Silicon Valley Bank, headquartered in California and founded in 1983, is special bank of startups tech companies known as. Silicon Valley Bank (SVB) 16th largest bank. Let’s once again draw attention to how big this bank is by stating that there are over 4,000 banks in America.

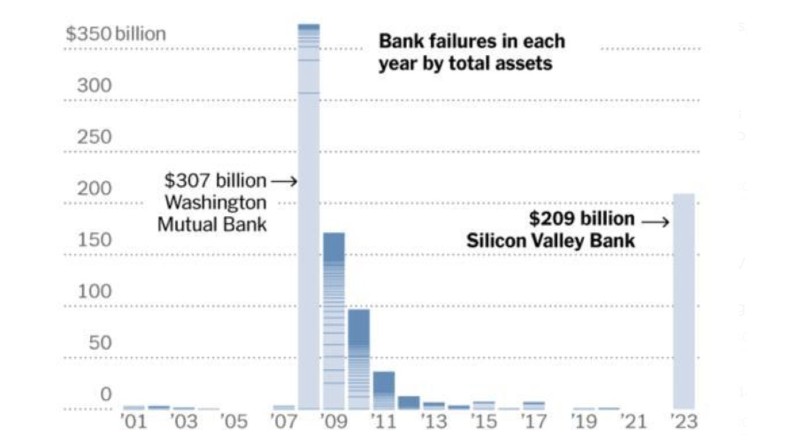

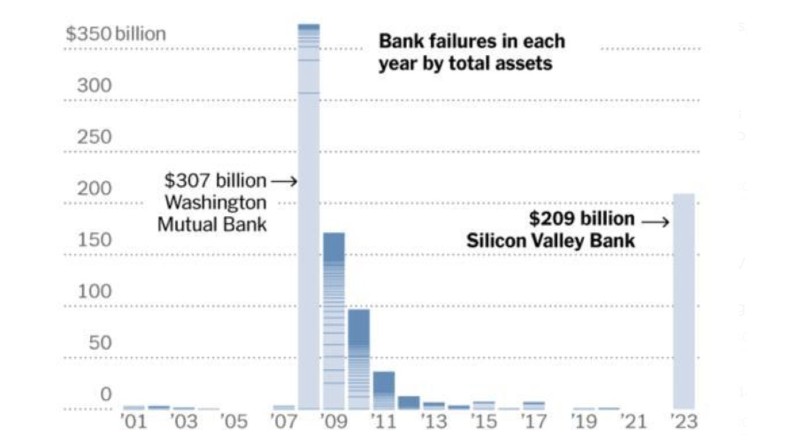

After the SVB was recently declared bankrupt, experts said the bankruptcy of Silicon Valley Bank is the worst case scenario since the 2008 global financial crisis. second largest bank failure states that it is.

The main thing that makes Silicon Valley Bank important is its customers.

In the customer portfolio of SVB; There are venture capital funds that finance technology companies, healthcare companies, healthcare start-ups, biotechnology companies, technology start-ups, and start-up (start-up) companies. Most of the customer portfolio startup companies and financing of these companies venture capital funds forms.

Working with companies like Circle, Roblox, Roku, Etsy, the importance of SVB to America, like Apple and the like in the future to make a big leap to include early stage (start-up) companies.

The bank’s total assets are almost a third of Turkey’s national income!

The total assets of the bank in the last quarter of 2022 $212 billion had stated. The total deposits deposited in the bank amount to $178 billion.

Economist Ozgur Demirtas, In his recent broadcast about the bankruptcy of the SVB, he said the following to draw attention to the magnitude of the bankruptcy: The total assets of the SVB are 1/3 of the Turkish national income!

Second largest bankruptcy in US history.

After Washington Mutual Bank, which failed with assets of $307 billion during the global financial crisis in 2008, SVB’s bankruptcy was due to assets of $209 billion. second largest bank failure became history.

One of the reasons behind the bankruptcy is the rate hikes by the FED.

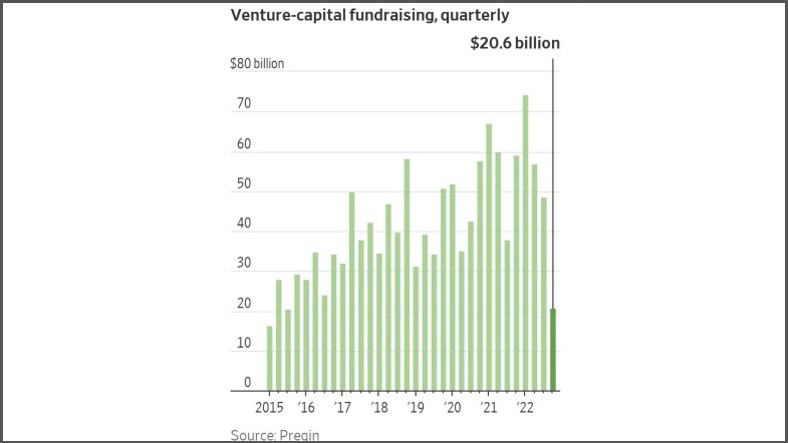

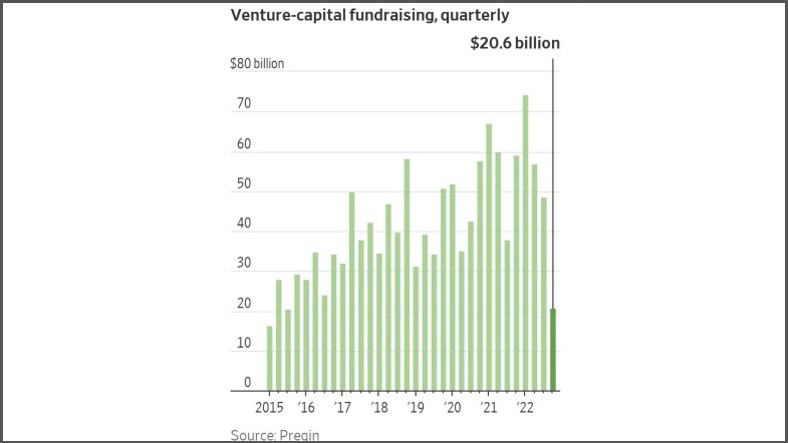

The increase in interest rates, which will be used for investments costs more money causes. Therefore, investors who will invest in technology companies with the cost of money. less willing to take risks There is a decline in investment in start-up companies.

Investors are hesitant to invest in new projects from both sides, as the SVB’s client portfolio mainly consists of start-ups and investors. It was detrimental to the SVB.

Companies that could not receive investments began to use their deposits for payments.

quarterly before rate hike 70 billion dollars Investments up to such amounts, together with the rate increase, 20 billion dollars had fallen to such amounts.

After this severe recession, companies with cash shortages started using the money in their deposits that the SVB had deposits began to decline.

They made risky investments with 55.4% of their investment!

The SVB, which derives most of its income from risky financial investments, holds more than half of its deposits. risky investments and with the rise in interest rates, he also lost from his investments.

Looking for ways to meet its clients’ withdrawal requirements, SVB has sold its bonds. decided to sell at a loss.

SVB shares plummeted after SVB announced it would be selling about $2 billion worth of shares.

760 dollars SVB share, which saw values like $39 dropped to its value.

The inevitable end occurred when depositors attacked the bank.

Customers who want to save their deposits run to the bank with the advice of some investment funds. “bank run” The so-called situation happened and the bank went bankrupt. Subsequently, the Federal Deposit Insurance Corporation (FDIC) seized the bank and curator announced his appointment.

What happens to depositors’ money?

Under US law, deposits up to $250,000 are covered. According to the statement of the authorities, the deposits from everyone declared protected.

SVB’s UK partnership was taken over by HSBC.

SVB (UK), which operates a small banking business with approximately 3,000 customers in the UK, was supported by HSBC. 1 poundwas purchased.

Investors sue CEO and CFO of SVB for fraud!

About a month before SVB went bankrupt, senior managers started selling shares known. from bankruptcy 2 weeks ago Greg Backer’s approach $3.5 million It turned out to be worth the sale of shares.

The bankruptcy also has an impact on the crypto market!

One of SVB’s clients, Circle is a very popular company in the cryptocurrency market. stable coin He is known as the creator of USDC (a dollar coin).

Following the news of the bankruptcy of the SVB, Circle of $3.3 billion Upon learning that the money was in the bank, USDC users panicked by withdrawing the value of USDC. $1 to $0.86 they dropped it.

In a statement from Circle, USDC users damage will be covered announced.