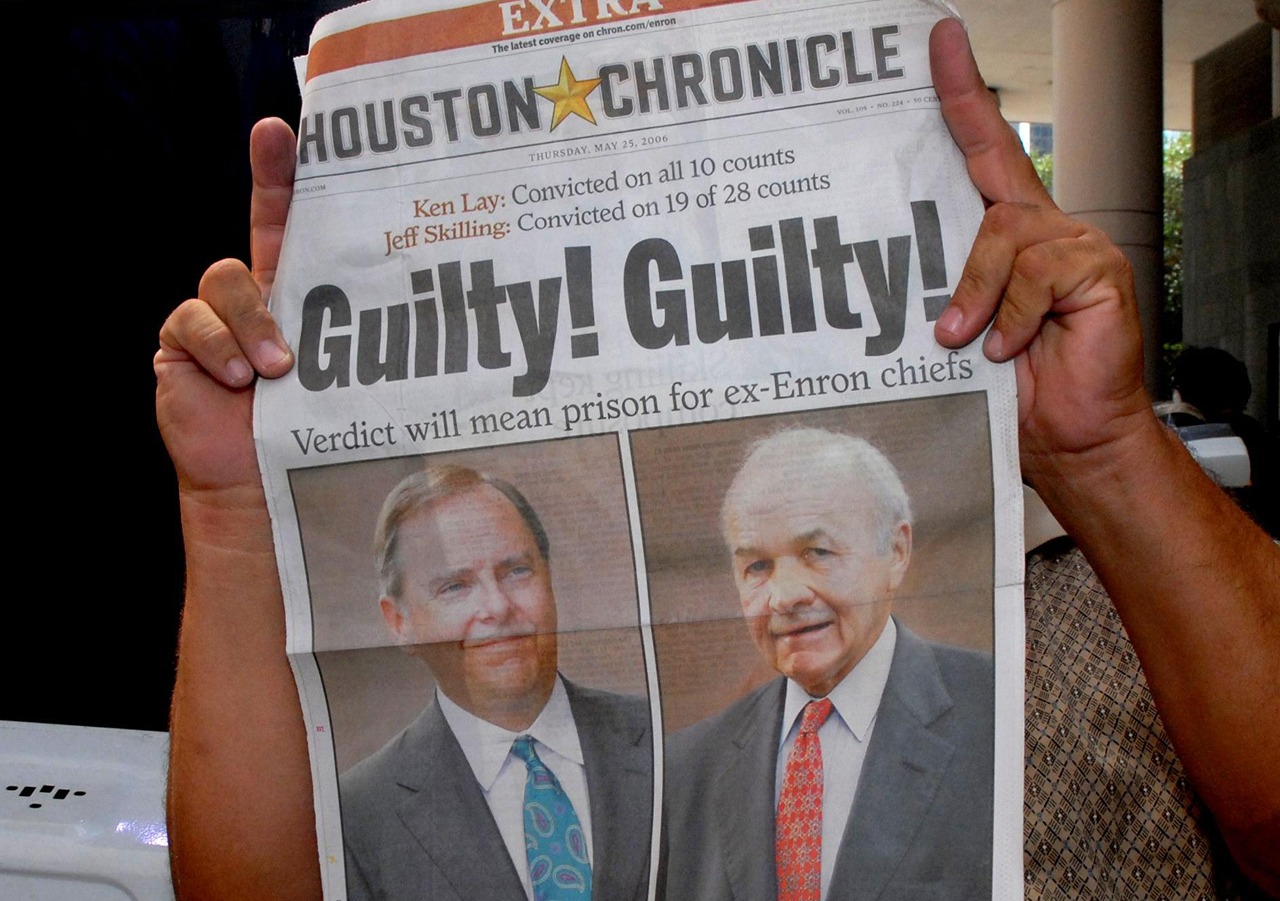

Following the investigation and lawsuits into the Enron scandal, the company’s CEO has decided Jeffrey Skill He was the person who received the harshest punishment.

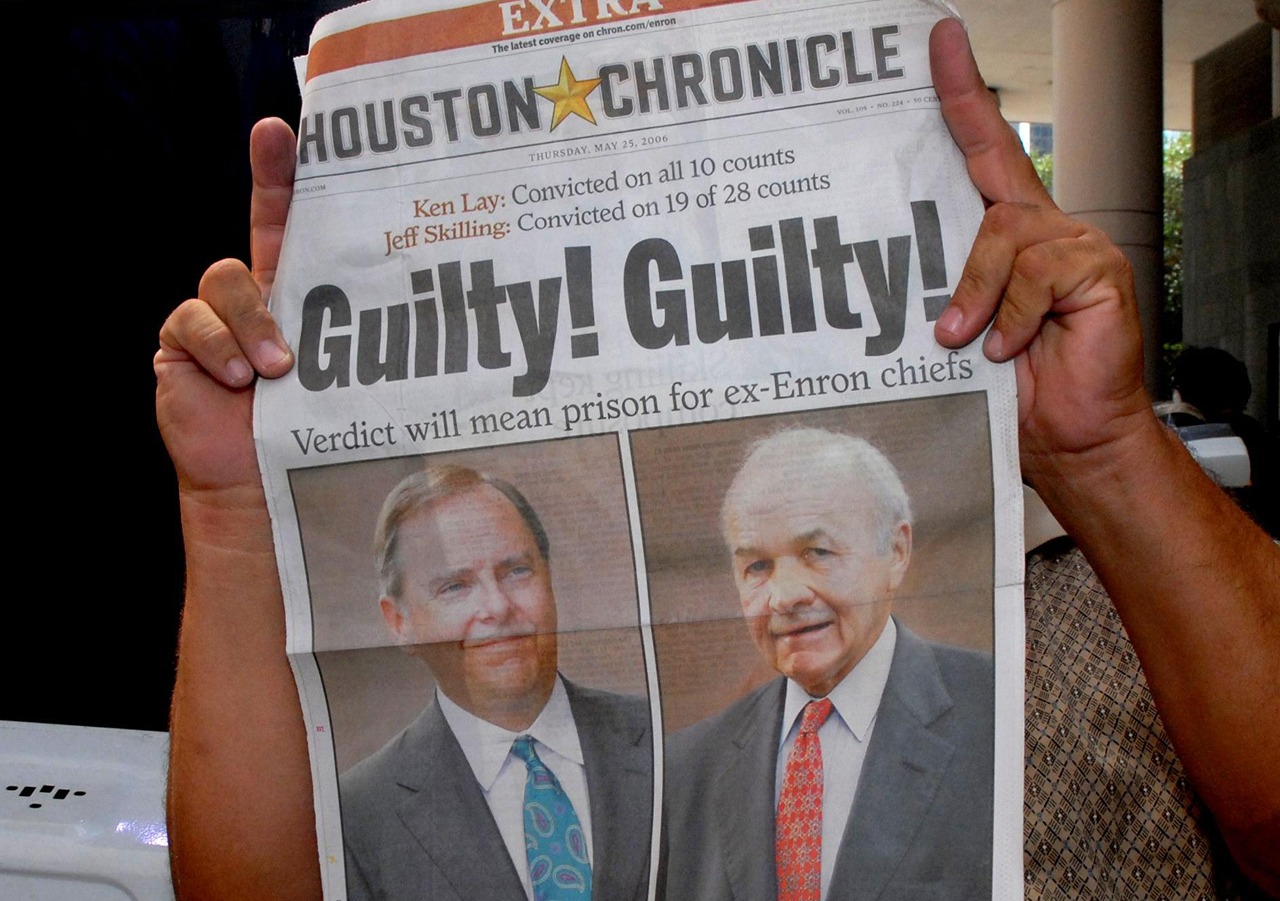

Skilling was sentenced to 17.5 years in prison in 2006 for conspiracy, fraud and insider trading. Enron’s CFO Andrew Fastow accused of facilitating corrupt business practices and securities fraud He admitted his crimes.

He was sentenced to more than five years in prison despite entering into a cooperation agreement with federal authorities. Enron founder Kenneth LayHe was convicted of fraud and bank fraud.

Arthur Andersen does for illegally destroying documents related to a U.S. Securities and Exchange Commission investigation. He was found guilty and his ombudsman license was revoked. However, this judgment was later overturned by the court of appeal. Still, the company lost its credibility and dissolved itself in 2002.

At the same time, the scandal exposed weaknesses in the regulatory system and problems that allowed Enron to engage in fraudulent practices undetected for years.

These events have led to significant reforms in accounting and corporate governance practices. Sarbanes-Oxley Act of 2002 These reforms included the creation of the Public Company Accounting Oversight Board and imposed stricter standards on public companies and accountants.

Finally, This scandal and the convictions in subsequent cases led to significant changes in financial regulation and accounting standards, as well as exposing shortcomings in regulatory processes. an effective control mechanism led to its creation.

These events are important for corporate governance and financial reporting. How crucial transparency is It also highlights the need for a more robust ethical framework in the business world.

Sources: Investopedia, Time, Britannica

Our other business content:

Follow Webtekno on Threads and don’t miss the news