Empty shelves in stores, stocks at their lowest levels in two decades, rising prices, a significant portion of the harvest affected by extreme heat – these are not good times for rice in Japan. nigiris And MaquisThis country, which is nearly self-sufficient when it comes to rice grains, has seen a perfect storm brewing over one of its staple foods.

This is a serious enough event to prompt a report from the United States Department of Agriculture (USDA), and even a report from one of its most influential newspapers, the veteran. MainichiHe stresses the need to publish an editorial in which he takes a swipe at government policies regarding agriculture, both “present” and “past”.

A perfect storm. It’s a cliché, but it perfectly reflects what has happened to rice in Japan, where per capita consumption has been around 50 kilos in recent years. Despite its importance, tradition and the fact that almost 100% of Japan’s grain is produced in its own fields, the country has been facing a severe rice shortage for the past few months. In August, there were stores that were out of stock or asking customers to buy responsibly.

This deficiency was voiced by local media as well as other international media outlets. Guard, Financial Times, CNBC or The Mondein addition to food experts and the US Department of Agriculture, which published a report a few days ago analyzing the situation of rice in Japan.

Where can I find rice?“Over the summer, Japan faced a table rice shortage that left stores empty and stocks depleted as demand exceeded production over the past three years, reaching their lowest levels in more than two decades,” the USDA said. That’s not the only reason it identified.

The agency’s diagnosis combines second-order factors, such as the peak in demand recorded in August, when Japanese began stockpiling rice out of concern about typhoon season or the risk of earthquake exposure, with other more structural factors related to the earthquake, such as market or policy.

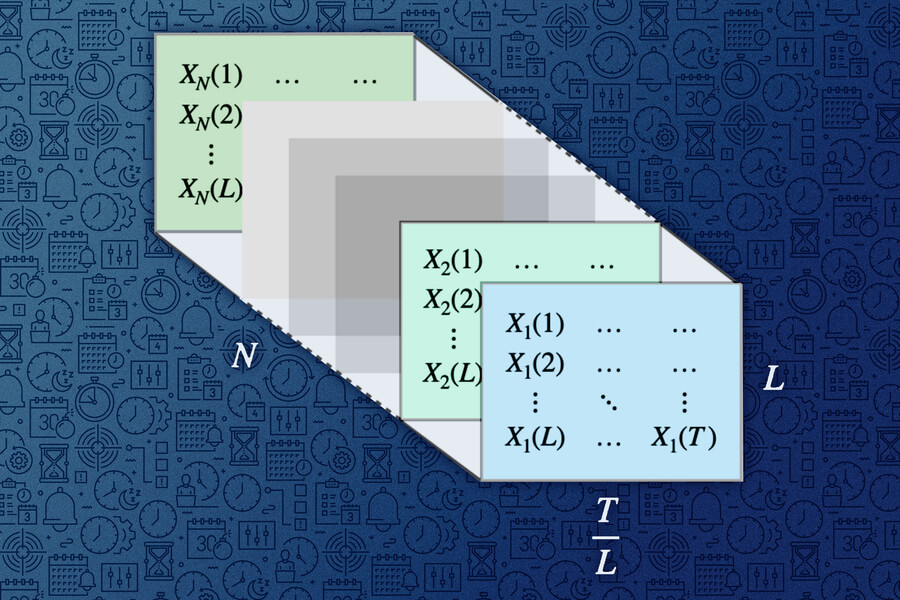

Stocks Fall. One of the ideas that the US agency focuses on is the decline in stocks. Note that, based on data from the Japanese Ministry of Agriculture, demand has exceeded production since the 2021-202 campaign. In fact, it estimates that the first will be 7.02 million tons in 2023/2024, while in 2023 there will be “only” 6.61 production. The harvest was also affected by high temperatures and drought.

Furthermore, there are analysts who note that 2023 is not a bad year for rice fields, but that the heat means that only 59.6% of the grain reaches the highest quality, 16% less than the previous year. What is clear to the Food Office is that private sector stocks in June 2024 have fallen “drastically” compared to 2023, reaching “the lowest level since 1999”.

Was there a bad harvest due to the heat? Kazuhito Yamashita, a former technician at the Japanese Ministry of Agriculture and research director at the Canon Institute for Global Stadiums (CIGS), denies that this is the main explanation for what is happening in the country. Mainichi He recalled that the indicator reflecting the volume collected in 2023 is not much different from “an average year”. “The harvest was not bad” hendek: “The reason for the shortage is the policy of reducing the cultivated area, which reduces the amount of land allocated.”

“To increase market prices, rice production is cut and the government subsidizes rice farmers who switch to other crops such as wheat or soybeans. Japan has been following this policy for more than 50 years,” he recalls.

“Controlled production”“As the consumption of bread, pasta and other alternative foods increases, if farmers were to produce as much rice as before, there would be a surplus, causing prices to fall. To prevent this situation, production has been reduced each year. Recently, only 60% of rice fields are being used; production has remained below half of the annual maximum of 14.45 million metric tons.

That, he says, is the “crux” of what’s happening to rice in the country. “Because production is so tightly controlled, even a slight increase in demand can quickly lead to shortages and higher prices,” he believes. Supply is not flexible enough to withstand unforeseen events, such as a surge in tourists eager to eat sushi or “panic buying” due to the threat of a major earthquake.

Add and continueThe scenario is actually more complex and includes other factors: the gradual decline in per capita rice consumption in recent years, the increase in exports, the gradual aging of farmers dedicated to rice production, or the loss of arable land that cannot be recovered overnight.

There is also the danger that in Japan, tariffs are imposed on imported grain to protect its own production, or that the part of the national harvest that is earmarked for purposes such as feed, processing, reserves or export cannot be diverted to meet household consumption due to the rental or subsidy. According to figures from the Japanese Government, of the 7.91 million tonnes grown in 2023/2024, 1.3 million tonnes of rice earmarked for “other purposes” accounted for 2.0 million tonnes.

Footprint of tourismAnother factor that explains why supermarkets have been running out of rice packets in recent weeks, even limiting the amount customers can buy, is the country’s tourism boom. Its popularity as a destination and the yen’s weakness against other currencies have brought record numbers of travelers to the island nation. And few are visiting its restaurants to try sushi or other rice-based dishes.

CNBC notes that grain consumption attributable to visitors has increased by almost 170%. Oscar Tjakra, an analyst at Rabobank, the world food and agriculture bank, said it rose from 19,000 tons between July 2022 and June 2023 to 51,000 tons between July 2023 and last June.

To what extent does it affect? Yamashita acknowledged that record visitor numbers are one element of the equation, but questioned whether it really is a “significant factor.” “Even if about three million visitors were to stay in Japan for a week each month and eat rice for breakfast, lunch, and dinner, as many Japanese do, that would only represent about 0.5% of total consumption,” the CIGS researcher believes.

For some analysts, the surge in demand from tourists shows that grain supplies have a limited ability to adapt to changes in demand, like the “panic buying” that precedes typhoons or earthquakes. That’s why they talk about the “urgent need” for reform and new policies in the sector. The government hopes that grain shortages will ease as this year’s harvested rice reaches supermarkets across the country.

“Isolated from the world”The quote in this case comes from Joseph Glauber of the International Food Policy Research Institute, who warns: “Japan’s rice economy remains largely isolated from the world market.” Beyond better or worse harvests or tourists’ love of sushi, he says, what explains the overall decline in supply is the country’s own rice policies. CNBC reminds us that Japan imposes high tariffs on imported grain, despite importing hundreds of thousands of tons a year due to its agreements with the WTO.

As background, the country has seen a noticeable increase in the price of a key food commodity: 16,133 yen, or about $113, was paid for 60 kilos of grain in August. That represents a 3% increase from the previous month and a 5% increase since the beginning of the year. The diplomat notes that the price of rice reached an 11-year high in July, which could be contributing to “panic buying.”

Pictures | Debs (ò‿ó)♪ (Flickr), Steven Rieder (Flickr) and USDA

At Xataka | Risotto faces its worst crisis: drought hits Italy’s rice fields and iconic carnaroli grains turn rancid