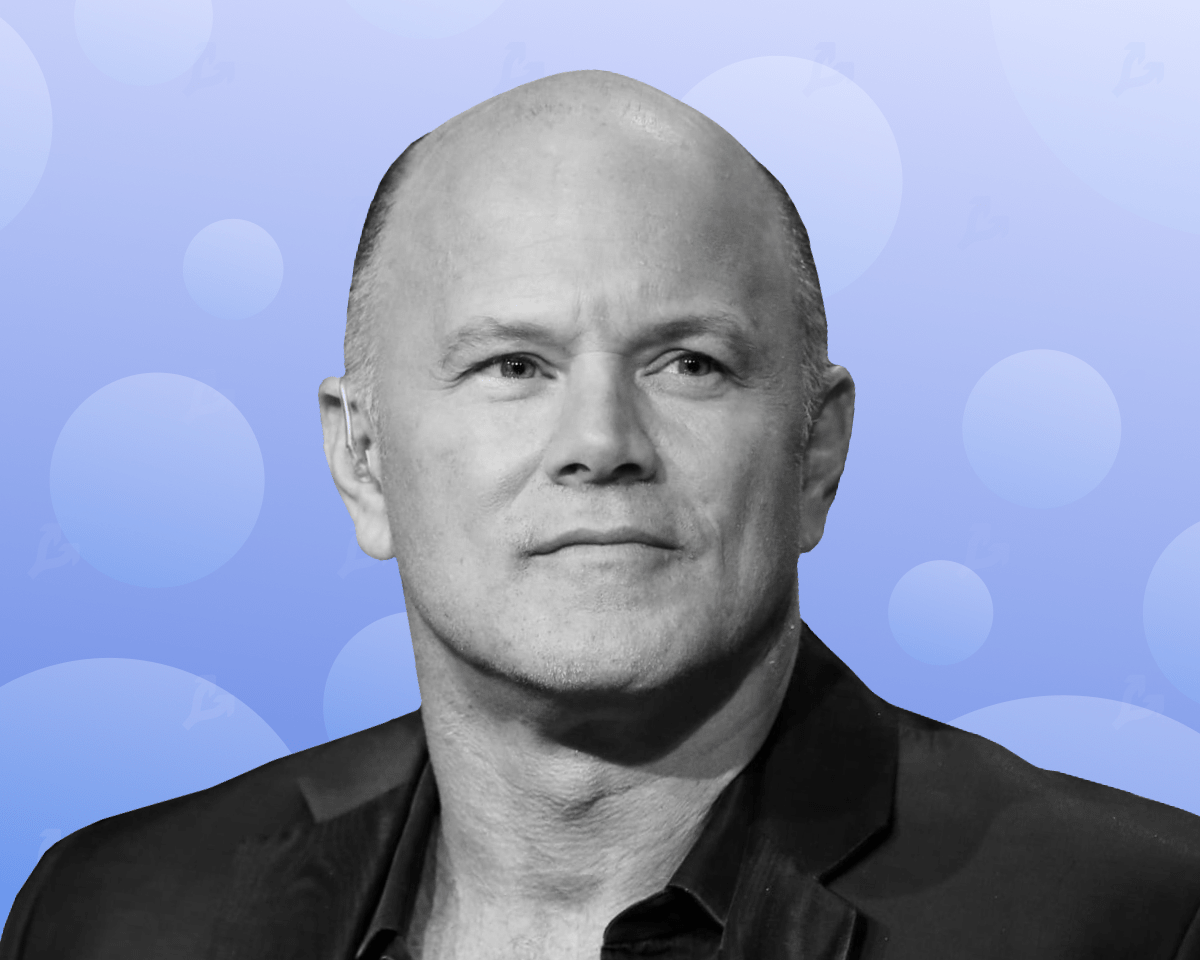

The stagnation in the cryptocurrency market will continue for about 18 more months, and the industry will see the first signs of recovery after monetary policy loosening. fed. This was stated by Mike Novogratz, president of Galaxy Digital, in an interview with New York Magazine.

When asked by journalist Jan Witzner about the depth and duration of the current recession, he said:

“I wish I had a crystal ball. My intuition tells me it’s 18 months, maybe even a little less. I think by the fall the Fed will have to stop raising interest rates, and I think that will calm people down and start rebuilding.”

According to Novogratz, the market is in a major recession as the crisis has changed people’s attitudes towards high-risk assets such as cryptocurrencies. He noted that the past few months have shown the industry’s dependence on leverage that no one knows about.

“Hopefully we’ve seen the worst. If I knew what inflation was going to be in the next two quarters, I would have been more sure of that,” Galaxy Digital added.

Novogratz emphasized that it will take time for weak players to go bankrupt and sell collapsing assets. He drew an analogy with the 2008 global financial crisis, followed by a wave of consolidation in the investment and banking sectors.

The millionaire stated that the community should not worry about the collapse of Tether’s USDT stablecoin. According to him, the issuing company looks “pretty stable” to him.

Coinbase expressed a similar view on the bitcoin exchange:

“They have a lot of money on their balance sheet. I think CEO Brian Armstrong will cut that number down significantly in the next quarter or two. They have a great brand. The worst-case scenario for them is the emergence of a large traditional financial actor who either has partners or buys the company.”

According to Novogratz, Galaxy Digital has not invested in any “credit stores” like Celsius Network. At the same time, the cryptocurrency bank invested in the BlockFi lending platform, but it was out of capital more than a year ago.

He also stated that his company has never taken positions in algorithmic stablecoins and is not involved in Ethereum 2.0 liquid staking.

“I think staking ETH will be big business. That’s why I believe we’re going to join it,” Novogratz added.

Recall that in June 2022, the head of Galaxy Digital said that once the Fed stops raising its main interest rate, Bitcoin will “lead” a new rally in the cryptocurrency market.

Read ForkLog bitcoin news in our Telegram – cryptocurrency news, courses and analysis.