Canada actively supports Ukraine in the fight against Russian invaders. In addition, this is the country where one of the largest Ukrainian communities abroad lives. channel 24 decided to ask our compatriots about their experience of living in Canada and the characteristics of this country’s financial system and banks.

For comparison, we spoke with Anna Deineka, who came to Canada after the start of Russia’s all-out war against Ukraine, while Volodymyr Godunko was moving to Canada. 2 years ago. They live in the preferred province of Ontario. 60% inhabitants of the country.

Bank cards and transfers

Anna Deineka: The banking system works 1:1 with Ukraine. You also need to load a credit card, there is a percentage of the monthly payment. Therefore, in principle, everything is very similar. But the credit card plays a very important role.

Canada has two active debit cards – credit and debit cards. It should also be taken into account that in some stores you can only pay with a credit or debit card. The card number is not used for money transfer. To do this, simply specify an e-mail address.

Banking practice in the country is quite good. Of course, this is not the Ukrainian Monobank, whose counterparts I have not yet met. Transferring money from card to card takes about 5 minutes.

On cooperation with the Ukrainian banking sector, the application is the best for me Wise (also known as TransferWise). I manage to transfer money for a mortgage in Kharkiv in a few clicks. Ukrainian cards can also be used in general without any problems.

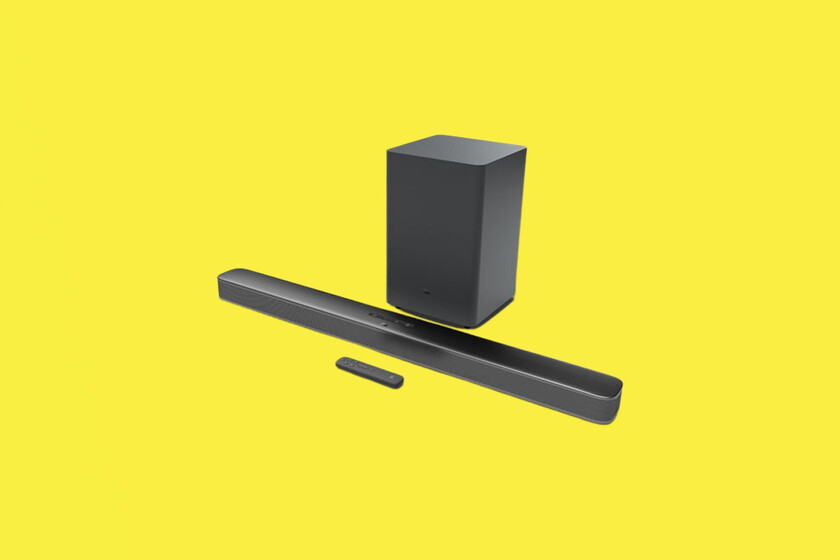

Features of life in Canada / Unsplash photo

Features of life in Canada / Unsplash photo

Volodymyr Godunko: All newcomers planning to stay in Canada must open a credit card. This process can take about a week or two. First, the customer receives a card by mail. After activation in the application, the bank sends a pin code to the card. This is due to security issues. It is generally recommended to open three bank accounts: salary, loan, deposit.

Credit cards are always refundable. Minimum one – %2this is not bad. During the year I used the card I still spent and bought 200 – 300 back. Bank transfers from one person to another, the system here is rather complicated and inconvenient. Regarding transfers to Ukraine, it is most convenient for me to do this with PayPal, which can be easily connected to a bank card.

credit rating

Anna Deineka: After getting a credit card, you can start working with your credit history and credit score. This includes, for example, mobile phone payments, electricity bills, rent payments. Therefore, it is very important to pay everything on time.

Credit score is important when a person wants to get a loan. And if I am not mistaken, this indicator is important if a person wants to go abroad.

I think this is generally very good practice. People in Canada are very conscious, our mentality is a little different. It’s actually hard to adapt very quickly because you have to take it one step at a time to reap future benefits. Renting a house, buying a house, etc. This is why Canadians approach life planning very consciously. They behave similarly to the banking system.

Volodymyr Godunko: Everyone here lives on credit. Roughly speaking, I even pay my cell phone bill a month after using it. This also applies to accommodation and any purchases. Regarding the credit rating, it cannot be checked first. A drop is recorded each time it is checked. In a month, I wore it once 50 points, without even realizing it. Moreover, this is a very significant decrease..

In fact, a credit score is required for large purchases. In principle, credit score is usually checked before having to take out credit for anything.

In addition, the loan has a positive effect on the credit rating. This is necessary so that in the future, for example, it is possible. Buy a car on loan with better terms, lower interest rate. good credit score – It is 700 points. It is better not to check it yourself and everything will be fine.

Also, without your credit score and credit history, you can’t even talk about buying your own house or apartment in Canada. Now I am very surprised at the Ukrainians who come to the country and ask if they can buy a house. first answer – NO. First, it’s hard even for Canadians at current prices. Secondly, there is no credit score and credit history, which is extremely important in Canada.

Credit score doesn’t affect anything until you need a loan for something big. It is then controlled, for example, by a banking institution. However, if credit is not given after the audit, this will negatively affect the indicator.

residential rent

Anna Deineka: It is quite difficult to rent an apartment without a credit rating. Possible but difficult. You will need to show a bank statement. We were really lucky to find accommodation so quickly.

Finding housing is real, there are a lot of postings, you just have to make an effort. Also, many real estate agents who are natives of Ukraine are ready to help. I also wrote a post on Facebook asking for help. Many people from Kharkiv wrote back to me and offered it.

At the same time, some landlords demand housing payments several months or even a year in advance. Official employment, the presence of the necessary documents help to solve this problem.

One of the residential options for visitors – this is the rental of basements. They are ready to deliver even if they don’t have a credit score. Also, due to Canadian laws that essentially protect residents, people are very careful when choosing potential tenants.

Volodymyr Godunko: Today, the only difference between Ukrainians who came to the country after the start of the war and all other Ukrainians is that tenants can demand payment. 4 – 6 months in advance, so that there is confidence that a person will live there. The truth is that if a tenant in Canada stops paying, it will be very difficult to evict them legally.

I’ve heard stories where people didn’t pay for half a year and lived. Therefore, homeowners try to protect themselves. Having a job significantly simplifies this process.

Plus, there are certain housing-related moments on the market today as the offer is small. Prices go up a bit, hard for locals as well. Finding housing is problematic, even with a credit rating. Some landlords are arrogant and demand payment several months in advance, and prices soar.

It is also worth considering that it is the host who chooses between them. 2 – 5 candidates, therefore it is in a person’s interest to rent housing. Plus, they’ll choose the one who’s willing to pay more. Also, now we can talk about a certain crisis in the real estate market in Canada. It’s a huge problem in this country.

Features of life in Canada / Unsplash photo

Features of life in Canada / Unsplash photo

Security of the banking sector

Anna Deineka: I myself did not encounter any problems. I can share the experiences of people I know who have bought many different things with a credit card recently. After clarifying this situation at the bank, they managed to return all the written money and get a new card. There are some nuances regarding the security of the banking system, but A bank customer in Canada is always protected.

Volodymyr Godunko: You don’t need to use a debit card when shopping online, you need to use a credit card. If they steal your debit card information, they’ll steal your money too, if it’s a credit card then In the second case, the bank will take care of it.

The system is generally quite reliable. It is not as convenient and inclusive as in Ukraine, where you can buy tickets and pay for utilities through the bank application. This is not the case here, as the banking system developed much earlier than the Ukrainian system. And it was overgrown with many complex things, so replacing it is expensive and unprofitable.

Salary and taxes

Anna Deineka: We chose Toronto, Ontario because the priority was to get to a place where you could earn money to have regular salaries. But it is worth considering that everything is reflected. The higher the salaries, the more expensive the housing, the higher the taxes.

It is also extremely important to open a SIN number, which is especially necessary for the tax office upon arrival in Canada. Different employers have two options regarding taxes. Some deal with their cuts, while others transfer it to the shoulders of employees. If the income 50 thousand dollars, then accounting firms will help you prepare the statement for free. There are also certain tax benefits for the self-employed, for example on fuel.

Volodymyr Godunko: In general, people are usually paid weekly or biweekly. Ukrainians should take into account that there are two types of salaries, when the taxes are withheld immediately or this issue is considered separately. There are many accounting firms and practices in Canada that can help facilitate this process.

It’s easier to kill and flee in Canada than not to do it pay taxes taxes – this is the most serious topic and they are not kidding about it. If the Ukrainians will somehow try cheating, then deportation is mandatory. It’s not even discussed.

average cost of living

Anna Deineka: For one month of life, a family with children will need on average 5 thousand Canadian dollars including all essential articles In addition, various publications state that in such a scenario you should have approximately. $10k when moving, but you can come up with a smaller quantity. Internet is also extremely expensive in Canada.

Volodymyr Godunko: Everything is very individual and depends on wishes for life. First, everything changes a little. The average rent for a two bedroom apartment in Toronto is approx. 3000 – 3500 thousand dollars At the same time, to go 20 kilometers from the city, then the price will be approx. 2800 dollars. That is, within a province, prices can vary significantly. At the same time, Ontario for today It is the most expensive city to live in Canada.

Regarding the cost of products, if it is a family of 3 or more, then Costco – an ideal option (there you need to buy their card for a year). Another option – This food banks that you can do for free once a month buy product So you can save some money from it.

It is worth considering that the Internet and mobile communications in Canada are quite expensive, but the quality leaves much to be desired. The cheapest tariff plan for mobile communications $15 per monthif we talk about something more adequate, then we are talking about 40 dollars and above.

Features of life in Canada / Unsplash photo

Features of life in Canada / Unsplash photo Features of life in Canada / Unsplash photo

Features of life in Canada / Unsplash photo