Today’s edition of the Government Gazette contains a notice that concerns all citizens who own a car. hosted. According to the General Communiqué Motor Vehicle Tax, citizens can calculate their MTV 2024 compared to 2023. 58 percent They will pay an increase.

How much will MTV cost in 2024?

| Cylinder capacity of the engine |

Lowest MTV |

highest MTV |

| 1300 cm3 and lower |

347TL |

4,032TL |

| Between 1301-1600 cm3 |

690TL |

7,026TL |

| Between 1601-1800 cm3 |

1,235TL |

12,413TL |

| Between 1801-2000 cm3 |

1,898TL |

19,553TL |

| Between 2001-2500 cm3 |

2,880TL |

29,332TL |

| Between 2501-3000 cm3 |

4,016TL |

40,898TL |

| Between 3001-3500 cm3 |

5,657TL |

62,289TL |

| Between 3501-4000 cm3 |

8.111TL |

97,937TL |

| 4001 cm3 and higher |

11,374TL |

160,284TL |

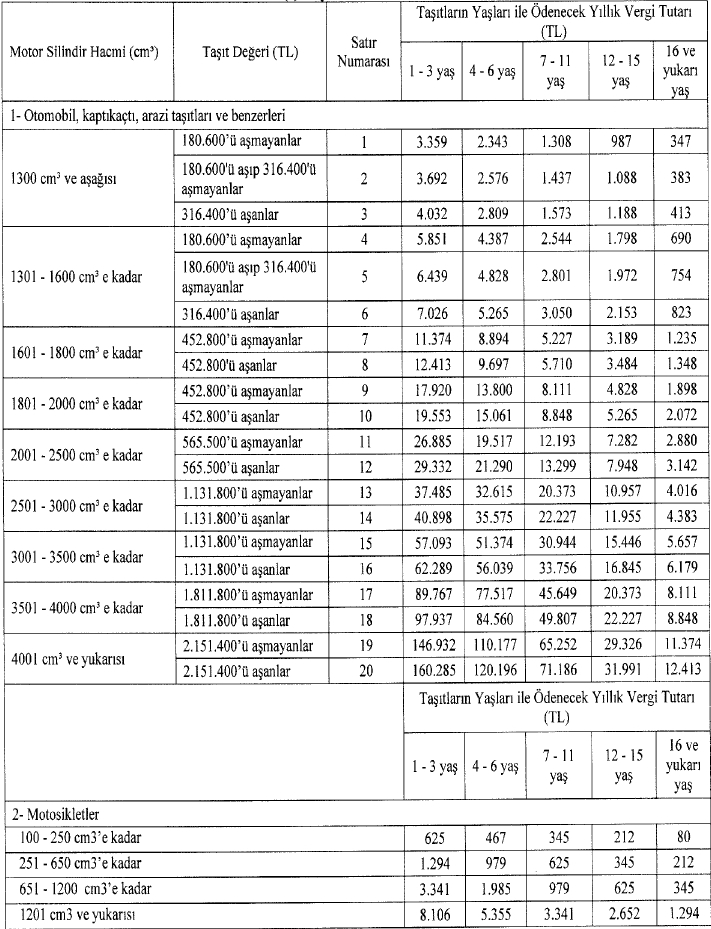

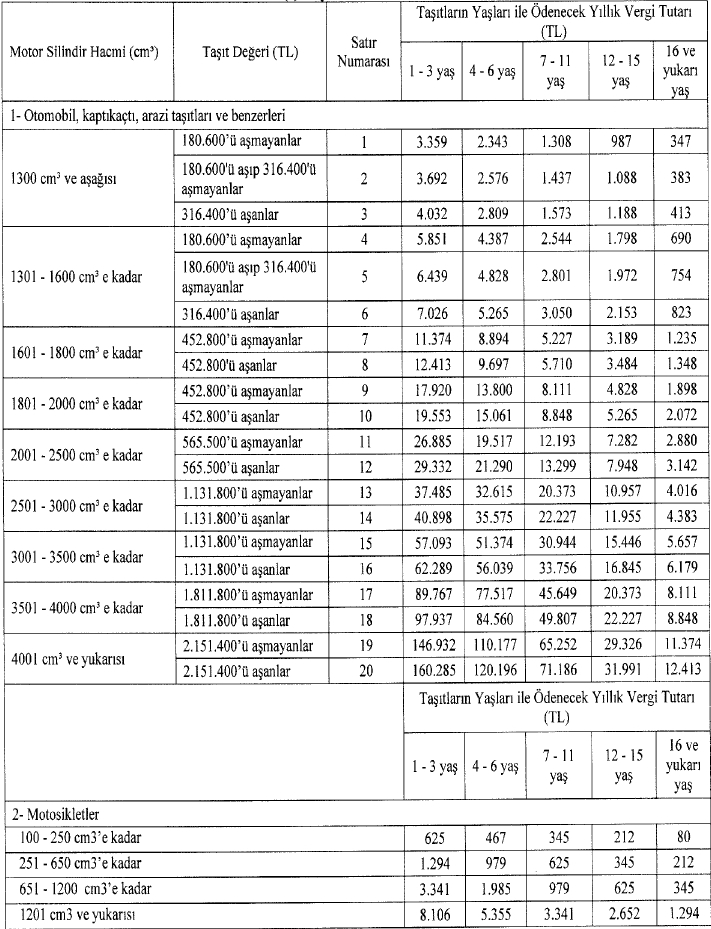

The table above shows the lowest and highest MTV amounts to be paid based on different engine volumes. Let’s dig deeper and see how much TL MTV the vehicle owners will pay based on their age and tax base.

Remark: If the registration date of your vehicle is before 01.01.2018, go to the last part of our news.

MTV Awards 2024 (for cars with registration date 01.01.2018 and later)

What will vehicle owners with license plate dates before 01.01.2018 do?

Government, in 2018 Switched to a new system regarding MTV. This system also included vehicle bases in determining the MTV amount. Purpose of this, Citizens who buy a more expensive car pay higher taxes. Naci Ağbal, the Minister of Finance and Finance at the time, made the following statement on this matter: If you buy a Ferrari worth more than 2 million lira, you will also pay an additional tax of 6,000 lira.

Follow Webtekno on Threads and don’t miss the news