Glassnode: Only hodlers remain protected by the market

- July 5, 2022

- 0

The record plunge in the price of bitcoin in June practically removed the remnants of “market tourists” from the game, leaving only hodlers “ahead”. These are the conclusions

The record plunge in the price of bitcoin in June practically removed the remnants of “market tourists” from the game, leaving only hodlers “ahead”. These are the conclusions

The record plunge in the price of bitcoin in June practically removed the remnants of “market tourists” from the game, leaving only hodlers “ahead”. These are the conclusions made by Glassnode analysts.

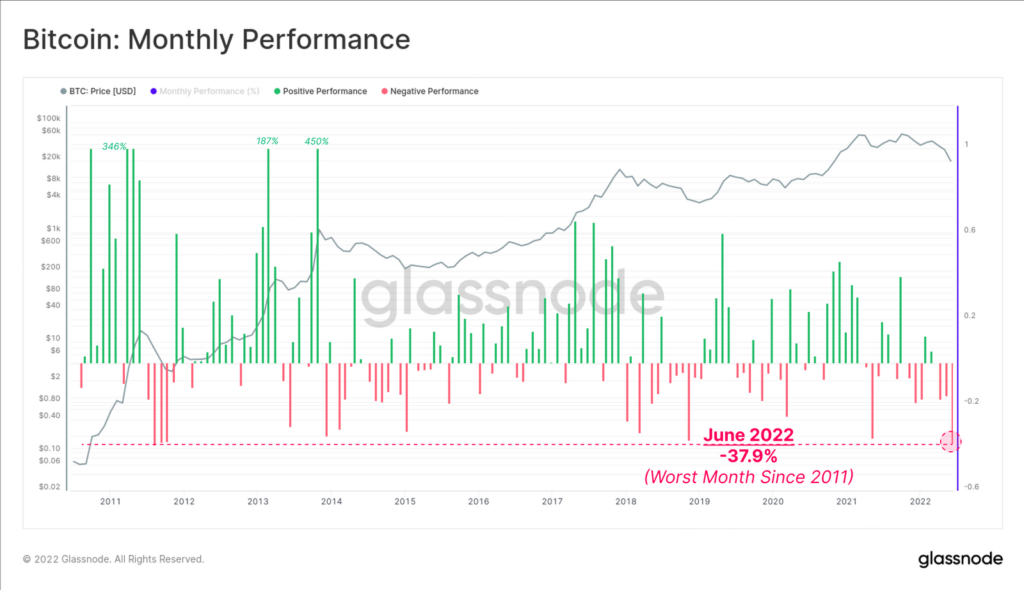

#Bitcoin It experienced the worst monthly price performance since 2011, down 37.9% in June.

Insufficient on-chain activity indicates that ‘fair air’ investors are almost completely cleared and only HODLers hold the line.

Read more👇https://t.co/qu840y9Iug

– glass knot (@glassnode) July 4, 2022

In terms of monthly dynamics, the situation was only worse in 2011.

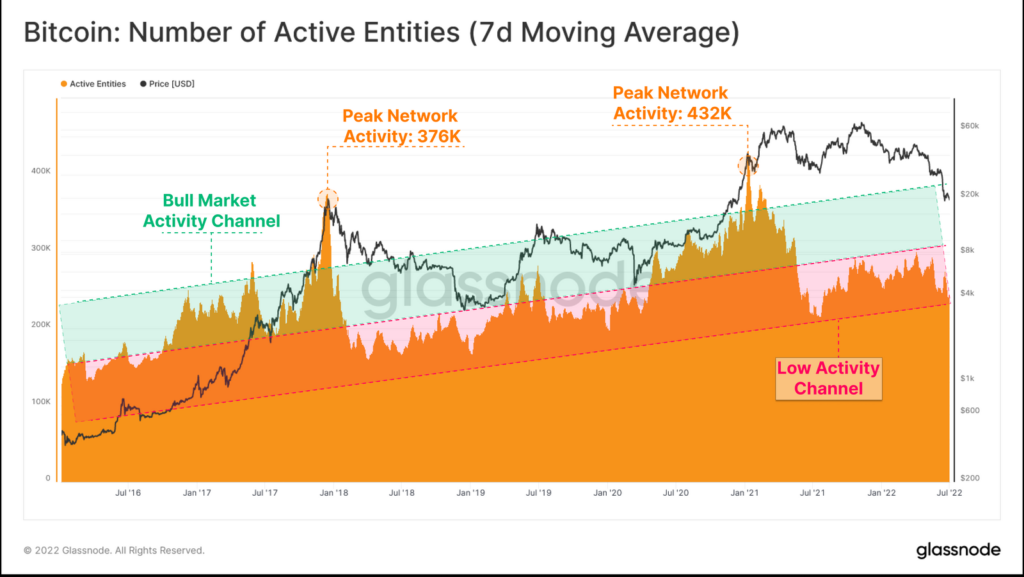

On-chain activity remains in the bearish zone. The number of daily active addresses has dropped from over 1 million in November to ~870,000 available. This indicates a slight influx of new users and a struggle to keep existing ones.

The same indicator applied to individual bidders shows a similar trend. The metric (the flattened seven-day moving average) is at the bottom of the bear market-specific channel of limited activity (highlighted in red).

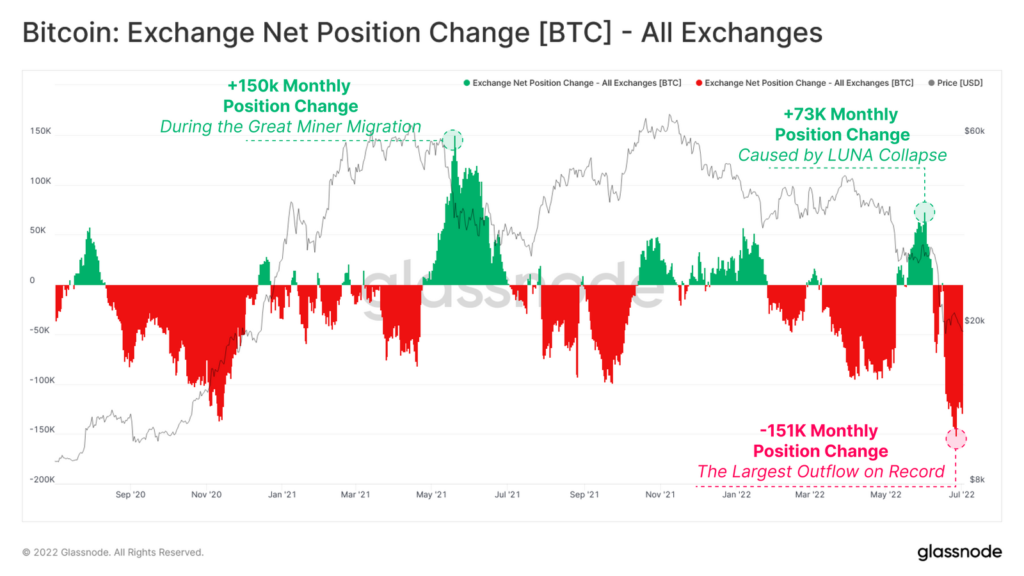

Bitcoin outflows from centralized exchanges drained reserves to levels last seen in July 2018. In June, monthly rates reached 150,000 BTC (5-6% of the total); this contrasts with half of the earlier flow from Terra’s collapse.

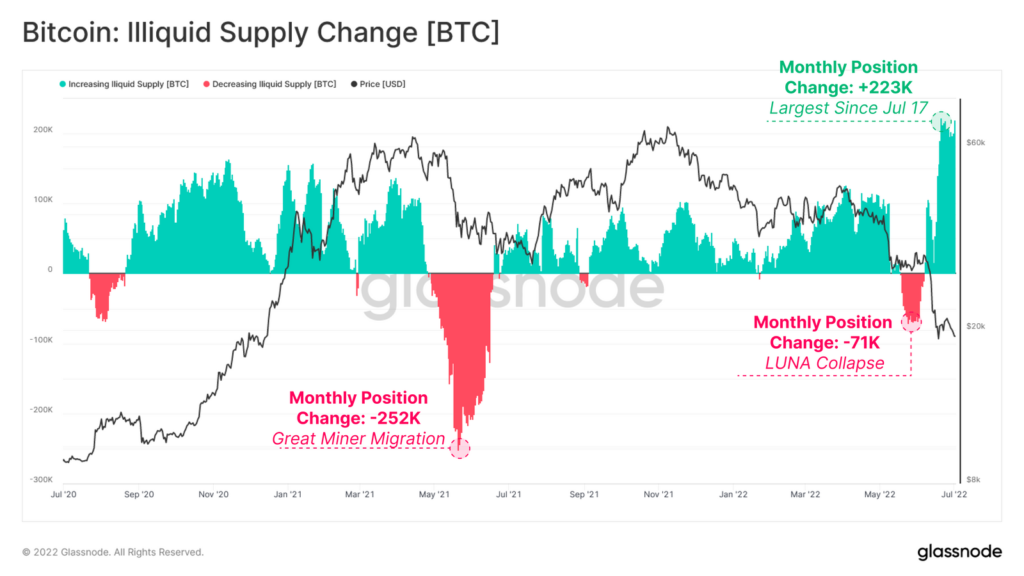

The decrease in foreign exchange reserves complements the “illiquid supply” indicator. In June, it jumped to 223,000 BTC, a record since July 2017. A month ago, the collapse of the Terra ecosystem caused a tense response among hunters, which has now subsided.

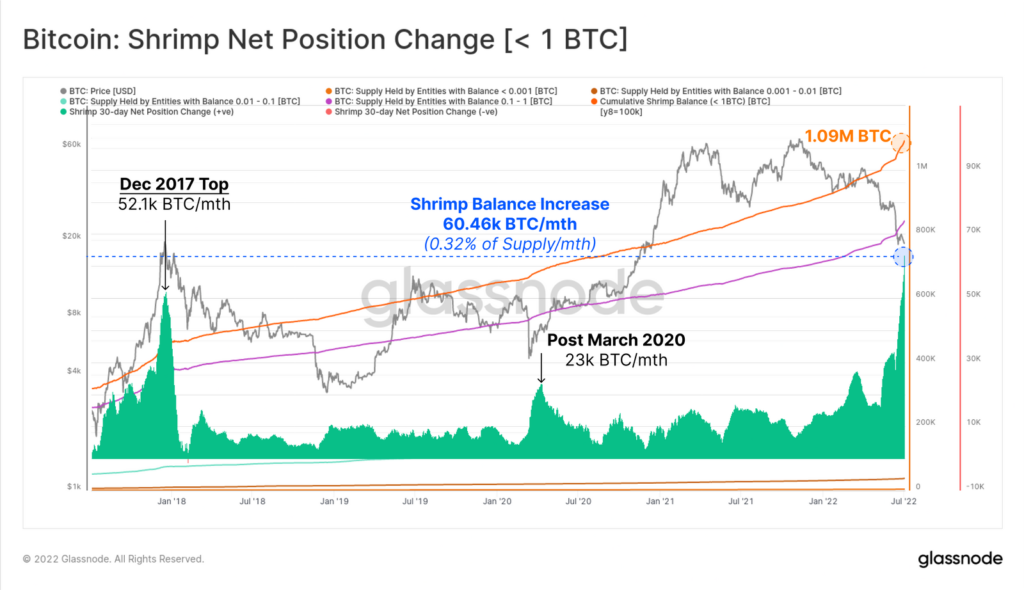

Aggressive coin accumulation is seen between shrimp (balances less than 1 BTC) and whales (over 10,000 BTC). The monthly coin deposit rate was the first to reach 60,460 BTC (0.32% of the market supply), higher than the previous record of 52,100 BTC in December 2017.

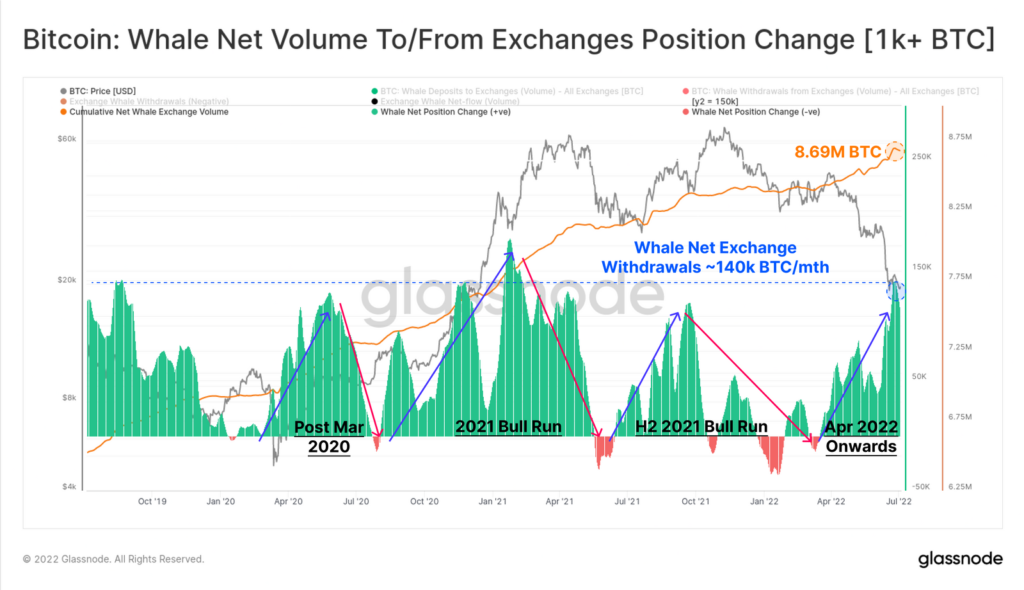

Whales removed 8.99 million BTC from exchanges in total. In June, the pace hit 140,000 BTC – the second highest in the last five years. The dynamics of their action can serve as a leading indicator of price dynamics.

Recall that JPMorgan strategist Nikolaos Panigirtzoglou allowed the completion of leverage in the crypto market.

Previously, Deutsche Bank experts had predicted that Bitcoin would recover to $28,000 by the end of 2022.

Read ForkLog bitcoin news in our Telegram – cryptocurrency news, courses and analysis.

Source: Fork Log

I’m Sandra Torres, a passionate journalist and content creator. My specialty lies in covering the latest gadgets, trends and tech news for Div Bracket. With over 5 years of experience as a professional writer, I have built up an impressive portfolio of published works that showcase my expertise in this field.