The once highly secretive ability to detect and pinpoint radio frequency (RF) radiation from space is rapidly moving into the commercial sector, giving companies powerful new capabilities for all kinds of surveillance and intelligence gathering.

Interest in radio frequency monitoring from space has increased significantly in recent years as geopolitical conflicts disrupt vital shipping lanes and supply chains, exposing vulnerabilities.

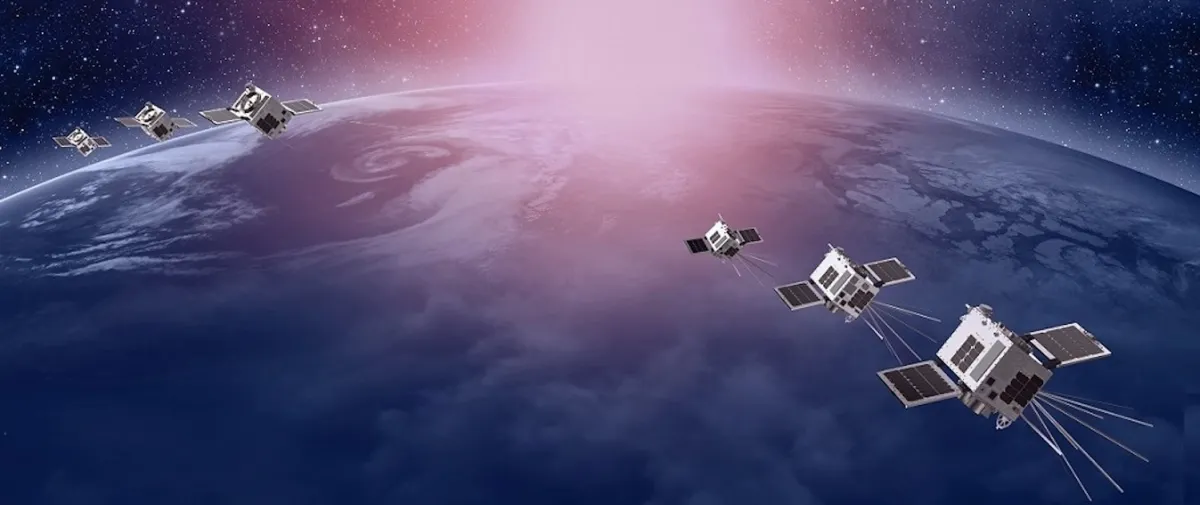

Companies like Virginia-based HawkEye 360 use shoebox-sized satellites that listen for electronic signals emitted by ships, aircraft and other sources to provide intelligence on “dark ships” that evade detection and locations of GPS intercepts in Ukraine. James “Sandy” Winnefeld, a retired U.S. Navy admiral and HawkEye 360 board member, said the technology’s potential is just beginning to be realized.

“We’re just scratching the surface of what’s possible,” he said in an interview.

Radio frequency data helps track ships even if they turn off their Automatic Identification System (AIS), a common tactic for illegal fishing or smuggling. According to Winnefeld, by using data from other emitters, such as a ship’s radar, it is possible to create an electronic “fingerprint” of that ship that can be detected even when the AIS is disabled or tampered with.

More programs

While the maritime environment has been a primary focus for commercial RF companies, a new frontier is emerging on land as the proliferation of GPS, communications devices, and other emitters creates a flood of exploitable intelligence signals.

All this data, from smartphones and IoT devices to in-car communications systems and more, has intelligence value as long as it can be captured and analyzed, Winnefeld said.

“You’ll see more RF processing capability, more frequency coverage, more sensitivity,” he said. Geolocation of multi-range ground-based radars, which are difficult to locate, remains a technical challenge. “This is a much more difficult task and we will work hard in the future.”

Winnefeld said countries around the world are creating new requirements for RF monitoring. “Everyone has different needs.”

In April, the HawkEye 360 constellation grew to 29 satellites after launching two trios into medium-inclination orbits optimized for monitoring busy shipping lanes. Towards the end of this year, it plans to deploy two more clusters of three spacecraft and test a new payload designed to collect more advanced intelligence signals.

new rivals

American companies like HawkEye 360 face increasing international competition as space-based radio frequency sensing evolves into a commercial industry. New players, especially in Europe, are benefiting from democratized access to space, sensors and AI technologies.

Startups such as Aerospacelab and Unseenlabs have recently announced plans to develop advanced radio frequency tracking satellites and data processing products in the coming years.

The Belgian aerospace laboratory launched the first three radio sensing satellites in March, flying in a triangular shape like HawkEye 360. In a paper published last month, the company touted its ability to characterize and localize unique radio frequency emissions from ground-based radar systems.

Meanwhile, French startup Unseenlabs has announced plans to expand its radio frequency monitoring satellite network beyond its core maritime business with a new generation of satellites capable of tracking emissions from land, air and space sources.

The company aims to expand its suite to around 20 satellites over the next few years. Unseenlabs geolocates radio frequency signals using individual satellites rather than orbiting clusters like its competitors.

radar image

Commercial RF tracking data providers also face increasing competition from synthetic aperture radar (SAR) satellite operators using their own maritime intelligence offerings.

Companies like Capella Space, Iceye and others are offering new maritime domain recognition services that promise to detect and identify shadowy ships trying to hide their location.

While different types of space sensors are often viewed as competitors vying for the same customer dollars, Winnefeld said interesting intelligence emerges by combining different data sources into integrated solutions.

In his view, phenomenologies work best in a complementary way. A prime example of this is the increasingly common fly-and-tumble approach, in which a satellite detecting suspicious RF emissions from a ship signals or “hints” another satellite with other detection capabilities to look closer and take a high-resolution image.

This type of data fusion is already used in U.S. military and intelligence programs that hire a prime contractor to integrate data streams from multiple commercial remote sensing providers into unified situational awareness solutions.

As the market for space electronic intelligence expands, one of the obstacles facing commercial firms is a lack of awareness among potential government customers about the availability and capabilities of commercial services, according to Winnefeld. Defense budgets and procurement processes that feed existing programs can also inhibit adoption, he said.

“The military sometimes doesn’t have enough visibility into what’s going on in the commercial sector,” Winnefeld said. He invited companies to offer pilot programs at little or no cost to defense organizations to demonstrate their capabilities in monitoring electronic signals.

![YouTuber Marques Brownlee announces the most powerful sedan he has ever reviewed [Video] YouTuber Marques Brownlee announces the most powerful sedan he has ever reviewed [Video]](https://cdn.webtekno.com/media/cache/content_detail_v2/article/144812/marques-brownlee-mkbhd-lucid-air-sapphire-1717395513.jpg)