Glassnode: Bitcoin Closer to Fair Price Amid UST Crash

- May 17, 2022

- 0

The bitcoin exchange rate has dropped 10% to its fair price for 17 months with a new minimum. According to a report by Glassnode analysts, this happened against

The bitcoin exchange rate has dropped 10% to its fair price for 17 months with a new minimum. According to a report by Glassnode analysts, this happened against

The bitcoin exchange rate has dropped 10% to its fair price for 17 months with a new minimum. According to a report by Glassnode analysts, this happened against the background of the UST stablecoin’s collapse and the associated turbulence.

Last week was a historic week #Bitcoin,as $LUNA overblown, $UST failed, forced 80k sales $BTC

Later on, $USDT Peg was under pressure for 24 hours, lost $5 billion and was a near miss with Realized Price

Read our complete analysis👇https://t.co/nYnG04dfDR

– glass knot (@glassnode) 16 May 2022

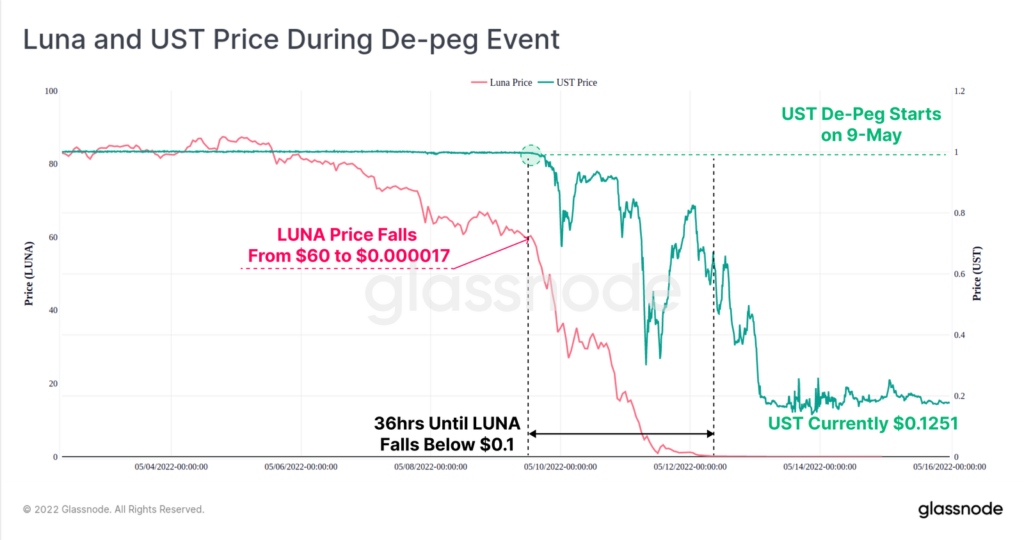

Full use of backups LFG 80,394 BTC did not stop the collapse of the UST-LUNA ecosystem, TVL It was approaching $40 billion. At the time of the report’s release, the first asset was pegged at $0.125, while the second was down 99.9998%. ATHup to $0.0002.

The chart below shows the sharp increase in LUNA supply (343 million to 6.53 trillion, or 99,263,840% per annum, logarithmic scale) against the backdrop of 7.5 billion UST or 40% (linear scale) repayment of the bid.

Due to such drastic changes, Terra network validators rebooted it twice.

LFG emptied its $3.275 billion bitcoin reserves in 21.5 hours in three tranches of 22,189 BTC, 30,000 BTC and 28,205 BTC from May 9 to 10. The first two went to Gemini via OTC platforms, and the last one went directly to Binance.

On May 16, the organization reported that it has only 313 BTC left in its reserves. The share of LFG (80.394 BTC) was decisive in total coin inflows into swap balances (~88,000 BTC) during this period.

“Events [коллапс UST] “contagion” and created a panic effectexperts concluded.

On May 14, there was a 32,000 BTC drop in the balance of exchanges, coinciding with bitcoin’s return to levels above $30,000.

The departure of the UST from the US dollar has put pressure on the rate of the systemically important stablecoin USDT. It hit a low of $0.9565 before reversing the discount.

During this time, other assets in this category – BUSD, DAI and USDC – traded at a premium of 1-2%.

The total market cap of the latter has increased by $2.64 billion Analysts have explained this phenomenon with the desire to protect funds from “infection” and have assumed that USDC has become the “preferred” stablecoin.

Experts also noted the 24.4% ($2.07 billion) decrease in DAI’s capital, which was partially affected by the liquidation of collateralized assets. They added that the price of DAI is fixed at $1.

On May 12, the daily volume of converting Tether to fiat reached $2 trillion.

Tether Continues To Honor All Redemptions From Verified Customers During Market Volatility, On Way To 2 Billion Transactions Today https://t.co/p1AugHb9Gn

— Tether (@tether_to) 12 May 2022

During the week, the benchmark reached a record $7,485 billion for the industry, with USDT’s total capitalization falling to $75.75 billion.

To stabilize the UST, LFG went to sell digital gold below its purchase price. The organization’s net actual loss was $703.7 million, and the total number of bitcoin investors in those two days was $2.5 billion (one of the largest capitulations in history).

The LFG loss figure above does not account for additional losses from BTC to UST swaps and LUNA hyperinflation.

Pressure from issues with UST and LUNA has pushed bitcoin price down actual price. Previously, this metric gave reliable signals about the formation of the bottom when the indicator exceeded the bid level. Last week, the first figure was $23,940, the second ($26,500) was 9.5% higher.

Recall that Robert Kiyosaki, author of the best-selling book “Rich Dad Poor Dad”, described Bitcoin’s collapse as “great news” and predicted the cryptocurrency’s testing of the $17,000 level.

Earlier, Peter Schiff, a prominent gold supporter and critic of the first cryptocurrency, thought it was “likely” for prices to drop to $10,000.

Source: Fork Log

I’m Sandra Torres, a passionate journalist and content creator. My specialty lies in covering the latest gadgets, trends and tech news for Div Bracket. With over 5 years of experience as a professional writer, I have built up an impressive portfolio of published works that showcase my expertise in this field.