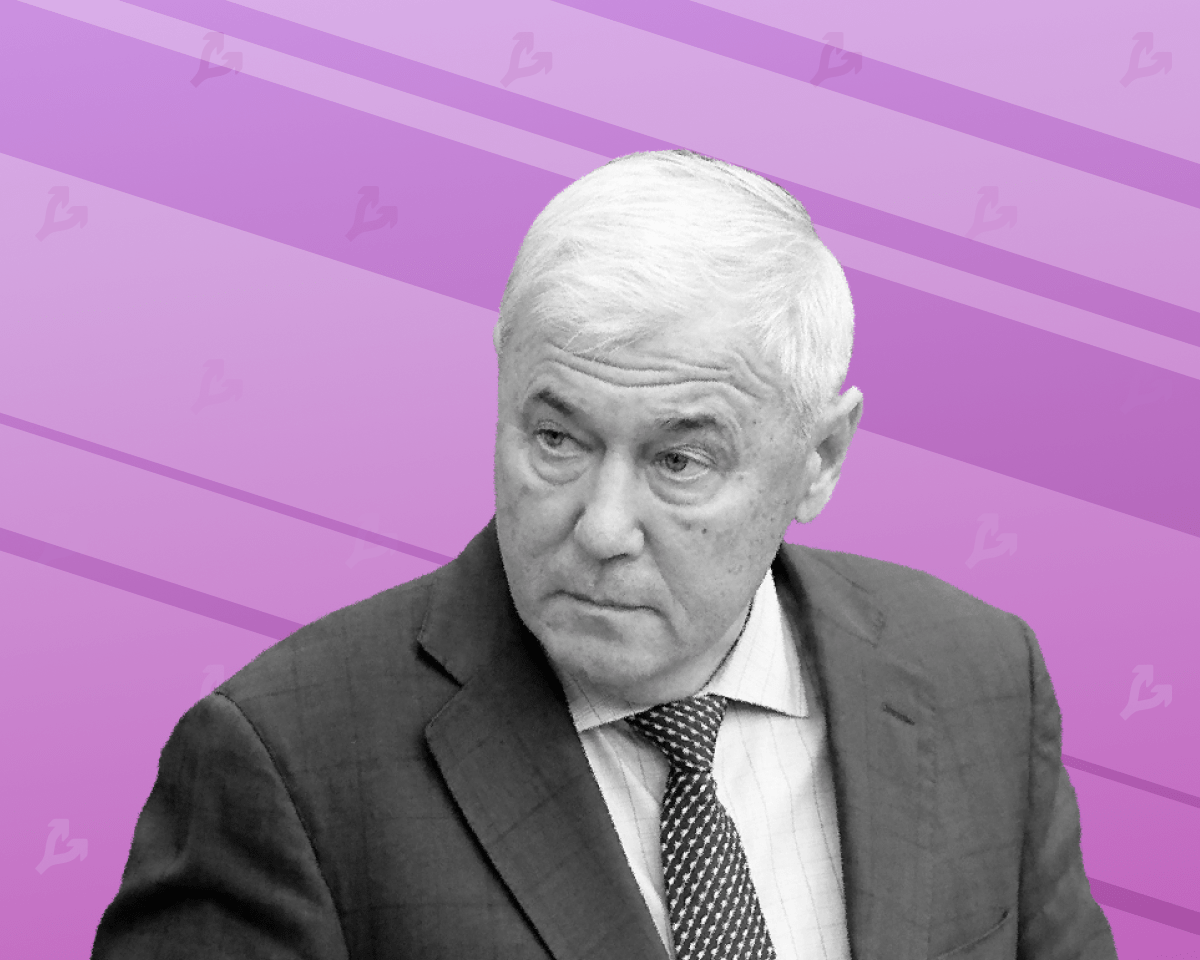

The authorities of the Russian Federation continue to discuss options for regulating the cryptocurrency market, and it is not worth waiting for the bill “On Digital Currencies” to come in the near future. This is the head of the State Duma Committee of the financial market Anatoly Aksakov writes “Parliamentary newspaper”.

According to him, the authorities are already considering the third version of the draft law on the regulation of cryptocurrencies:

“I do not think that the document will appear in the State Duma in the near future. The situation in the cryptocurrency market also does not add optimism: Bitcoin collapsed a lot against the background of sanctions decisions.”

Aksakov believes that the bill on the regulation of cryptocurrencies will be adopted in a “hard” version.

According to media reports, the Ministry of Finance finalized the document, taking into account the comments of various departments.

Now the bill includes a clause that allows the use of cryptocurrencies as a means of payment in the foreign trade activities of legal entities and individual entrepreneurs. It is assumed that they will be able to perform such transactions by obtaining an “identifier provided by the operator of the digital trading platform”.

The document also explains the obligation of bitcoin exchanges and exchangers to cooperate with law enforcement and retain information about users and their operations for three years.

It is reported that the norms on the volume of investments in cryptocurrencies for legal entities and “professional buyers” of digital currencies have been removed from the bill.

Mining provisions have also changed. For example, the requirement for inclusion in a special register of legal entities and individual entrepreneurs engaged in the issuance of cryptocurrencies, as well as the disclosure of information transfer to tax authorities, has disappeared.

Aksakov believes that the US authorities are starting to “pin up” the crypto market due to the hypothetical use of bitcoin to circumvent sanctions:

“There are suspicions that American intelligence services largely control this market, so there is no desire to come under their invisible or visible eye when conducting financial transactions.”

He also admitted that they will create a single centralized platform to conduct operations with crypto assets in the Russian Federation.

Recall that the draft “On Digital Currency” developed by the Ministry of Finance provides for transactions with cryptocurrencies through Russian banks, identification of holders of crypto wallets and separation of investors by qualifications.

In April, the ministry changed the terminology of the document. Later it became known that he also supported a number of proposals of the FSB, the Federal Tax Service and the Ministry of Internal Affairs for the bill.

In May, the head of the fiscal policy department of the Ministry of Finance, Ivan Chebeskov, acknowledged that cryptocurrencies can be used by Russia in international settlements.

At the same time, the Central Bank of the Russian Federation recognized the impossibility of avoiding sanctions with the help of crypto assets. Analysts at international rating agency Moody’s also believe that digital currencies will not help the Russian Federation circumvent sanctions.