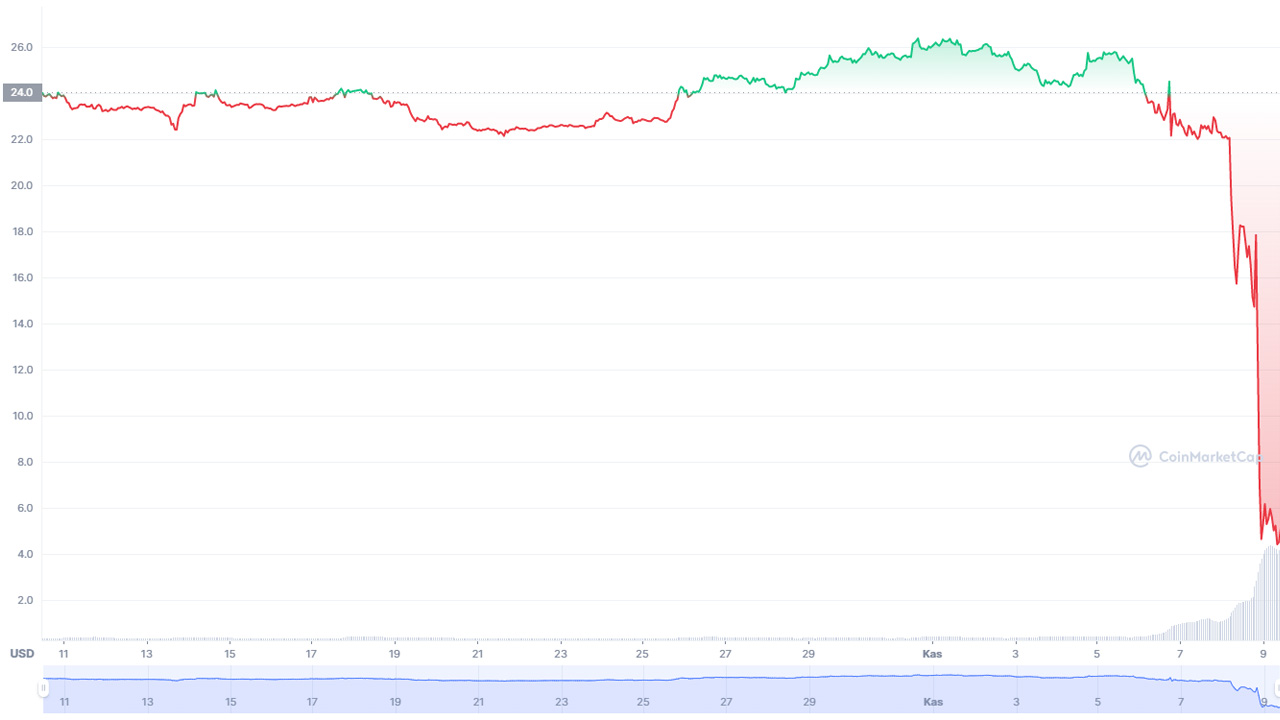

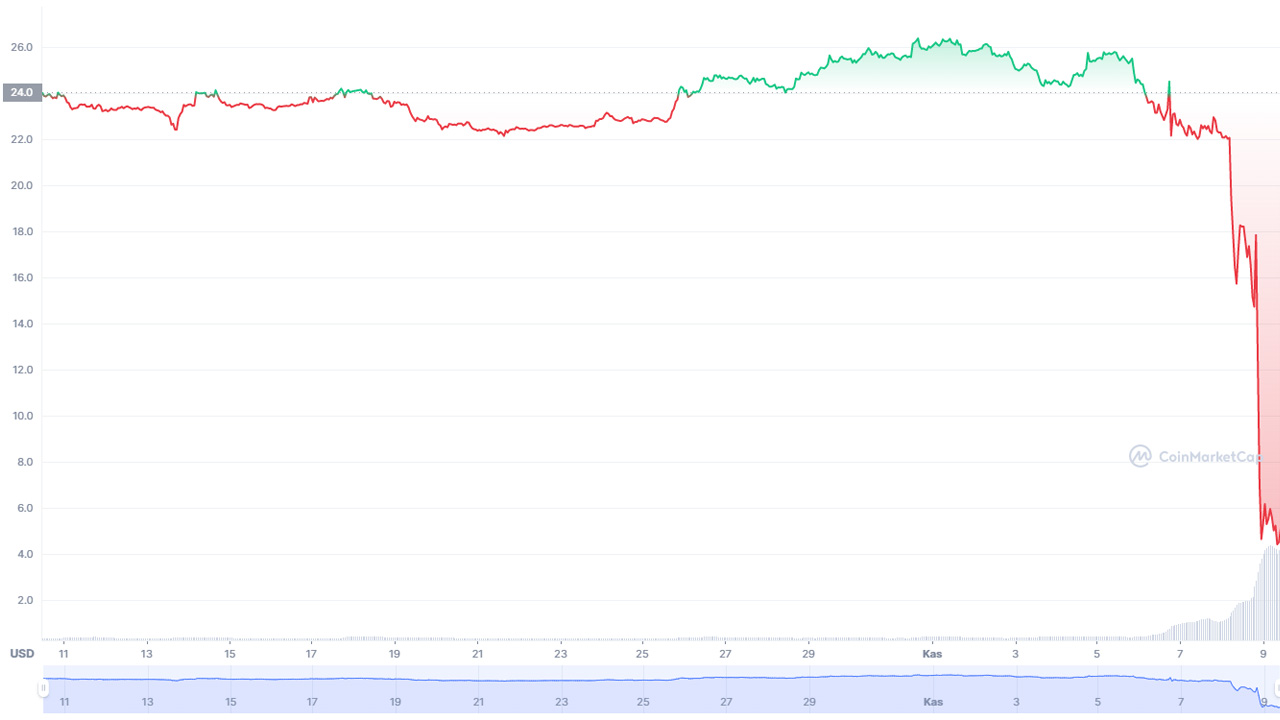

Back in the cryptocurrency community weird weird things is happening. Bitcoin, which has not been doing well for months, recently recovered and surged above the USD 21 thousand level. Seeing this surge, altcoins also started to recover and started making profits for their investors again. However, after the news was suddenly served, the markets collapsed again. Bitcoin decline, more than 7 percent in the last 24 hours.

So what happened again? In this content, we have been talking about cryptocurrency investors for several days now. Binance FTX conflict We’re going to take a closer look. If you’re ready, let’s get started…

The discussions sparked with a report shared last week!

*Bitcoin’s one week price chart. Source: Coinmarketcap

The foundation of the events of the past few days is Coindesk, one of the largest cryptocurrency news sites in the world. to a published report is based. In this report published on November 2, 2022, third largest cryptocurrency exchange in the world There was some information about FTX and the billionaire founder of this stock market, Sam Bankman-Fried. However, these are not the main points of the report. The Real Bomb was also founded by Sam Bankman-Fried and is known for his close relationship with FTX. Alameda Research The cryptocurrency has exploded on the trading platform.

Coindesk, which hit the balance sheet of Alameda Research, shared statistics that hit the agenda like a bomb. According to the report, Alameda Research with FTX, two independent companies Although it looked like this, the truth was different. So much so that Alameda had $14.6 billion in assets. However, $5.82 billion of that is the native cryptocurrency used on the FTX exchange. FTX Token‘di (FTT). In addition, the $3.66 billion portion of this FTT was also blocked. So it could not be converted into cash. “What’s in it?“We seem to hear you say. Let’s explain!

The amount of FTT Alameda owned was more than the cryptocurrency’s market cap, 193 percent more!

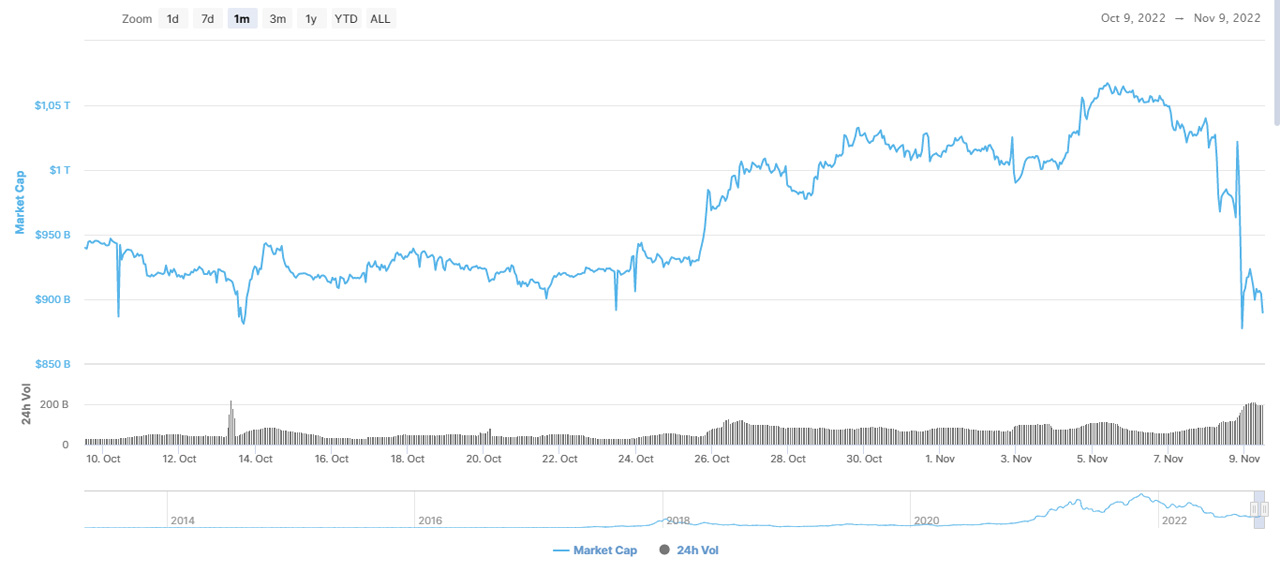

*One month Bitcoin price chart. Source: Coinmarketcap

Coindesk’s report, FTT is so to speak”balloonBecause according to the statements so far, the market value of FTT was $3 billion. However, Alameda said that the market volume of FTT up to 193 percent He held the cryptocurrency. Cory Klippsten, CEO of investment platform Swan Bitcoin, made a statement on the subject, “It’s fascinating to see that most of Alameda’s equity is actually FTX-issued tokens.“In this statement by Klippsten, in a sense, “it’s just a big balloon“ implied.

Alameda’s balance sheet was not quite FTT. The company has $134 million in cash, $2 billion in stock, $3.37 billion in crypto – of which $863 million locked Solana (LEFT) – hold. Let’s say another interesting thing: Alameda was a $8 billion debt company. All this led to the idea that Alameda was really just a startup and FTX-funded company. Sam Bankman-Fried seemed to have founded two big companies, but in fact your own realm had established. Because both FTX and Alameda were among the largest in their industry. In addition, it became known that Alameda would provide financing to companies with money problems. Yes, without money…

Both Alameda and Sam Bankman-Fried denied the allegations!

The first name to speak out about Coindesk’s report was Alameda CEO Caroline Ellison. Ellison defended himself, saying that the report… subset of all entities Said it contains. Mention that all loans so far have been paid in full, the CEO said, which is not included in the report. $10 billion There was more capital. Sam Bankman-Fried said in his published report “unfounded‘ he described.

Binance CEO CZ did not miss the opportunity!

The first to react to what happened was Binance CEO Changpeng Zhao, also known as CZ. About in the past $2.1 billion Speaking on behalf of Binance, which bought FTT, the CEO said that the cryptocurrency in his hand announced that it will sell everything. The events that happened months ago and caused a serious collapse of the cryptocurrency markets. of the Luna incident CZ explained the lesson had been learned and said these sell”risk management‘ noticed.

CZ’s statement contained remarkable details. Recognizing that they have supported FTX in the past, the CEO said this is now over. “We’re not going to pretend to have sex after we’re divorced.CZ, who made a strong exit like “, said they are not against anyone but behind other names in the industry. lobbying activity He said they wouldn’t care about an establishment that lasts. What CZ meant here were some of the allegations that have surfaced in the past. According to these allegations, FTX lobbied behind Binance. In addition, FTX’s senior management recently dealt with Binance. hard statements they did too…

And the button has been pressed for FTT sales!

In its statements, CZ argued that the sale of FTT so as not to influence the investor. He said it would be done with care and would take several months. After the explanation there was a remarkable development. So much so that about $585 million in 23 million FTTs, It was taken from his wallet. Citing a post on Twitter, CZ explained that this FTT is owned by Binance.

Caroline Ellison aims for Binance’s FTTs so FTT doesn’t lose value!

A new curtain opened in the events that started to make the investor very uneasy. A new post following CZ’s statements, Alameda CEO Ellison said they can buy all of the FTTs in Binance’s hands, per FTT. that they can pay 22 dollars explained. The reason for making such a statement was very simple. The number of active portfolios trading FTT has ranged from 200 to 300, and high volumes of sales demand allowed FTT to write off would cause. For those wondering, let’s say; price of 1 FTT when this offer is made $26 level… As you can imagine, this request was rejected!

While it was already messy enough, Bybit was included in the discussions!

*BitDAO weekly price chart. Source: Coinmarketcap

The events and subsequent statements had a direct impact on the markets and the investor’s money, fearing mutual bickering, began to melt. As investors focus on calming the situation, this time with another cryptocurrency exchange. BybitStrong statements came out. According to the company’s claim, Alameda had 100 million BitDAO (Bybit’s local cryptocurrency) in exchange for a promise not to sell for 3 years, but did not keep this promise and sold a large amount of BitDAO for the resulting cash needs. This hefty sale was completed by BitDAO in just 1 hour. more than 20 percent led to his fall. Parallel to this, FTT also lost another 20 percent in value…

Caroline Ellison also denied this claim!

The name that made statements about the allegations of Bybit co-founder Ben Zhou was again Alameda CEO Caroline Ellison. “We’re very busy at the moment, but when things settle down, we don’t think these sales were caused by us. we will prove.‘ said Ellison, articulating Bybit’s claims with these words. rejected it happened.

Let’s go to yesterday: withdrawals have stopped in FTX!

The tremors in the cryptocurrency markets had intimidated the investor. People have been chasing the FTX related accusations to save their money. The easiest way to do this is to make money in the stock market. transfer to another medium. In this context; Within a few days, the amount of money withdrawn from FTX reached $6 billion. However, yesterday was expected and FTX stopped all recordings. FTX, literally was on the brink of bankruptcy.

CZ is back in action: we’re going to buy FTX!

Binance CEO CZ made a statement on Twitter last night, saying that FTX ask them for help told. The reason for this help was that there was no more money to give on the stock exchange. So FTX, had actually sunk. CZ also uses the stock market to both protect the investor and save FTX. on the purchase He said they had reached an agreement of intent. According to CZ, a formal agreement will be reached in the coming days. Immediately after this statement, FTX Global of FTX Turkey No recordings can be made transferred.

“#SAFU”, one of Binance’s insurance funds, has been raised to the $1 billion level!

When we came in the morning hours, a new statement came from CZ. Binance’s against price fluctuations An addition was made to “#SAFU”, one of the insurance funds he created for investors. With the last appointment made, the money in the fund, 300 million dollars in Bitcoin (BTC) and $700 million in Binance Coin (BNB) and Binance USD (BUSD).

So what should we get out of all this? (Editor’s Note)

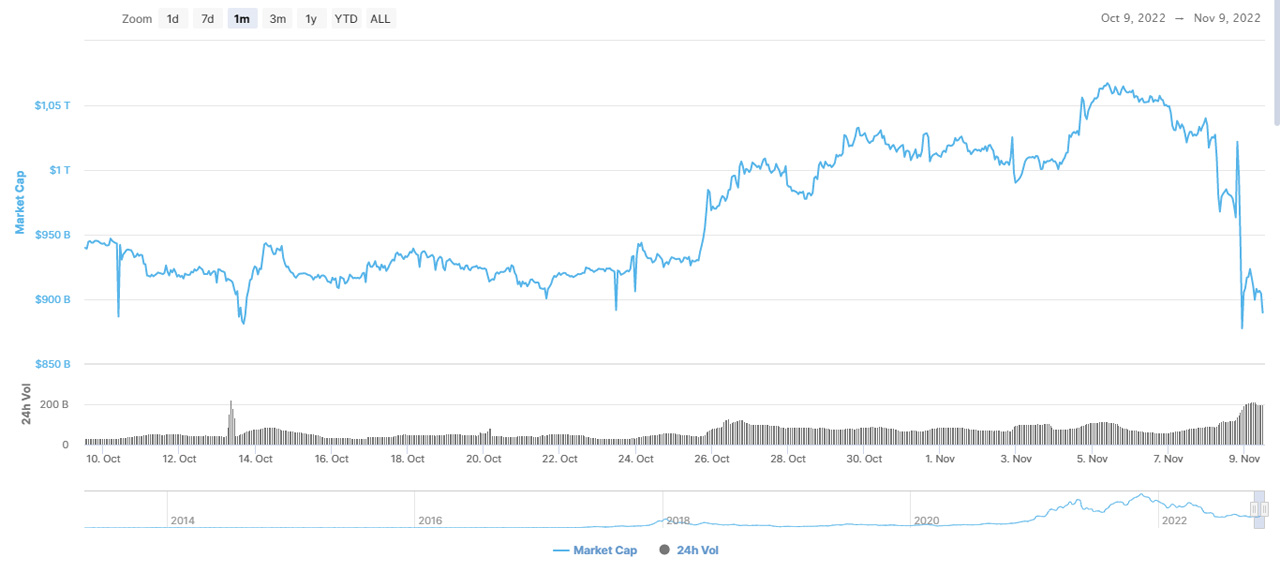

These events showed that the atmosphere of panic, again lost to the investor. Because if we look at the market volume on Coinmarketcap, we see that the volume, which was over $1 trillion a few days ago, has dropped to $878 billion 223 million $182 thousand 200 at the time of this article. That is, the investor sold (possibly at a loss) while taking blood in the markets and withdrawing his money from the crypto world. He also met CZ, CEO of Binance, the world’s largest cryptocurrency exchange. bicker We’ve seen what impact it can have with this event…

Discounted technology product recommendations on Amazon