Warren Buffett is not only 93 years old but also one of the oldest investors with many years of experience dedicated to professional investing. To carry Sixty years at the helm of Berkshire HathawayInvestment company he founded with Charlie Munger, who died in November 2023 at the age of 99

Buffett’s good sense of smell has put him at the top of the billionaires list. Forbes His estimated fortune is $135.4 billion. This leads many of those who have the opportunity to talk to him to ask him what his secret to success is. Answer: Most of the work is done over time.

Invest in a business, not a product

The investor known as the “Oracle of Omaha” differs from other investors in terms of his investment strategy. invest in business models, more than just products, with stable economic characteristics and reliable managers. This philosophy, known as value investing, is based on holding high-performing stocks for the long term rather than trading based on short-term price fluctuations.

For decades, Warren has been a major investor in companies such as American Express, Coca-Cola or Apple, not because he believes in the iPhones that the Apple company releases every year, but because he trusts in his business vision. from managers.

Time does most of the work

According to Morgan Housel, author of ‘The Psychology of Money’, “All of Warren Buffett’s financial success can be attributed to the financial foundation he established in his youth and the longevity he has maintained.”

In an episode of Lewis Howes’ podcast The School of Greatness, financial popularizer Tony Robbins commented on a conversation he once had with Warren Buffett: “I asked Warren Buffett, What makes you the richest man in the world?” He smiled at me and said: ‘Three things: living in the United States for great opportunities, having good genes to live long, and compound interest.'”

The master millionaire has never hidden that this is the basis of his fortune. compound interest. But the secret ingredient in this sauce is time, which causes your investments to grow exponentially for decades.

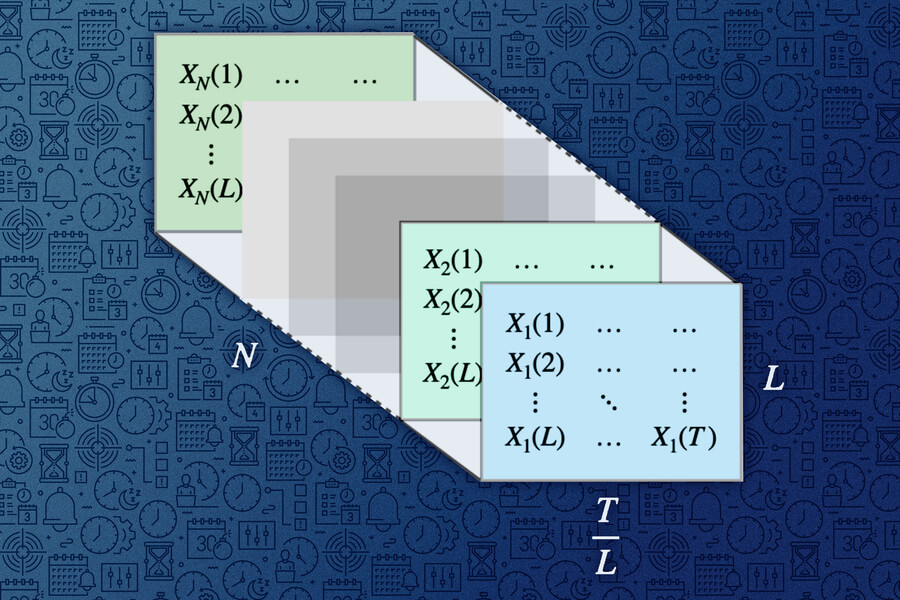

To simplify it to the extreme, compound interest consists of investing a certain amount of money and reinvesting the resulting interest. To give an example, imagine you have a bank account that gives you 10% interest every month. The first month you pay 10 euros and the next month the bank pays you interest, so you already have 11 euros.

However, the next month, interest will no longer be calculated on the initial 10 Euros, but on the 11 Euros you have (10 Euros of capital + 1 Euro of interest). Therefore, the next interest income will be 1.10 euros, meaning a total of 12.1 euros without touching the money.

Follow this progression throughout Warren Buffett’s six-decade career and you’ll understand why he’s one of the few members of the $100 billion club. Only it’s a matter of time.

in Xataka | Warren Buffett gave away $3.5 billion of his enormous fortune. Of course Bill Gates

Image | Gates’ Notes