It has been one of the most talked about investment instruments since day one. cryptocurrenciesis going through one of the most tumultuous periods in its history. All cryptocurrencies in the market, especially Bitcoin, are experiencing an unprecedented ‘collapse’. It is impossible to predict when the decline will end. What happened to the markets then? Let’s go to the cryptocurrency markets the latest situation, events, details and forecasts for the future. Let’s take a closer look together.

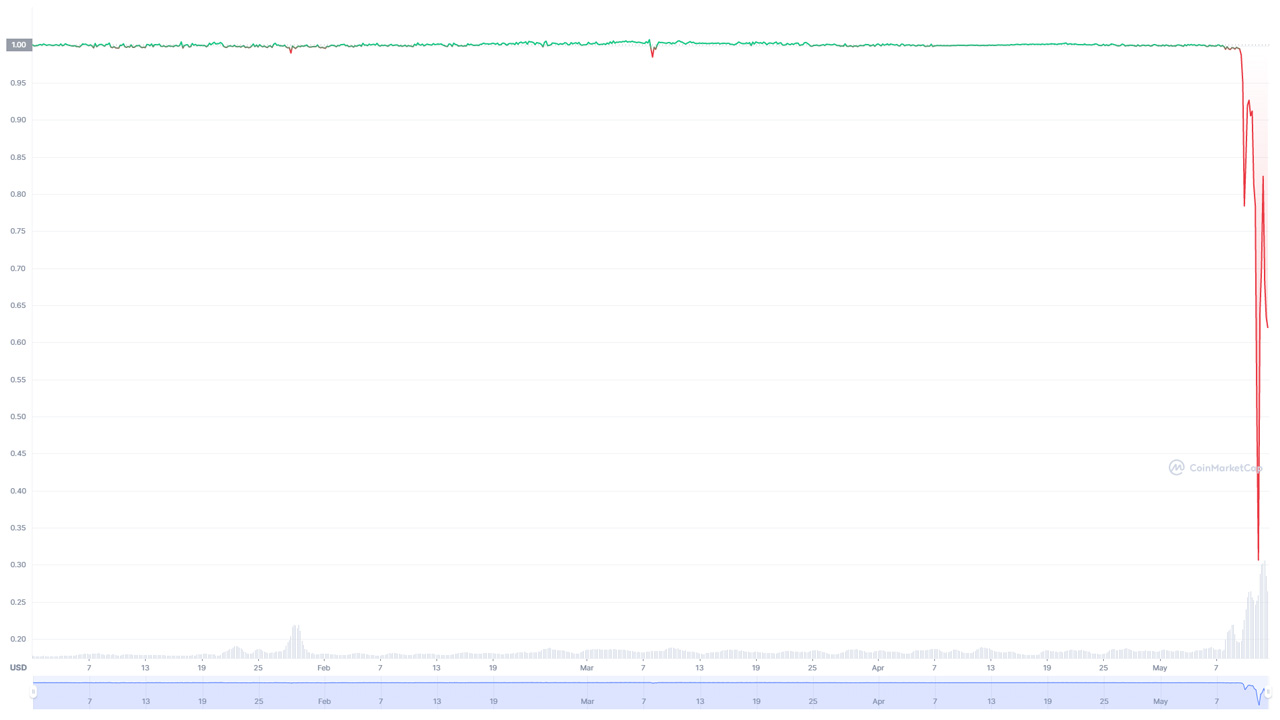

In fact, Bitcoin is still at a fairly high level. coin market capitalizationAccording to the data we received from , the cryptocurrency is hovering above $28 thousand as of now. After all, you cannot buy any other investment instrument as a unit at such a high price these days. But if we look at the big picture, that is, the long-term situation, The decline in Bitcoin is eaten and swallowed We can see that it is not flat. Let’s take a look at what kind of picture Bitcoin has painted since 2021.

We were talking about $70,000 for Bitcoin in November 2021

*Bitcoin price chart. Source: Coinmarketcap

Bitcoin traded at $29,000 on the last day of 2020. 2021 was quite active for the markets. Even if we come to November 2021 70 thousand dollars we started talking. But now the situation is reversed. As of the date and time this article was written, Bitcoin is trading at $28,350. In other words, a person who bought 1 Bitcoin on December 31, 2020, first increased his money by 2.4 times and then lost this money.† In fact, this ‘fictional investor’ has made a loss as of now. This was of course true for all altcoins. So what was it like when everything went well?

Actually, Thursday’s arrival was clear from Wednesday.

The COVID-19 pandemic has economically affected the entire world. The downsizing due to curfews, the loss of businesses come to an end, disruptions in supply chains… All these things get governments into trouble. Even the ‘superpower’ US announced record inflation in this process. Not everything could go smoothly in the cryptocurrency markets when there were such large-scale problems in a global sense. Yes, Bitcoin’s decentralized nature was unaffected by the pandemic, inflation rates and crises, but those who set the markets were also affected by it. were people† So basically Thursday’s arrival was clear from Wednesday…

Governments for their citizens in the onset of COVID-19 support packages they announced. Many analysts initially attributed the rise of the cryptocurrency markets to this. The prevailing view was that the support people got when they had money in their pockets flowed into cryptocurrencies. This was a gamble that sounded plausible at first glance, as the size of the total money in the cryptocurrency markets, By the end of 2021, it had reached $3 trillion† So the money poured into the market, pouring into Bitcoin and all the other cryptocurrencies.

Safe Harbor issue and rising interest rates

Cryptocurrencies have been considered “risky” by analysts since the early days of their introduction. The biggest reason for this is that cryptocurrencies are not connected to a center. In addition, the status of a country’s currency is not important to cryptocurrencies. This situation has always scared investors. So much so that many people use cryptocurrencies”unreliableInvesting in technological currencies was insane for many economists when there were traditional, “safe” investment vehicles such as gold, silver and even oil. they waited for a chance to escape† The decision to raise the countries’ interest rates was seen as a sufficient opportunity to withdraw the money by the investors seeking a safe haven and thereby devalue Bitcoin. But that wasn’t the only reason.

Whale Hits and Scams

The unsupervised and decentralized structures of the cryptocurrency markets, especially.whaleWhales, who have been around since the first day of cryptocurrencies, can play with the “settings” of the markets as they please. Whales, who sometimes put sell and sometimes buy pressure, annoyed small investors with their surprising moves, so to speak. If you look at the social media accounts posting about cryptocurrencies these days, you can see that this is the case. crypto- even the symptoms you can see. Of course, there is also the fraud dimension. With the proliferation of cryptocurrencies, there have been numerous hijackings. sometimes of the stock markets with money from investors no We witnessed that. These two reasons have brought Bitcoin, whose reliability has already been questioned, into question.

Meanwhile, the negative news spread by traditional finance proponents should not be overlooked. According to them, both Bitcoin and other cryptocurrencies of fraud it consisted of Basically, that was not true, because most cryptocurrencies had a specific project behind them. However, rumors that the digital financial system will overtake the traditional financial system and bring about a new world order has meant that negative news is constantly being pumped. As these happened, small investors lost money or couldn’t handle the stress.to safe harbors was on his way. This marked a decline for Bitcoin.

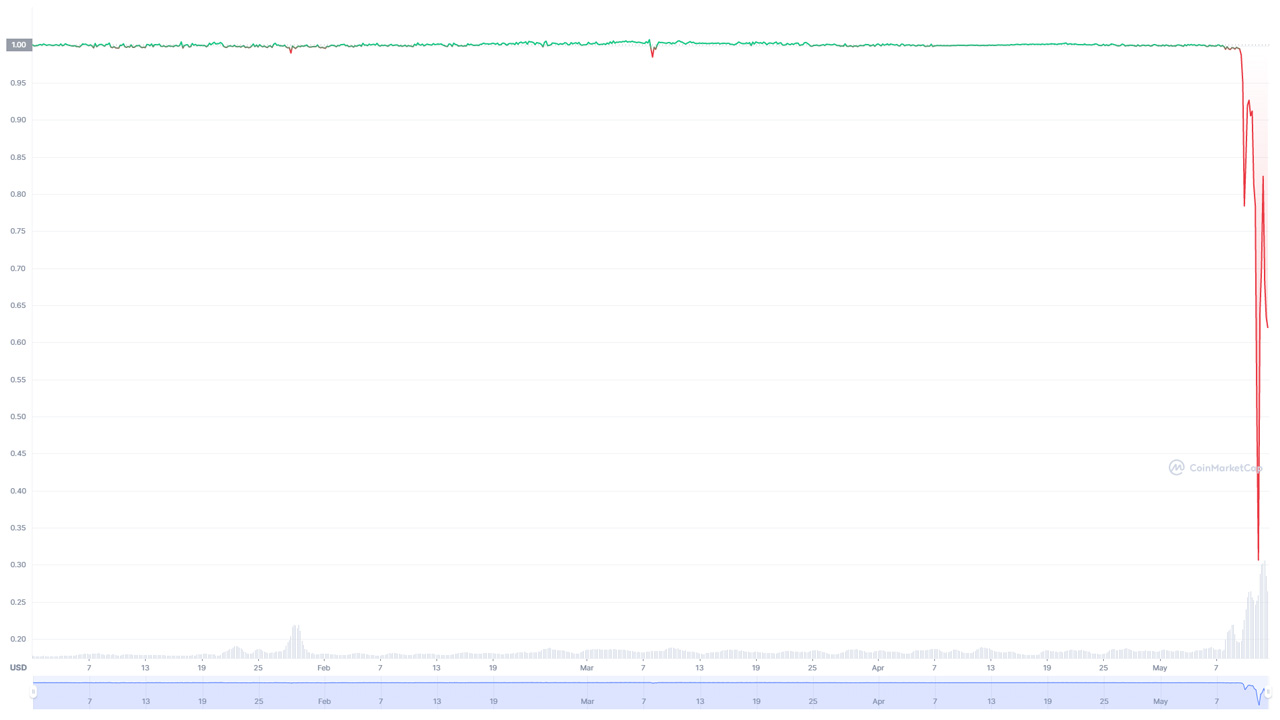

The markets that have been fluctuating since early 2022 nearly collapsed with the Terra (LUNA) and TerraUSD (UST) crisis.

*UST price chart. Source: Coinmarketcap

Everything we’ve talked about so far has been about Bitcoin and other cryptocurrencies entering a downtrend. by 2022 47 thousand dollars Bitcoin, entering the levels, fell heaving by one and a half moves. While small and medium investors and many cryptocurrencies waited for this decay process to end, an event happened that no one expected. A dollar-indexed stablecoin TerraUSD (UST)would have been the victim of an ‘operation’. The price of UST, which should always be near $1, recently fell towards the $0.2 level. The fact that even a dollar-indexed cryptocurrency depreciated in this way, the markets “your downfallwas another factor that caused it. Here’s another point that millions of investors have overlooked:

There are many different stable coins on the market. For example, Tether (USDT) and USD Coin (USD). The projects behind these cryptocurrencies try to keep the cryptocurrencies stable. direct dollar reserve they hold. This means exactly true certainty for the constant value. In UST the situation is different. The team behind this cryptocurrency also supports LUNA, an altcoin on the Terra network. So UST with LUNA brother and she work together† To keep the UST around $1, LUNA was traded, sometimes burned, with a certain algorithm. This is exactly why the events are described as “operation”. The algorithm to keep the UST at $1 is so to speak “be overthrown“It turned things upside down on behalf of Terra. The fact that the team behind LUNA and UST were selling Bitcoin, the investor outcry and the negative statements from names like the US Treasury Secretary hit Terra first and then the entire market. brought it to where it is today. it happened…

What can the investor expect?

The question everyone is asking now is what or what awaits the market in the future. Specifically at this point no information we can say. When we look at the statements of cryptocurrency phenomena, we see that there is a difference of opinion. While some think the markets will recover, others say the downtrend will deepen and these are good days. According to some, both Bitcoin and other cryptocurrencies, best buying opportunity in history and this opportunity should not be missed. What will happen in these circumstances where technical analysis and forecasting are opposite angles? we will watch and see together†

This content is not investment advice…