Cryptocurrency markets, which have been very active lately, last night experienced a very sharp decline. All crypto assets, especially Bitcoin (BTC), have suffered serious losses in value. According to shared statistics, the sudden drop was approx $800 million ensured that the transaction value was liquidated (liq).

The BTC price has been declining for several days 70 thousand dollars was on level. However, last night there was a fairly sharp drop. The BTC price quickly dropped to 65 thousand dollars. Naturally, altcoins took advantage of this situation and benefited from BTC. they fell harder.

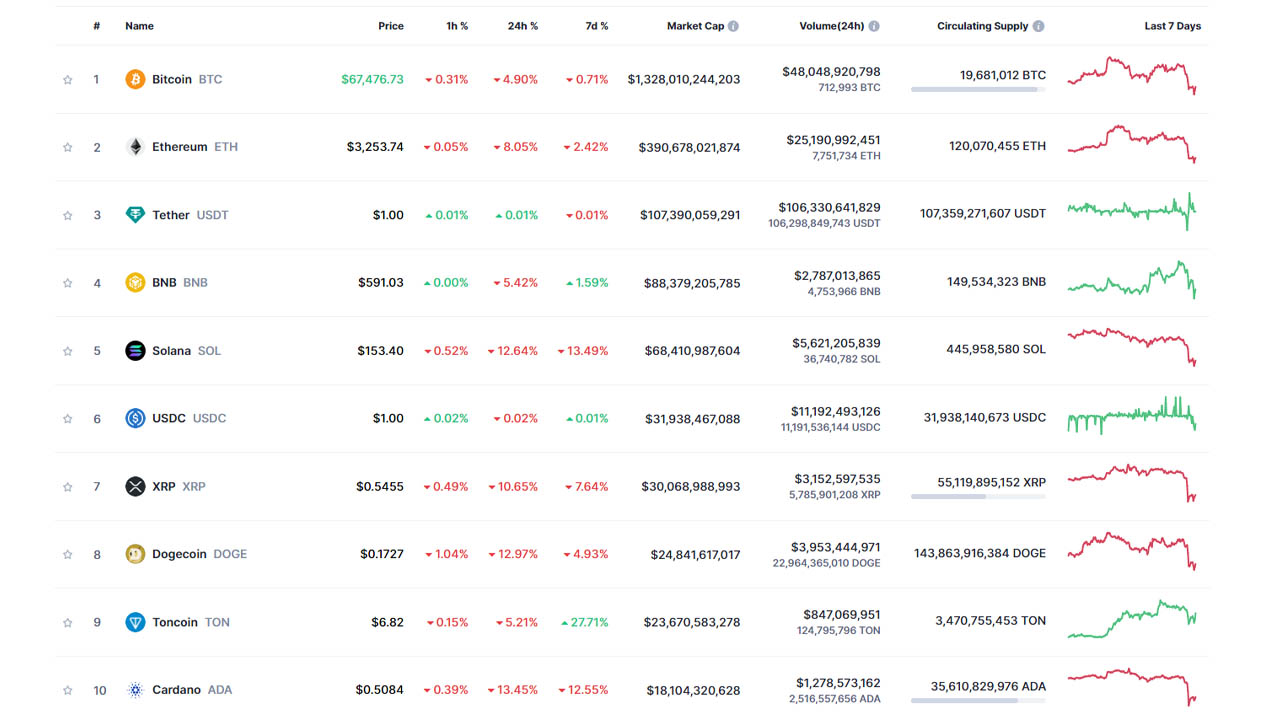

The current loss in value of BTC is 5 percent

BTC has recovered slightly after the sharp decline and at the time of writing this article 67 thousand 800 dollars It is trading at levels. However, the decline in the past 24 hours amounts to more than 5 percent.

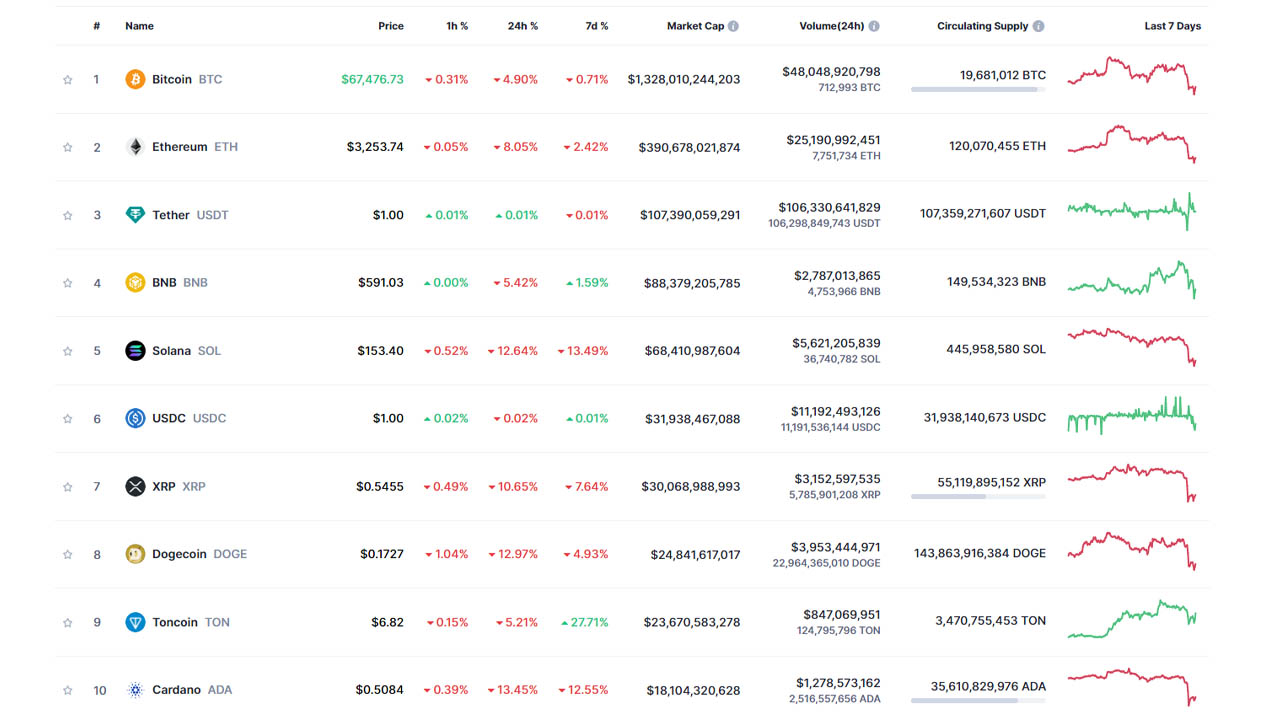

If we look at the Coinmarketcap data, we see that the situation is how serious it is We understand it better. In this context; All 10 largest crypto assets in terms of market volume have lost value. The drop in Ethereum (ETH) is 8 percent, in Binance Coin (BNB) 5.4 percent, 12.6 percent in Solana (SOL)we see a loss of 10.6 percent in Ripple (XRP), 12.97 percent in Dogecoin (DOGE), 5.2 percent in Toncoin (TON) and 13.45 percent in Cardona (ADA).

The clear reason for the decline is tensions between Israel and Iran

Before the severe decline in the cryptocurrency markets Actually, there are many reasons. The most obvious of these, however, is that Israel and Iran are tense. It appears that tensions in the Middle East will now spread to a wider region, impacting the markets. caused fear. Rumors that Iran will attack Israel have led to a decline in the cryptocurrency markets, which are already looking for an excuse.

*This content should not be considered investment advice.

Follow Webtekno on Threads and don’t miss the news