Stock market crash; a financial market, rapid and significant depreciation resources. When there is a daily loss of value of approximately 10 percent,stock market crash‘ we can say.

Such collapses Investors began to sell in panic, It occurs when prices fall rapidly, often due to periods of economic recession or uncertainty. Companies obviously face trust issues.

The Great Depression was the explosion of Wall Street in 1929, at the end of a period of great panic and uncertainty.

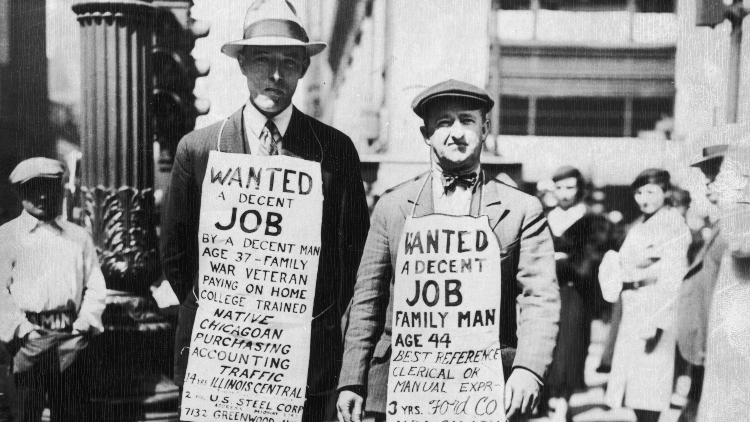

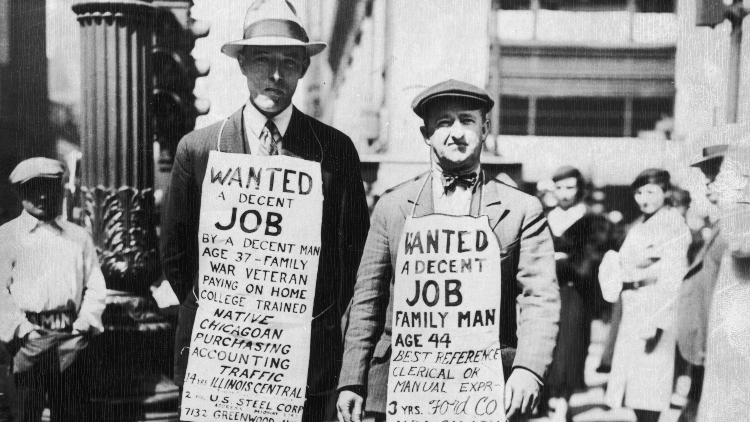

This great collapse, which was caused by interest rates, sudden sales due to panic and many other reasons, directly or indirectly affected the entire world. Hunger, poverty and unemployment have increased around the world; so this periodGreat DepressionIt has also become known as .

After the First World War, as a result of the loans that the US handed out without thinking, the banking policies that were not implemented in the US and the countries’ excessive debts to each other,Black Tuesday‘, Investors panicked and started selling their shares. As a result, stocks became cheaper and the world recovery lasted until the mid-1930s, although it happened earlier in America.

The economic consequences of World War II were, as you can imagine, just as bad as the last.

The crisis that started in Europe in 1945; It lasted until the mid-1950s and the end of the war Increasing unemployment with the population of disbanded armies, abandoned weapons factories and destruction, caused an economic collapse.

With the last name of the then US Secretary of State, ‘Marshall AidStabilized by ‘Europe was able to recover almost ten years later. This help The Cold War He played an important role in keeping American relations with the West warm during his administration.

The ‘stagflation’ of the early 1970s was a complex period in which economic stagnation and inflation occurred simultaneously.

Oil crises, rising energy prices and declines in productivity Factors such as were the main reasons for this problem. During this period, traditional economic plans were ineffective in controlling both inflation and unemployment simultaneously. The stagflation of 1970 also posed a major challenge to the economists and politicians of the time.

In 1987, when the entire world was experiencing a crash that shook the financial markets, an ordinary Monday suddenly became ‘Black Monday’.

This incident took place on October 19, 1987. largest in history It was one of the one-day stock market crashes. The main reasons were excessive speculation and higher interest rates. Sudden losses in stock markets had serious consequences for investors.

The 2000 Technology Crisis, also known as the Dotcom Bubble, was the bursting of a technology bubble that occurred in the late 1990s and early 2000s.

This bubble was recorded as the collapse of investments due to excessive speculation in Internet and technology companies. While the shares of Internet companies, a new ocean, were extremely valued, many investors invested large amounts in these companies. However, many internet companies actually sell the quantities they say they sell. It was not with profit, but even with loss.

As a result of speculation, shares and therefore investors suffered large losses. Many internet companies went bankrupt and thousands of people became unemployed.

The 2008 crisis, the collapse of the mortgage market, was a financial disaster that deeply affected the global economy.

The crisis that arose due to dysfunctional lending practices and financial institutions that found themselves in dire straits; millions of people lost their homes, It led to higher unemployment rates and the bankruptcy of many financial institutions.

The crisis forced a closer examination of the complexity and risks of financial markets and taught important lessons about economic management. about this crisis ‘The big short one’ The film can be recommended to those interested.

The 2020 COVID economic crisis was a prolonged economic recession due to the quarantine during the COVID-19 pandemic.

In many countries, important sources of income have been limited by measures such as travel restrictions and the cancellation of mass events. While unemployment rates rose in industries that turned to automation during the quarantine period, especially in many sectors in the service sector There were great losses.

Although governments are trying to support their economies with various fiscal stimulus programs, this economic crisis is causing economic instability in 2020. When and how the unpredictability of the future revealed.

Naturally, we were also affected by the crises the world was experiencing.

2020 COVID-19 crisis, 2008 Mortgage crisis, 1987 ‘Black Monday’… But the one who can always keep his individuality Borsa Istanbul They also had their own pitfalls. Let’s take a look at them:

The financial crisis of November 2000 – February 2001 caused a 60 percent decline in BIST.

In the last week of November 2000, panic caused by poorly managed and failing banks pushed investors out of the stock market. On the one hand, banks are rushing to collect foreign currency, and on the other, investors are fleeing; The first two days of the crisis, on November 27 and 28, from the Central Bank of the Republic of Turkey 3 billion dollars has been withdrawn.

Government policy in the future It caused the Turkish lira to rapidly lose value and many banks were on the brink of bankruptcy. Requests for international financial assistance, an agreement with the IMF and economic reforms helped bring the crisis under control. However, this process caused a major shock to Turkey’s economic stability.

The Gezi events of 2013 and the protests that started on May 28 long occupied the agenda of not only the Republic of Turkey, but also the world.

Ten years have passed since the Gezi events, with violence escalating day by day and police intervention increasing. It resulted in a mass protest. Besides BIST having profoundly influenced Turkish politics, as a result of the actions that lasted almost three months and the political policies of the period government, lost 30 percent of its value. The total market value of companies traded on BIST is 164 billion liras in 3 months fell.

The 2023 presidential election process has shocked BIST, just as it has shocked us all.

BIST, which started trading on May 15, the morning after the first round of elections, started its opening with a loss of 6.4 percent. Since the depreciation exceeded 5 percent, the Index-Linked Circuit Breaker System was activated and trades were halted from 9:55 a.m. to 10:30 a.m. Throughout the election Lost 20 percent of its value BIST gained 85 percent in value after the decline.

Our other stock market content:

Follow Webtekno on Threads and don’t miss the news