DeFi Herald: TVL Halves, Anchor Price Drops 98%

- May 14, 2022

- 0

The decentralized finance (DeFi) sector continues to attract increasing attention from crypto investors. ForkLog has gathered the most important events and news of the last weeks into a

The decentralized finance (DeFi) sector continues to attract increasing attention from crypto investors. ForkLog has gathered the most important events and news of the last weeks into a

The decentralized finance (DeFi) sector continues to attract increasing attention from crypto investors. ForkLog has gathered the most important events and news of the last weeks into a summary.

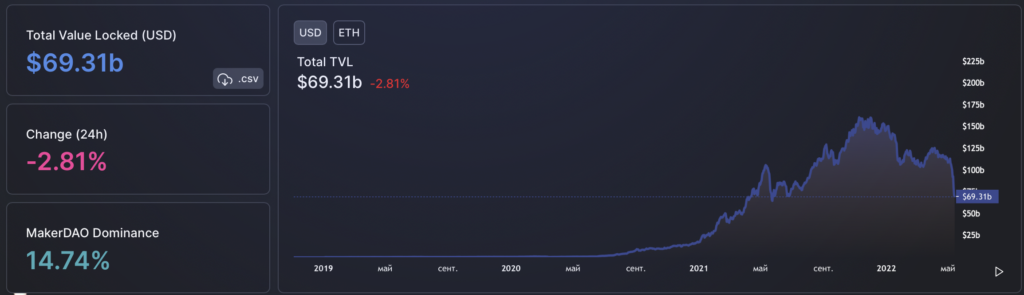

The amount of blocked funds (TVL) in DeFi protocols decreased to $ 109.5 billion, while MakerDAO was the leader with $ 10.21 billion, while Curve ($ 8.48 billion) and Lido ($ 8.47 billion) took the second and third places, respectively.

TVL has dropped to $69.3 billion in Ethereum applications. In the last 30 days, the indicator has decreased by 41% (April 14, value was $118 billion).

The decentralized exchange (DEX) trading volume over the past 30 days was $91.3 billion.

Uniswap continues to dominate the foreign exchange market with 61.1% of the total turnover. In terms of trading volume, the second is the DEX Curve (21.4%), the third is the Stabilizer (6.5%), and the fourth is SushiSwap (5.1%).

The TVL of DeFi protocol Anchor (ANC) fell 97.83% as the algorithmic stablecoin TerraUSD (UST) and the cryptocurrency Terra (LUNA) used to issue it dropped.

Amid the decline in the rate of return on deposits, more than 2.2 billion UST was withdrawn from Anchor on May 7-8, as a result of which the stablecoin was briefly pegged to the US dollar. Then the situation stabilized.

On May 11, TerraUSD lost value again against the US dollar and its price dropped below $0.2. Against this background, the LUNA token has dropped 98% in one day to just under $1. According to CoinGecko, the asset is trading at $0.0038 at the time of writing.

Following the event, the Anchor community has proposed reducing the target rate of return on UST deposits to 4% per annum. Voting will last until May 18.

Anchor uses a variable interest rate. If the initiative is approved, its minimum value will be reduced to 3.5% and its maximum value will be increased to 5.5%. At the time of writing, the rate of return on the protocol is 18.13%.

Since the beginning of the crisis in the Terra ecosystem, approximately 9.5 billion UST has been withdrawn from Anchor. The largest fund outflow was recorded on May 9 – 3.33 billion UST. The TVL of the project fell to $355 million.

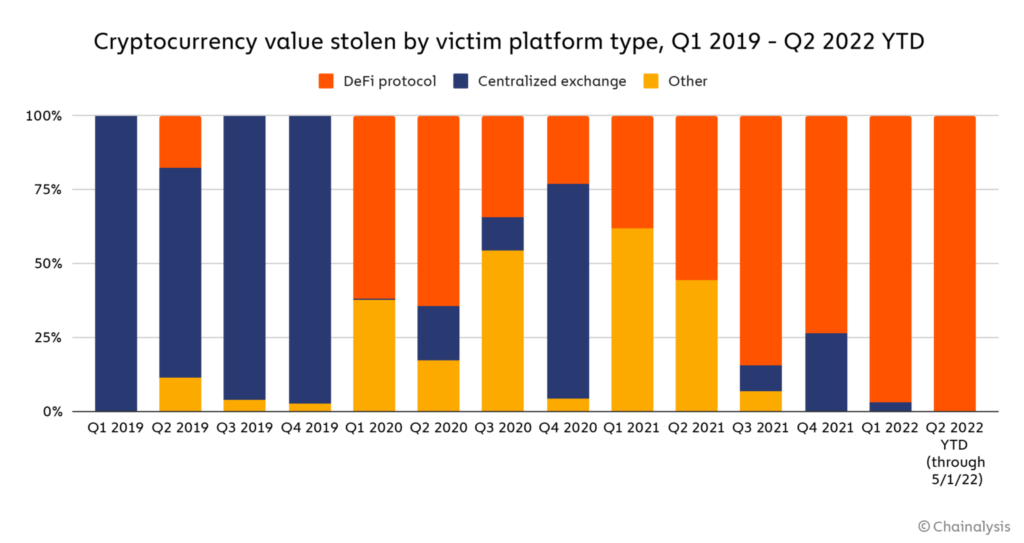

According to analytics firm Chainalysis, the overall volume of illegal cryptocurrency transactions has decreased significantly in recent years, but cybercrime in the DeFi segment has increased.

Among the main reasons for the current situation at Chainalysis is the focus of hackers on stealing funds through DeFi projects and using them for money laundering.

Throughout 2021, decentralized protocols have been the main target of hackers.

As of May 1, DeFi projects accounted for 97% of the total $1.68 billion worth of cryptocurrencies stolen in 2022, according to experts.

Most of the stolen funds as a result of attacks on decentralized protocols ended up with hackers associated with the DPRK. During the current year, they stole more than $840 million from similar projects.

Experts say that another major problem is money laundering through the DeFi sector.

In 2022, decentralized protocols received 69% of all funds sent from crime-related addresses. Last year, this figure was 19%.

Most DeFi protocols cannot compete with Bitcoin in terms of an efficient monetary network due to its lack of decentralization. This was stated by the former director of strategy at Blockstream Samson Moe.

According to him, DeFi project teams have the right to change the protocol at any time.

“At a fundamental level, money should not change. “If you can make changes at any time, it’s no better than a central bank-managed fiat currency,” Moe said.

The expert believes that the decentralized nature of bitcoin does not allow for easy protocol changes, making the first cryptocurrency the best candidate for the role of a global monetary system.

Despite the unwavering foundation of digital gold, developers dapps can use second-level scaling solutions.

developers auroraThe Layer 2 (L2) protocol of the NEAR network has launched approximately $90 million in funding in AURORA tokens to accelerate the development of DeFi applications.

The initiative is implemented in partnership with Proximity Labs, which will manage the fund and provide grants to developers interested in building Dapps on the protocol. Aurora Labs allocates funds from the Treasury DAO.

Liquid staking solution starting behind pSTAKE permanence raised an undisclosed amount from Binance’s venture capital arm as part of a strategic funding round.

Unknown pulled from DeFi protocol Capital of Rari Approximately $80 million worth of assets held in Fuse loan pools.

Smart contract auditing firm BlockSec cited a “typical reentry vulnerability” in the code of the Fei Protocol project as the cause of the attack.

The developers confirmed the information, suspended cryptocurrency loans, and offered the hacker a $10 million payment to return the stolen funds.

After the event, the price of Rari Governance Token (RGT) dropped 20% to $11.5.

DeFi protocol Deus Finance DAO was once again subjected to a hacker attack. According to PeckShield, the attacker withdrew approximately $13.4 million worth of assets from smart contracts, but the project itself “could have lost more”.

The Deus Finance DAO team has confirmed the attack. The developers reported that user funds are safe, their positions are not liquidated. Lending with DEI suspended, stablecoin pegging to dollar restored.

An unknown person hacked a decentralized stablecoin and wrapped asset exchange saddle financing. The hacker has mined more than $10 million in Ethereum. The project team said they are investigating the incident. Withdrawals from some pools have been suspended.

BlockSec, a cybersecurity company specializing in the DeFi industry, was the first to discover the hack. Its specialists were able to save $3.8 million in Saddle Finance funds.

Source: Fork Log

I’m Sandra Torres, a passionate journalist and content creator. My specialty lies in covering the latest gadgets, trends and tech news for Div Bracket. With over 5 years of experience as a professional writer, I have built up an impressive portfolio of published works that showcase my expertise in this field.