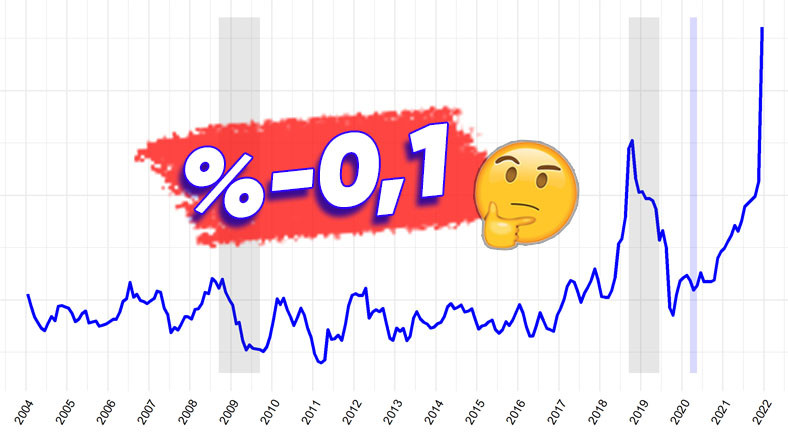

Recently, the Bank of Japan (BoJ) since 2007 The period of negative interest rates was ended by raising interest rates for the first time.

As a result, policy rates in Japan have risen This increased from -0.1% to 0-0.1%.

Let’s first look at what the policy rate is.

Policy interest rate determined by central banks, a country’s short-term interest rate there stands that. In other words, countries’ central banks set a certain interest rate for borrowing or lending.

One of the most important instruments of monetary policy is the policy rate; It is used to ensure economic equilibrium, meet the need for cash in the market or to control the quantity of cash, control inflation and direct economic growth.

Central banks can increase or decrease the policy rate depending on current economic conditions. For example, with the decision announced today in our country policy interest rate from 45% to 50% DELETED.

Let’s look at the interest rates by country.

According to data published by Trading Economics; Turkey has followed a policy of rising interest rates in recent years, following the example of Argentina, which had an interest rate of 80%, with an interest rate of 50%. country with the second highest interest rates happened.

As we mentioned at the beginning of the content, it is the country with the lowest interest rate Japan has an interest rate of 0%. Then comes Switzerland, which has an interest rate of 1.5%.

What does it mean if interest rates are high or low?

policy rate increasingIt is usually a decision made to combat high inflation or stabilize exchange rates. Rising interest rates can attract foreign investors and maintain depreciating exchange rate levels.

However, as interest rates rise, the cost of borrowing will increase. decline in consumer spending and investments visible. There may therefore be a slowdown in economic growth.

If the policy interest rate is lowered Unlike the situation mentioned above, it reduces financing costs. There is therefore an increase in consumption and investment expenditure. But as consumption and therefore demand will increase thanks to affordable loans, There is an increase in inflation.

Defined as “unusual” in monetary policy If it is a negative interest rate It is a tool generally used to combat low growth and deflation (negative inflation). In economies where a negative interest rate policy is in place, banks, contrary to custom, do not receive interest on the reserves they hold with central banks. interest payment situation arises.

Now let’s get to our main topic. What would happen if negative interest rates were applied in our country?

First of all, in an environment where there is a negative interest rate policy Financing costs will fall. Due to negative interest rates, banks will have to pay interest to keep their reserves with the central bank. For this reason, banks offer interest to their customers instead of paying interest to the central bank. tend to provide low-cost loans It will happen.

Cheap debt instruments tendency to consume and invest can increase. For example, between 2021 and 2023, when interest rates in our country were reduced, It was no coincidence that house and car prices rose. The affordability of loans encouraged individuals to purchase houses and cars, and as a result, the prices of these products increased due to the increasing demand for houses and cars.

In summary; The fact that low loans increase demand causes prices to rise, and that brings with it rising inflation brings.

Low policy interest rates cause the local currency to lose value.

Because interest rates are low causes foreign investors to lose interest and this results in the local currency falling.

The depreciation of the local currency will actually make the goods the country sells abroad cheaper. increase in export tariffs can cause.

On the other hand, individuals who expect their money to lose value due to negative interest rates reduce their savings. tend to spend more is happening.

Changes may occur in individual investment preferences.

The policy interest rate is negative instability in the financial system can make. As a result of this instability, an increase in the propensity of individual investors to take risks can be observed.

For example, the investment income of someone who typically invests in fixed-income assets will decrease as a result of negative interest rates. This situation makes investors investing in riskier financial assets can push.

Increasing demand for risky financial assets in these markets It can increase prices and volatility. To give an example: during the period when interest rates were reduced in our country, there were many people with or without financial knowledge Get caught up in the cryptocurrency craze We can show you.

In summary; against situations such as negative inflation or slow growth Negative interest, an intervention method, aims to ensure that the economy in question, when used correctly, achieves a long-term benefit. However, if it is not used in the right and balanced way, it can have enormous and irreversible consequences.

Sources: The Economist, Euronews

Our other content that may interest you:

Follow Webtekno on Threads and don’t miss the news