In a thread we did recently McDonald’s We explained that the source of his wealth is not the sale of hamburgers. There’s another company that comes out of an area like McDonalds that seems to have little to do with its business: Starbucks.

Come on, once upon a time coffee roaster in one store Let’s see how the company, founded by three friends, today became one of the most famous coffee chains in the world, and how it changed the balance in several sectors.

Starbucks didn’t serve coffee before.

When Starbucks was first founded, there were no drinks like Pumpkin Spice Latte or Frapuccino. Already Starbucks coffee bean He sold, that is, he was a kind of American Kurukahveci Mehmet Efendi. Jerry Baldwin, Zey Siegl and Gordon Bowker What changed the fate of the company founded by? Howard Schultzo it happened. Schultz, who managed to enter the company as a sales and marketing manager, became the name that changed the future of Starbucks.

Going to a coffee shop in Milan, Italy, Schultz thought of Starbucks. convert into coffee chain That’s where the idea came from. The founders of the company were not happy with this idea at all. Schultz, who took over a group of investors in 1985-86, bought Starbucks and the Starbucks we know today was born.

Starbucks grew rapidly during this period, until it went public in 1992. at 140 different locations began to serve. That number tripled in 1994. 1996 was the year we saw the 1000th Starbucks and the first store outside the US (Japan). by the year 2000 When the company arrived, the company had about 3000 stores.

Running to Starbucks, Four Minutes from Home: The Frapuccino Effect

On the other hand, in 2000, Howard Schultz rose to the position of president of the company, while Orin Smith left the CEO seat. During the Smith era, the company opened approximately 1,500 new stores each year. The size of the company in this process more than four times It increased.

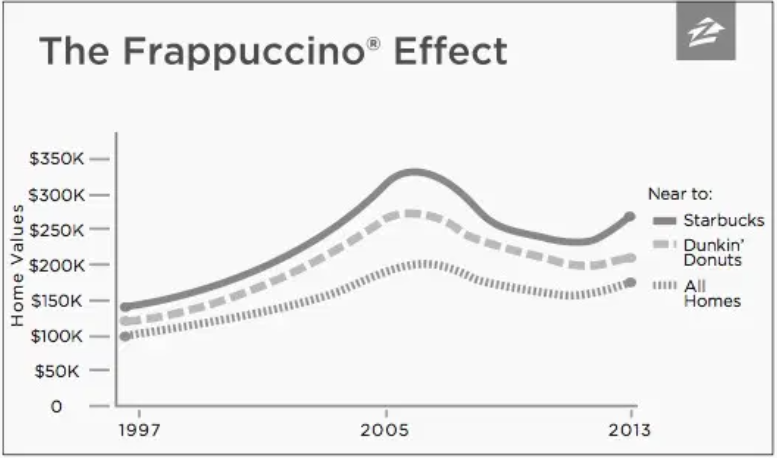

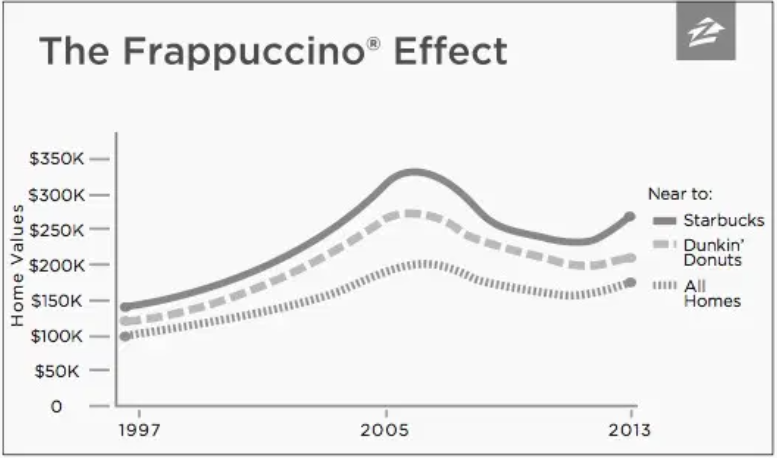

During this period, it is necessary to open a separate paragraph for the company’s real estate investment choices. starbucks, from optimizing (I promised to explain this in the McDonalds article, I swear to you, I’ll tell you) began to be seen as a castle. In addition to places with high valuation potential, one of the first brands remembered as one. Even to this Frappuccino effect Was called. In summary, if there were a Starbucks near a property, the value of that property would increase significantly.

Of course, because it’s not without a lot of lies, not a lot of growing pains. Starbucks Of course, there are also problems during this period. Chief among these was that the company put customer experience and coffee quality on the back burner during the rapid growth process led by Orin Smith. 2008 crisis along with Starbucks suffered serious injuries. After that, Schultz returned as CEO of Starbucks.

Howard Schultz didn’t just enjoy doing business in coffee shops

Schultz, who initially disliked selling only seeds and changed it, also continued through his second CEO term. don’t just sell drinks and tired of closing shops in nice places. Instead, he decided to turn the company into a bank or even a fintech bank.

“What is the vision?” The CEO, who almost answered the question, first CTO (CEO’s Minister of Technology Affairs) has been adopted. After this recruitment, Starbucks launched its loyalty card program. In the beginning, this program was no different from the others. Shopping with a card had small advantages, you could occasionally drink a free cup of coffee or get small discounts.

The great Starbucks invention here also makes cards vehicles for loading money it became. Money can be loaded onto the card and this money can be used for Starbucks products. On the other hand, it is not possible to withdraw money from the card except in very rare cases. Which brings us to the next point:

Starbucks: coffee bank

Take the money we load into our Starbucks cards or mobile apps. This money is now from Starbucks money, they promise us coffee in return. We also collect stars when we use the app. If there is no campaign etc we earn 1 star for every drink and get one free coffee on our birthday. In this regard, the application has user-friendly features.

On the other hand, the money in only at Starbucks pass. So it is not possible to use the money elsewhere. In this case, users actually lend the money to their accounts. The brand with thousands of branches, 30% of its turnover Doing this with Starbucks cards or accounts will bring in an additional $1.5 billion a year.

Obviously the interest that the company pays to its customers in exchange for this amount. 0%. If it had received $1.5 billion in investment loan from the United States, the company would have been about 50 million dollars would pay interest. Moreover, this is not the only advantage of the program.

Average amount of money entering the system 10% of forgotten, lost or somehow unused. This amount, which is included in the balance sheets, can be translated in Turkish as ‘loss value’ in general. $150 million a year finds it. So Starbucks remains in the position of owning this money without doing anything. .

There is also more money in Starbucks vault than in banks in general. thousands of banks in the US. Total assets do not exceed $1 billion. The fact that people gift each other Starbucks cards also means that money can change hands without leaving the company’s ecosystem.

So what’s Starbucks going to do next?

The CEO of South Korea’s third-largest financial group said in a statement that Starbucks’ an unregulated bank He said it was a coffee shop and not just any coffee shop. According to another bank, the company actually… fintech firm. So what will Starbucks do in the future?

There is so much that an organization with such great financial strength can do. A little “I wish it was me” To give an example, as an institution with such a wide network and with different types of balances, for international roaming I would make it fit. Then pave the way for using Starbucks cards in multi-brand agreements and enter the insurance industry can take place. Of course these are my views, there is no news that the company has such a plan.

As can be seen, large and complex operations take place in the background, even though large companies seem to be doing one job.