Spain’s demographic context is creating a transfer of wealth between an aging population and their descendants, which has left the Tax Office alert to suspicions of tax fraud when it comes to paying taxes on the transfer of this inheritance from parents to children.

One of the temptations for parents who want to give real estate to their children without being taxed with Inheritance and Gift Tax is to “sell” the property for a symbolic price. The Treasury has a keen eye on these operations and can impose fines of up to €100,000 if a property is sold for too little.

Cannot be sold at any price. Real estate sales and purchases are regulated according to a set of reference values to combat tax evasion. These reference values, in turn, form the basis for calculating the payment of taxes, capital gains, etc.

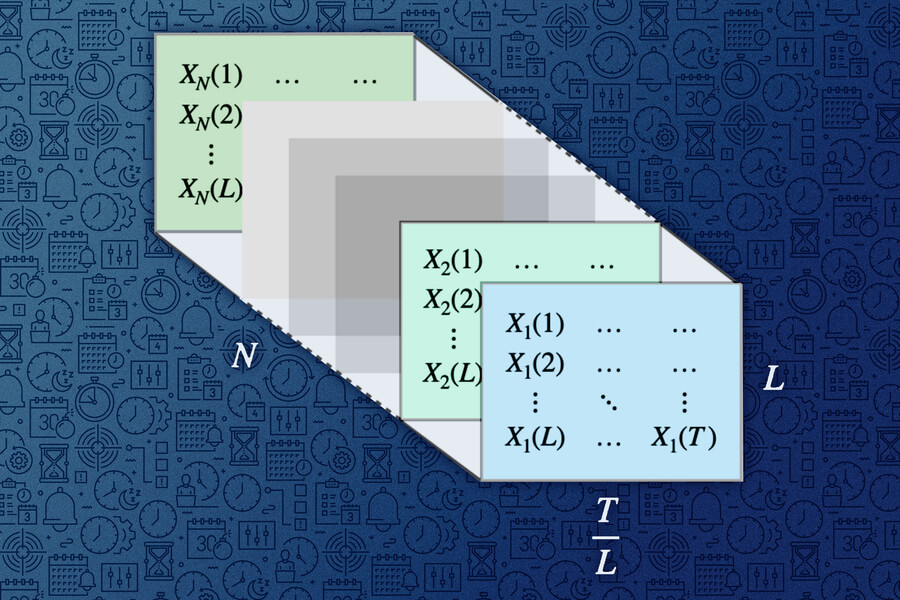

As stated by the Tax Office, all real estate is conditioned by the Cadastral Value, which reflects the administrative value of a property and is defined by the General Budget Laws of the State; and by the Reference Value, which tries to approximate the real market value of the property, taking into account the conditions of the property, its location and the prices registered in the region in the last year.

Selling below these levels will trigger all alarmsAs a general rule, the person selling real estate expects to receive the highest possible return, so the actual sales price will always be equal to or higher than the cadastral value or the reference value determined by the Undersecretariat of Cadastre and Treasury.

If the sale price is much lower than these values, the transaction rings alarm bells and the Tax Office mechanisms for investigating tax fraud are initiated, as provided for in the General Tax Law No. 58/2003 of December 17. This law regulates that apartments sold well below this real market value may be subject to the inspection of the authorities, as this may indicate a transaction with undeclared money and constitute a serious crime.

Serious consequences of tax evasion. The disguise of the donation as a sale at a price much lower than the reference values is counterproductive due to the sanctions that both the alleged seller and the buyer must face. According to data from the real estate portal İdealista, the Treasury can impose sanctions on the seller, punishable by fines ranging from 1,000 euros to 10,000 euros, for a minor violation that sells the property at a symbolic price of less than 10% of the reference value.

For example, if a house has a market value of €100,000 and the sale price is between €5,000 and €10,000, it is a minor violation. If the sale is closed for less than €5,000, the owner will face more severe penalties.

Reference values and their impact on different taxes. Market reference value and Cadastral value are used in the calculation of different taxes. If the sales price is lower than these values, one of the determined values may be ignored and applied as default.

- Property Transfer Tax. This applies to second-hand transmissions, where the Treasury will use the reference value to calculate the tax if the purchase price is lower than the reference value, so setting a price too low will not serve to reduce this tax.

- Inheritance and Gift Tax. When receiving an inheritance or gift, the reference value applies when assigning the value of the asset and is added to the tax base of the tax, so an abnormally low sales price will not reduce this tax.

- IRPF. This also affects the calculation of capital gains in the case of donation, as the Treasury assumes that donating a house is equivalent to selling it. This means that tax will be paid on the difference between the purchase price and the value reflected in the donation. In other words, if the purchase price is much lower than the reference value of the asset declared as a donation, you will have to pay tax on this difference.

Buying cheap is not a bargain. Beyond the fraud penalties of the Tax Office, the buyer must fulfill a series of notarial procedures resulting from the change of ownership. One of the most important of these is the value that will appear on the title deed. A common mistake in Spain is to sell the property for less than the purchase price in order to pay less tax.

But this practice can be poisonous candy for the “buyer” who will have to bear a greater tax burden due to the existence of a larger capital gain when it comes to selling the property at the actual market price in the future. It was really more than expected and we even faced sanctions.

On Xataka | How can you view and search for houses, apartments and properties auctioned by the Treasury on the new website?

Image | Unsplash (Mallorca Region)