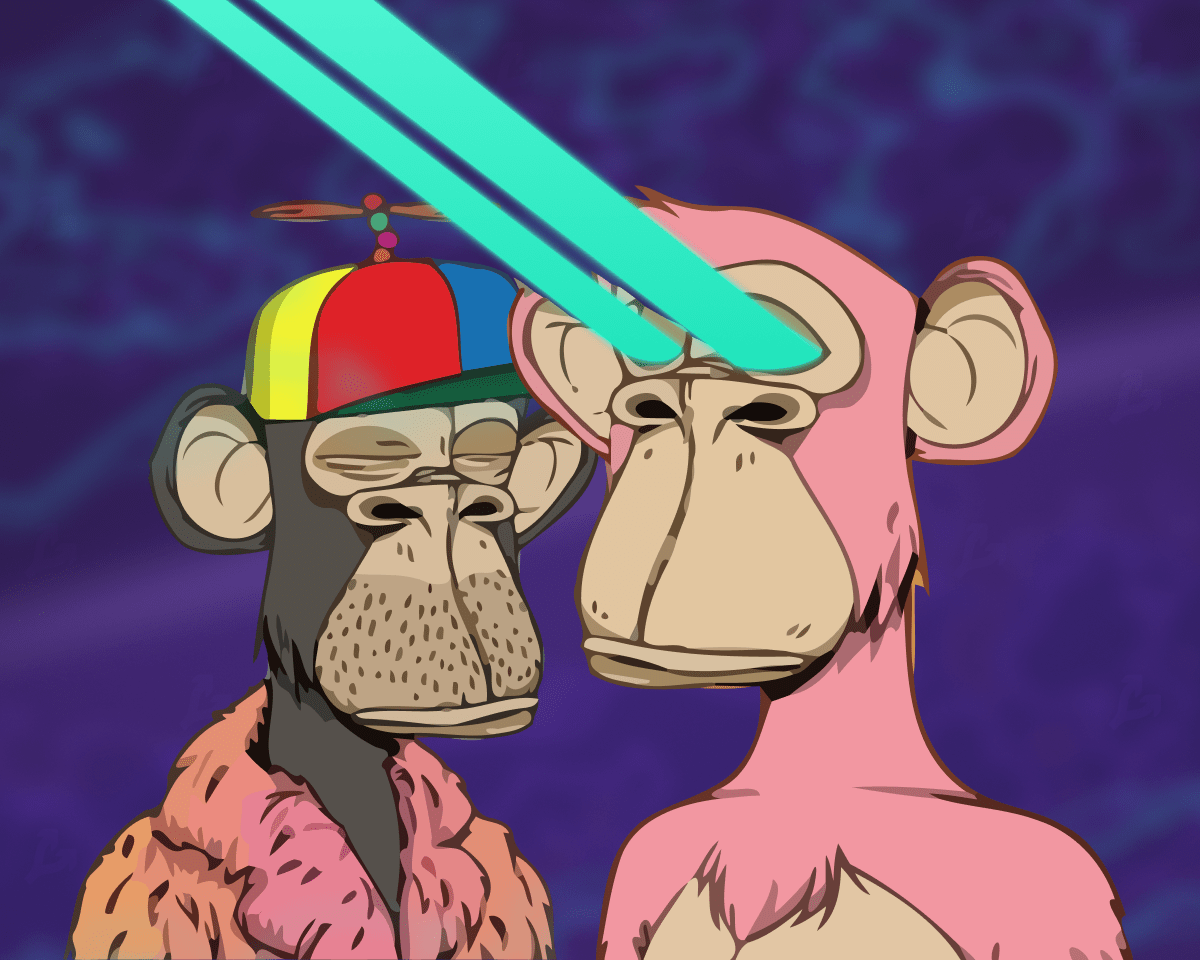

Digital currencies pose a security threat to the global payment infrastructure. This was stated by Ann Boden, founder and CEO of British neobank Starling Bank, CNBC reported.

During the Money 20/20 fintech conference in Amsterdam, the organization’s CEO stated that many cryptocurrency wallets are “directly tied to payment plans.”

“This is very dangerous,” Boden said.

Starling Bank CEO also reminded the fraud in the industry. According to him, it takes more time to protect customers than to promote cryptocurrencies.

Boden was skeptical that Starling would begin offering digital assets within the next few years. He emphasized that industry-related companies have a lot to compensate for in the fight against money laundering.

In March 2021, UK-based Starling Bank closed its £272 million ($341.6 million) Series D financing round led by Fidelity. In April, the organization raised £50m ($62.8m) from Goldman Sachs.

At the end of May of the same year, Starling Bank temporarily banned customers from depositing on cryptocurrency exchanges. Restrictions were promised to be lifted after testing a new system to prevent financial crime.

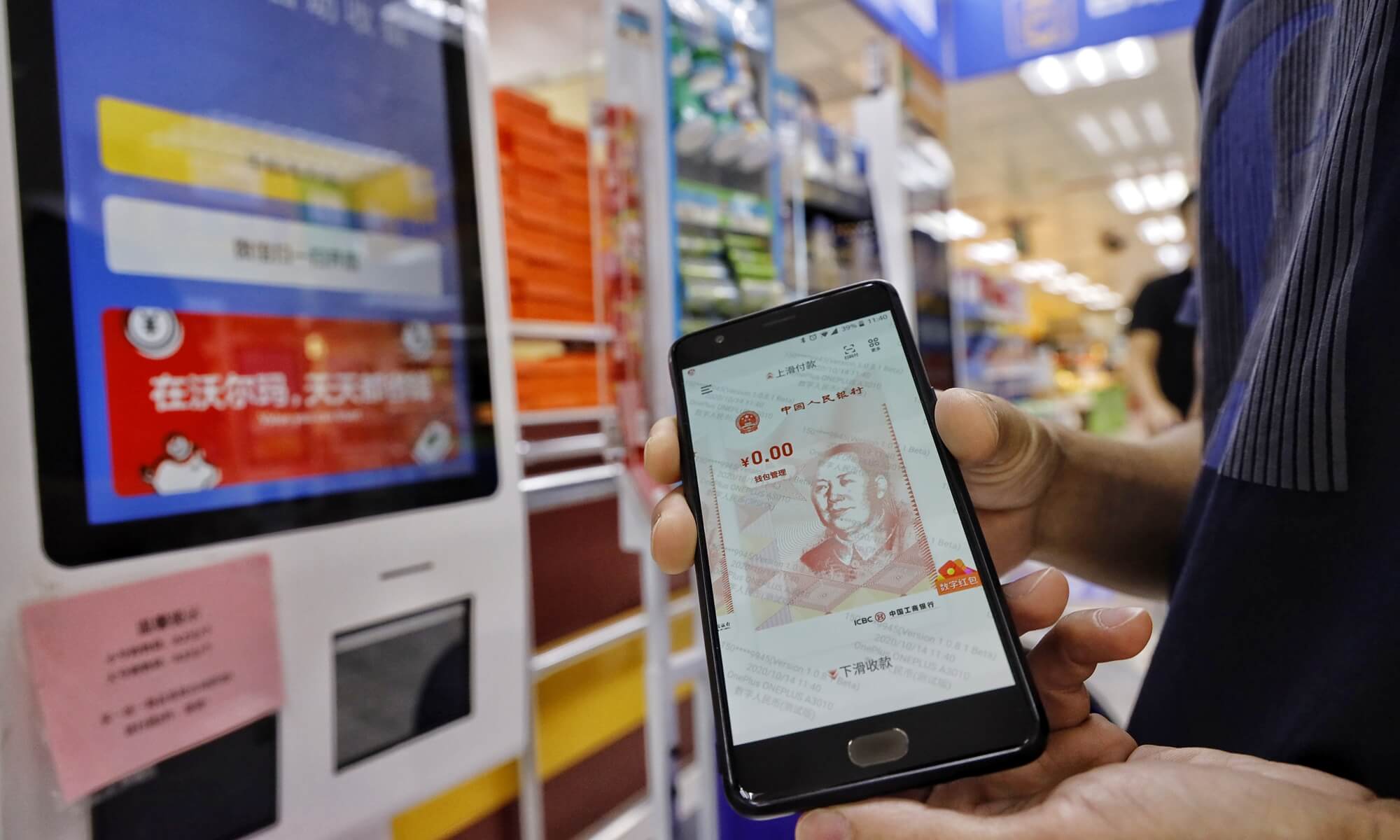

In November 2021, payment company Mastercard announced the launch of bitcoin-linked debit, credit and prepaid payment cards in the Asia-Pacific region.

In January 2022, Mastercard announced a partnership with the Coinbase bitcoin exchange. As part of a joint venture, the companies planned to allow the purchase of NFTs using debit cards.

Recall that in June PayPal opened the possibility of transferring cryptocurrencies between accounts and withdrawals to third-party wallets.

Source: Fork Log

I’m Sandra Torres, a passionate journalist and content creator. My specialty lies in covering the latest gadgets, trends and tech news for Div Bracket. With over 5 years of experience as a professional writer, I have built up an impressive portfolio of published works that showcase my expertise in this field.