Analysts noted an influx of funds to bearish Bitcoin funds

- September 5, 2022

- 0

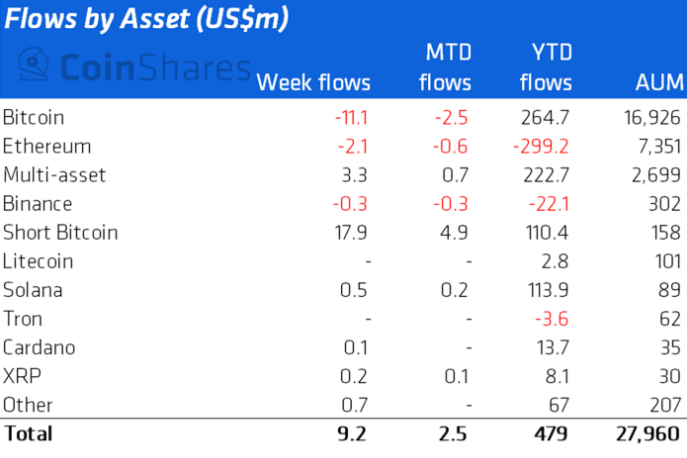

For August 27 – September 2, a record $17.9 million flow of funds was recorded in structures that allow you to open shorts in the first cryptocurrency, CoinShares

For August 27 – September 2, a record $17.9 million flow of funds was recorded in structures that allow you to open shorts in the first cryptocurrency, CoinShares

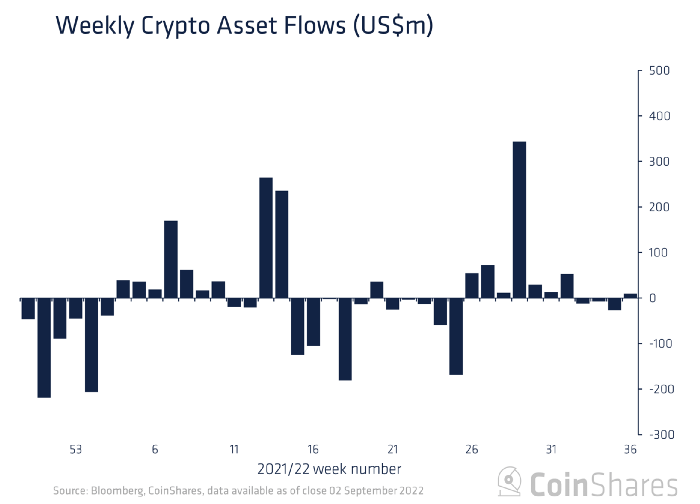

For August 27 – September 2, a record $17.9 million flow of funds was recorded in structures that allow you to open shorts in the first cryptocurrency, CoinShares calculated.

At the end of the week, the turnover of cryptocurrency investment products ($915 million) remained close to the minimum since October 2020 ($901 million).

Entry for all products based on digital assets totaled $9.2 million.

Traditional bitcoin funds experienced an outflow of $11 million. Negative dynamics were recorded for the fourth week in a row, totaling $70 million during this period.

AUM In products that allowed to create a diametrically opposite strategy, the record reached 158 million dollars.

“This has recently FED chief’s speech in Jackson Holewhere a much more hawkish stance is expressed”, analysts explained.

The outflow from Ethereum funds continued for the second week in a row (-$2.1 million).

No significant changes were observed in products based on other altcoins.

Recall that Peter Schiff, head of Euro Pacific Capital, predicted that Bitcoin would drop to $10,000.

Earlier, Charles Edwards, head of Capriole Investments, noted the passing of bitcoin miners’ capitulation phase.

Read ForkLog bitcoin news in our Telegram – cryptocurrency news, courses and analysis.

Source: Fork Log

I’m Sandra Torres, a passionate journalist and content creator. My specialty lies in covering the latest gadgets, trends and tech news for Div Bracket. With over 5 years of experience as a professional writer, I have built up an impressive portfolio of published works that showcase my expertise in this field.