Glassnode allowed bitcoin price to drop to $17,000

- September 6, 2022

- 0

The insistence of Bitcoin’s price above the June low of $17,600 has fallen on the shoulders of speculators who may face another wave of capitulation. In this case,

The insistence of Bitcoin’s price above the June low of $17,600 has fallen on the shoulders of speculators who may face another wave of capitulation. In this case,

The insistence of Bitcoin’s price above the June low of $17,600 has fallen on the shoulders of speculators who may face another wave of capitulation. In this case, the price could feel support at the $17,000 level, according to Glassnode calculations.

Amid the persistent contraction in global liquidity, #Bitcoin Short-Term Holders are finding themselves under immense pressure as Bitcoin markets struggle to maintain the psychological $20,000 support level.

Read our analysis here 👇https://t.co/b5qRZZ2ZQ2

– glass knot (@glassnode) September 5, 2022

Experts drew conclusions based on two measurements. They can be viewed as an area of interest and fundamentally derived support in case of further market weakness.

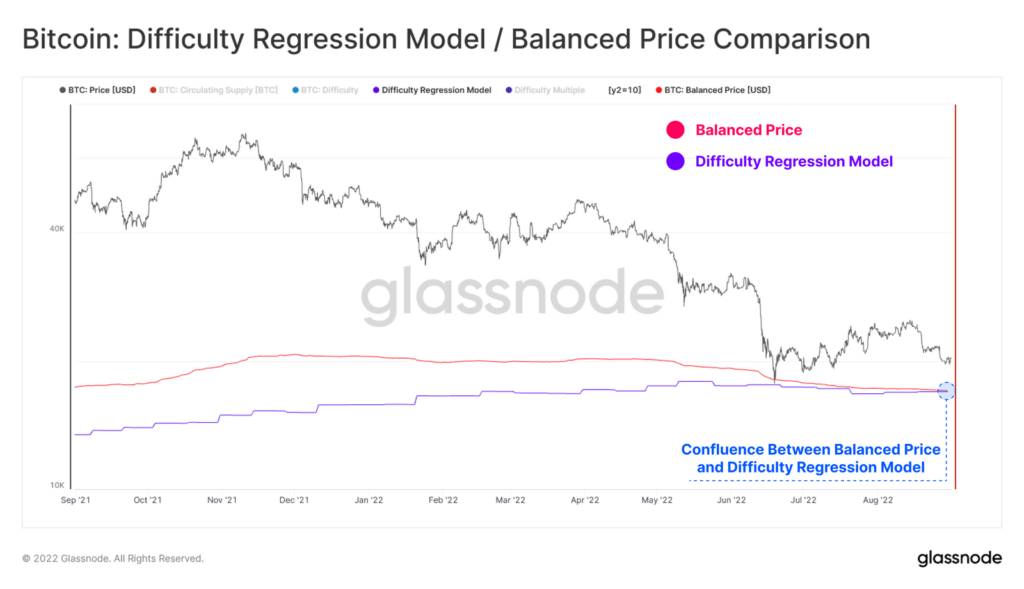

One of them is a balanced price. It is calculated as the difference between the realized price (purchase price of all coins) and the price of transfers (cumulative value of Destroyed Coin Days).

The second is the price of the difficulty regression, which models the total cost of mining the first cryptocurrency. It is calculated by running a logarithmic regression model between difficulty and market value.

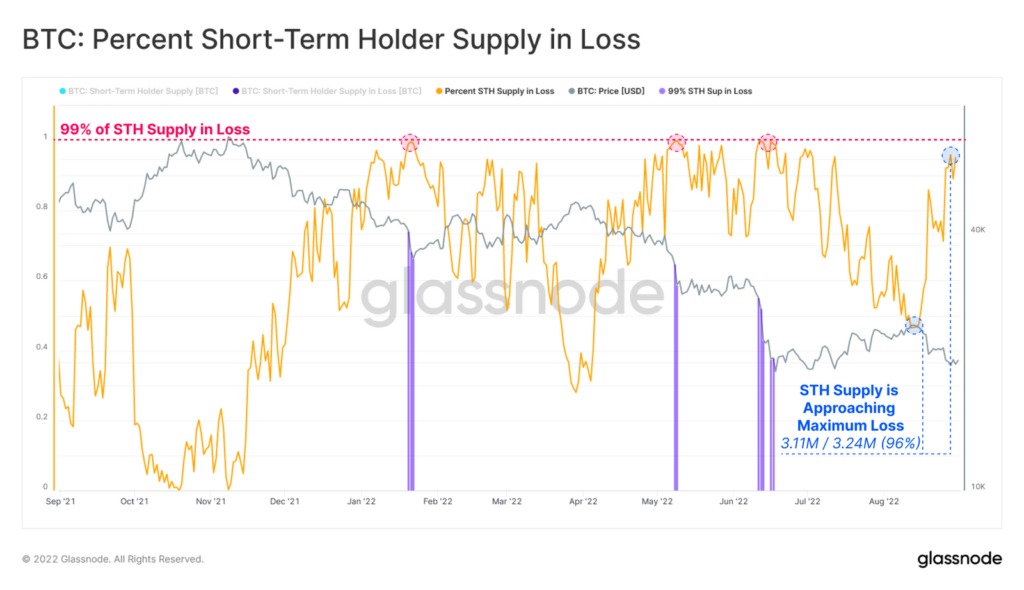

Experts did not ignore another wave of capitulation due to the increase in the share of “unprofitable” coins at the disposal of speculators (last actions in the previous 155 days) up to 96% (from 3.24 million BTC to 3.11 million BTC). .

Within three such episodes in the current downtrend, this has led to market participants selling with a short-term planning horizon followed by the formation of a local bottom.

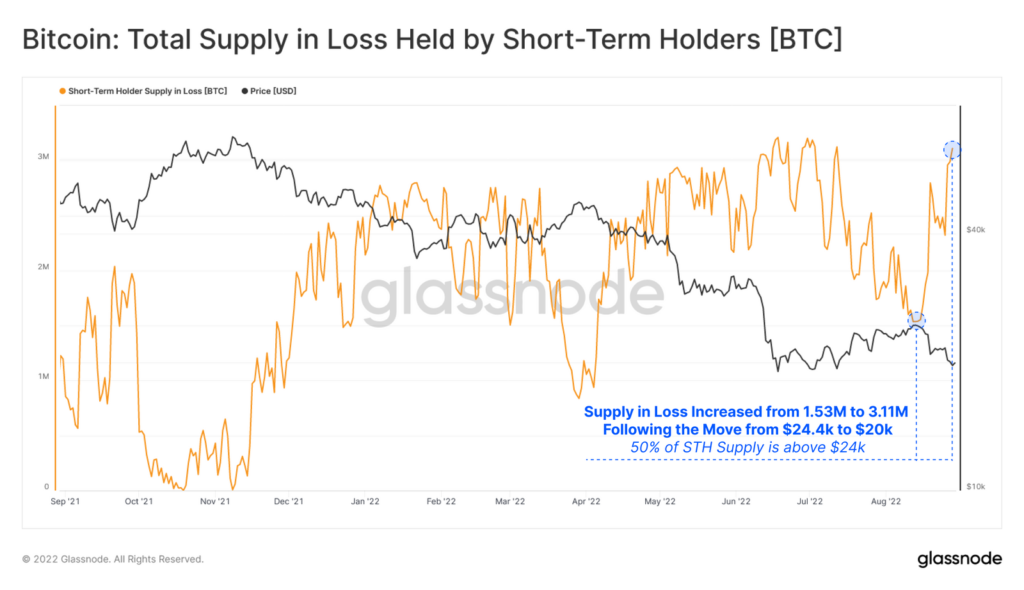

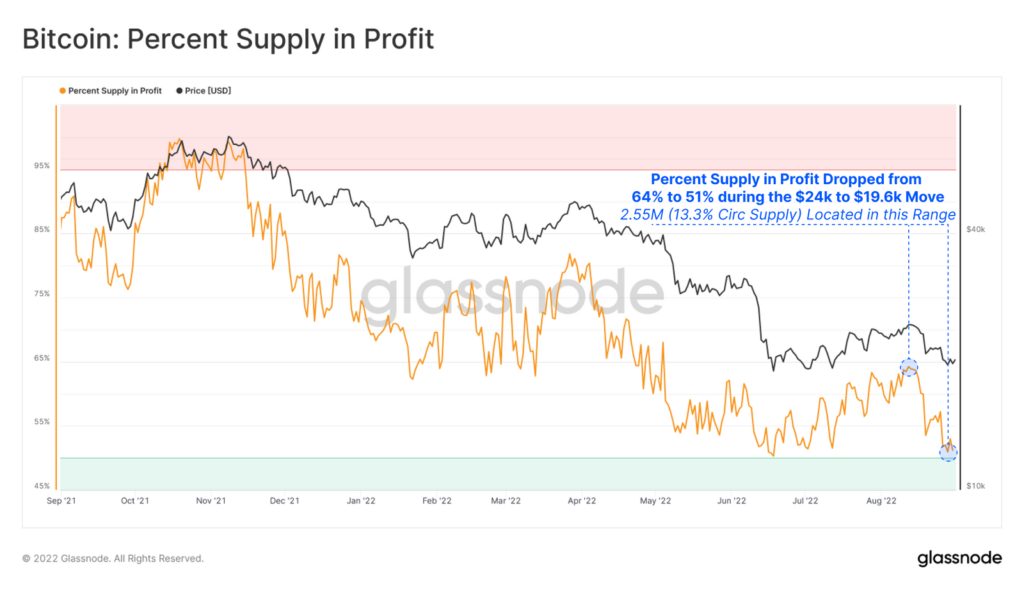

The situation worsened with the suspension of the bearish rally. The pullback of the price from $24,000 to $19,600 in just a few days transferred half of the “stocks” of the speculators’ coins to the “unprofitable” category.

Quantitatively, 13.3% of the coins in circulation (2.55 million BTC) lost their “profitable” status. 60% of them (1.53 million BTC) belong to speculators.

Long-term prospects for the first cryptocurrency remain constructive. This is confirmed by the increase in the number of coins at the hodlers’ disposal, clear indicators of changes in their position and “mobility”.

In the short term, it is the stress test of the speculators that will determine the trend in the market, as most of the activities on the chain are carried out by short-term players.

“Two outcomes remain: capitulation through turbulence or success in a desperate attempt by recent buyers to keep the price above the $20,000 psychological level.”experts concluded.

Recall that Peter Schiff, head of Euro Pacific Capital, predicted that Bitcoin would drop to $10,000.

Earlier, Charles Edwards, head of Capriole Investments, noted the passing of bitcoin miners’ capitulation phase.

Read ForkLog bitcoin news in our Telegram – cryptocurrency news, courses and analysis.

Source: Fork Log

I’m Sandra Torres, a passionate journalist and content creator. My specialty lies in covering the latest gadgets, trends and tech news for Div Bracket. With over 5 years of experience as a professional writer, I have built up an impressive portfolio of published works that showcase my expertise in this field.