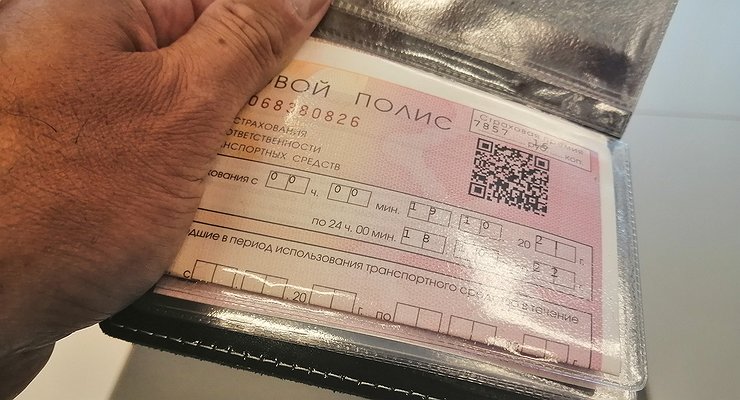

After the extension of the OSAGO base cost rate band, which took place in September, the price of insurance rose immediately. However, this was quite to be expected.

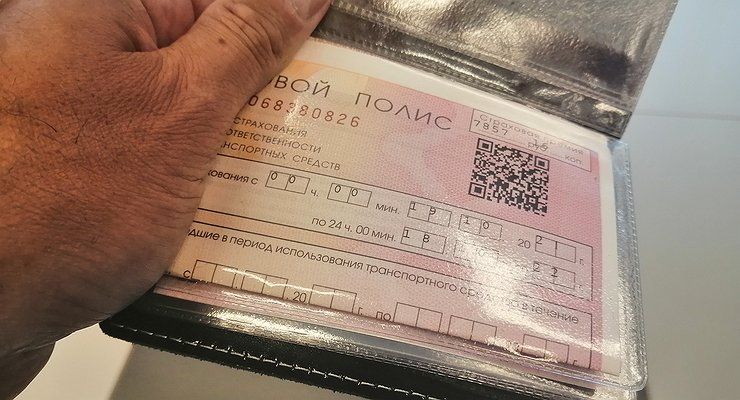

According to statistics on the sale of OSAGO policies for October, the price of insurance in Russia increased by an average of 4.21% compared to the previous month. The jump happened immediately after the Central Bank expanded the tariff corridor of the allowed basic costs of the mandatory insurance contract by 26%. That is, he allowed insurers to sell policies that were 26% more expensive and cheaper than the previously established limits.

Just before this event, the Central Bank itself and insurance companies organized an entire PR campaign in the media. In the course of this, they convinced millions of Russian car owners that, due to the increase in the cost of OSAGO, only accident drivers and novice motorists would pay more for “autocitizenship”. And most of the motorized citizens could even save.

The AvtoVzglyad portal then even predicted that the said Central Bank event would only be used by insurance companies as an opportunity to earn extra money from motorists by raising OSAGO prices. So it really happened: in October, the average price of a policy in Russia rose to 7,026 rubles.

The Central Bank and insurers promised that expanding the “corridor” would save money for accident-free drivers. In reality, such car owners who belong to the category “the driver has never been the culprit in an accident and has more than 13 years of accident-free driving experience” have started paying an average of 9.5% more for OSAGO since October, Vedomosti reports.

According to statistics on the sale of OSAGO policies for October, the price of insurance in Russia increased by an average of 4.21% compared to the previous month. The jump happened immediately after the Central Bank expanded the tariff corridor of the allowed basic costs of the mandatory insurance contract by 26%. That is, he allowed insurers to sell policies that were 26% more expensive and cheaper than the previously established limits.

Just before this event, the Central Bank itself and insurance companies organized an entire PR campaign in the media. In the course of this, they convinced millions of Russian car owners that, due to the increase in the cost of OSAGO, only accident drivers and novice motorists would pay more for “autocitizenship”. And most of the motorized citizens could even save.

The AvtoVzglyad portal then even predicted that the said Central Bank event would only be used by insurance companies as an opportunity to earn extra money from motorists by raising OSAGO prices. So it really happened: in October, the average price of a policy in Russia rose to 7,026 rubles.

The Central Bank and insurers promised that expanding the “corridor” would save money for accident-free drivers. In reality, such car owners who belong to the category “the driver has never been the culprit in an accident and has more than 13 years of accident-free driving experience” have started paying an average of 9.5% more for OSAGO since October, Vedomosti reports.

Source: Avto Vzglyad

I’m Sandra Torres, a passionate journalist and content creator. My specialty lies in covering the latest gadgets, trends and tech news for Div Bracket. With over 5 years of experience as a professional writer, I have built up an impressive portfolio of published works that showcase my expertise in this field.