DeFi segment ‘lost’ $130 billion since the start of the year

- May 29, 2022

- 0

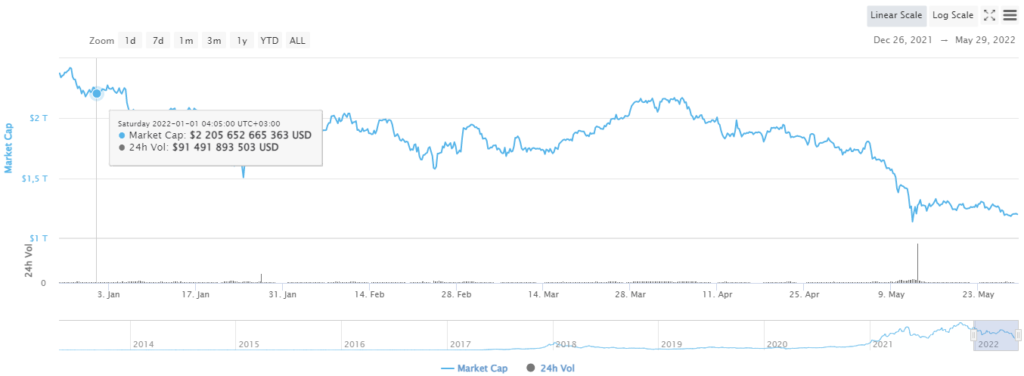

The total value of funds in DeFi applications (TVL) has decreased by 55% since the beginning of the year. On January 1, the segment’s total TVL exceeded $236

The total value of funds in DeFi applications (TVL) has decreased by 55% since the beginning of the year. On January 1, the segment’s total TVL exceeded $236

The total value of funds in DeFi applications (TVL) has decreased by 55% since the beginning of the year.

On January 1, the segment’s total TVL exceeded $236 billion. At the time of writing, this figure was $106 billion.

As early as May 9, dapps liquidity exceeds 180 billion dollars, on the background of the collapse of Terra, the indicator fell sharply, this is clearly visible in the chart above.

The decrease in TVL is also largely due to the bearish trend of the market, whose capitalization has fallen by 45.4% since the beginning of the year.

Some DeFi tokens are down 99% from their peaks. For example, the token of the Geist Finance landing project based on Phantom practically depreciated. It was trading above $30 in October and now its price is around $0.01.

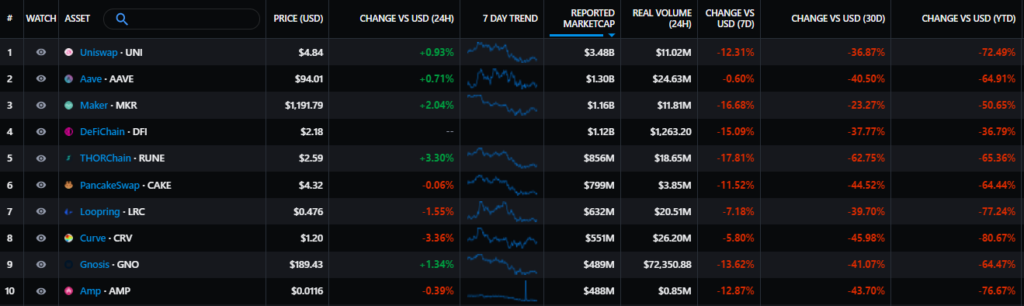

Even among the top 10 coins, some have dropped more than 70% since the start of the year.

For example, the token of the leading decentralized exchange Uniswap fell 72%, the native asset Curve – 80%.

Earlier, JPMorgan analysts said that events around Terra were a “significant blow to the crypto world” but had a limited impact on the DeFi ecosystem. In their view, the crypto winter will be short-lived due to the influx of venture capital into the industry.

Source: Fork Log

I’m Sandra Torres, a passionate journalist and content creator. My specialty lies in covering the latest gadgets, trends and tech news for Div Bracket. With over 5 years of experience as a professional writer, I have built up an impressive portfolio of published works that showcase my expertise in this field.